The account is still tax deferred for another 7 years.

Quote: SOOPOOJEPQ. Instead of putting the recent dividend/interest money into the money market, I’ve bought JEPQ. First equity purchase in the WoV portfolio in a LONG time! Now 0.1% of the portfolio.

The account is still tax deferred for another 7 years.

link to original post

Welcome to the dark side. It's addictive. Soon, you might go all the way up to one percent before people bark at you. They raised their payout 10% this month.

Quote: SOOPOOJEPQ. Instead of putting the recent dividend/interest money into the money market, I’ve bought JEPQ. First equity purchase in the WoV portfolio in a LONG time! Now 0.1% of the portfolio.

The account is still tax deferred for another 7 years.

link to original post

If I didn't re-balance and sell my 6figure dividend fund last week, i would have probably bought some of Billy's dividend recommendations.

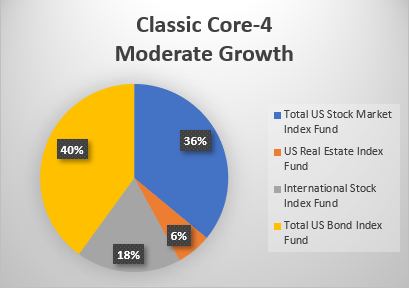

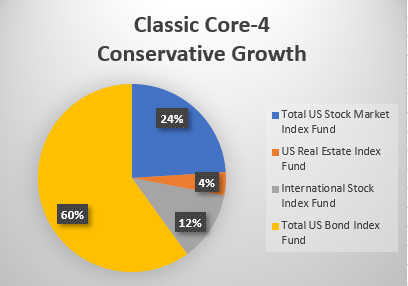

But happy that I'm back to a simplified portfolio of:

- total market with small cap value tilt

- total Intl

- total bonds with a splash of inflation TIPs + 3month Treasury Bill ladder

- a splash of REIT

- a spash of Healthcare since a large portion of the US population will be over 65 very soon

So a Core 4 Portfolio except i split the REIT portion into REIT and Healthcare

Quote: 100xOddsWhen i retire, it will look like this with 60% Bonds:

link to original post

To each his own. I am retired, 5 years now!, and I’m still well over 80% in stocks. LOTS of small holdings in individual stocks and larger holdings in various ETFs. As I mentioned earlier I consider my pension and (soon) social security to be like owning bonds. I do often forget about it, but I have a whole life policy which is worth around 5% of my net worth if I cashed it in.

I have a portfolio of over 100 stocks and I think I need to stop buying equities and plow new money into treasuries. I am really losing interest in following all these different stocks. I am way overweight in precious metal miners and I have a lot of unrealized cap gains in this area. I also have a lot of BDCs and REITs which pay hefty dividends.

I never liked paying fees to mutual companies. Have any of you ever added up the amounts you have paid to these leaches over the years?

Quote: MentalI never liked paying fees to mutual companies. Have any of you ever added up the amounts you have paid to these leaches over the years?

link to original post

Everything i have is Vanguard, fidelity, or schwab thus low expense ratios except My healthcare fund (prhsx).

it's .80% ER but i've had it for 2 decades.

it had way above avg returns but havent paid much attention to it in the past 10yrs

Quote: 100xOddsQuote: MentalI never liked paying fees to mutual companies. Have any of you ever added up the amounts you have paid to these leaches over the years?

link to original post

Everything i have is Vanguard, fidelity, or schwab thus low expense ratios except My healthcare fund (prhsx).

it's .80% ER but i've had it for 2 decades.

it had way above avg returns but havent paid much attention to it in the past 10yrs

link to original post

XLV is 0.09% ER

Quote: prozemaQuote: 100xOddsQuote: MentalI never liked paying fees to mutual companies. Have any of you ever added up the amounts you have paid to these leaches over the years?

link to original post

Everything i have is Vanguard, fidelity, or schwab thus low expense ratios except My healthcare fund (prhsx).

it's .80% ER but i've had it for 2 decades.

it had way above avg returns but havent paid much attention to it in the past 10yrs

link to original post

XLV is 0.09% ER

link to original post

hm.. Assuming ER is factored in, prhsx comes out ahead by .45%:

https://portfolioslab.com/tools/stock-comparison/PRHSX/XLV

Quote: Mental

I never liked paying fees to mutual companies. Have any of you ever added up the amounts you have paid to these leaches over the years?

link to original post

When I first started 35 years ago I bought Twentieth Century and Janus mutual funds. Once I paid attention I got rid of all of them except Ultra, which has FAR exceeded any benchmark. I would never buy more but for whatever reason am keeping it.

I have also never intentionally paid a ‘manager’ to pick stocks or bonds or mutual funds. What they charge is nothing short of ridiculous. I did have to use one for a specific pension I had and hated it. We got him to ‘only’ charge us 0.5%. But on $400k that was still $2k a year. What did he do? He’d plug the money into 6 or 7 different mutual funds that could only be bought through an ‘advisor’. So in addition to that $2k I was also paying internal fees on the mutual funds.

I guess if you are financially illiterate a manager makes sense. I only know they have the nicest car and biggest house!

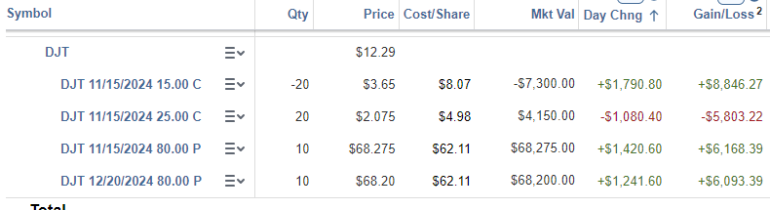

Quote: DRichDonald trump media stock DJT down 15% this morning.

link to original post

It is not easy to bet that DJT will decline. It is a very expensive stock to short due to high borrow costs. This translates through to the options premiums. The options premiums for selling calls (betting on DJT price falling) were actually negative for far OTM calls. My brokerage actually suspended my privilege to be short DJT calls after I sold too many DJT calls short. These got exercised early quite often, causing the brokerage to have to call me to cover the position. I am still allowed to by DJT puts, but the ITM and near-ITM premiums are outrageous.

I am currently holding 20 contracts of $80 ITM puts equivalent to being short 2000 shares DJT. I have another 10 contracts of a short straddle. The puts tie up a lot of capital until November, but I think it is the best remaining way for me to stay short DJT. My short DJT positions gained $6K in value this morning. I am expecting the trend to continue through lockup expiration next week.

Quote: billryanQuote: 100xOddsQuote: 100xOddsQuote: DRichQuote: SOOPOO

It’s now one year to the day until I start social security. Another check for not working. (I know I worked for 35 years and contributed…)

I am very jealous. May I ask how old you are? I have four years to go until I can collect at 62 which I plan on doing. Hopefully in four years I will have enough peanuts squirrelled away to retire.

link to original post

If you don't need to collect at 62, why not wait?

age 67 you get full ss, and every year you wait after that (till age 70) you get bonus $.

Or you dont think you'll be healthy enough to enjoy life at the breakeven age?

(i dont remember what the breakeven age is in collecting at 62 vs 67)

link to original post

Just saw a video that said breakeven is 79.

if you dont think you'll live till age 79, take SS at age 62

link to original post

I believe that involves taking the money at 62 and spending it. If you take SS at 62 and bank it so that at 67 or 70, you have your reduced SS, but you also have the monthly income from the interest on the sixty or ninety checks that you banked, and you have the money in hand.

Every year you wait, your payments will go up, but you are losing a year's income. If you can collect $1500 at 67 but start collecting $1000 at 62, you'll collect $60,000 in those years.

Invested in CDs, you should have around $70,000 before your 67th birthday. I prefer the lower monthly payment and the money in the bank. Others want a larger monthly payment.

link to original post

This is how much less you'll be receiving if you take SS early:

https://www.ssa.gov/benefits/retirement/planner/1960.html

Investing in CDs does not overcome the penalty % of taking SS early.

Quote: 100xOddsQuote: billryanQuote: 100xOddsQuote: 100xOddsQuote: DRichQuote: SOOPOO

It’s now one year to the day until I start social security. Another check for not working. (I know I worked for 35 years and contributed…)

I am very jealous. May I ask how old you are? I have four years to go until I can collect at 62 which I plan on doing. Hopefully in four years I will have enough peanuts squirrelled away to retire.

link to original post

If you don't need to collect at 62, why not wait?

age 67 you get full ss, and every year you wait after that (till age 70) you get bonus $

This is how much less you'll be receiving if you take SS early:

https://www.ssa.gov/benefits/retirement/planner/1960.html

Investing in CDs does not overcome the penalty % of taking SS early.

link to original post

Follow the math. At 62 , you can collect $700 or wait sixty months and collect 1000. You don't need the money to live on.

If you collect at 62 and bank it, you'll have $42,000 plus sixty months of interest, so let's say $48,000. If you die before you turn 68, your family or someone will get the money. If you don't collect and die at 67, they get $255.

Would you rather receive $700 monthly and $48,000 in the bank or get your full $1,000? If you start drawing interest on your $48,000, the gap closes to about $100. I think losing $100 a month but having the $48,000 feathered in my retirement nest is the way to go. Your choice may be different. I know that in some cases, a large SS payment becomes taxable, so that may be a consideration for some.The older I get, the better I recall things that never happened

ok, then taking SS at 62 does look better

Quote: 100xOddsInteresting.. did not know SS was tax free if your overall income was below $x.

ok, then taking SS at 62 does look better

link to original post

I think you are better off banking it. Most studies don't give the bank it option and simply compare 62 vs. 67. It really comes down to your circumstances imo.

Quote: 100xOddsQuote: 100xOddsQuote: DRichQuote: SOOPOO

It’s now one year to the day until I start social security. Another check for not working. (I know I worked for 35 years and contributed…)

I am very jealous. May I ask how old you are? I have four years to go until I can collect at 62 which I plan on doing. Hopefully in four years I will have enough peanuts squirrelled away to retire.

link to original post

If you don't need to collect at 62, why not wait?

age 67 you get full ss, and every year you wait after that (till age 70) you get bonus $.

Or you dont think you'll be healthy enough to enjoy life at the breakeven age?

(i dont remember what the breakeven age is in collecting at 62 vs 67)

link to original post

Just saw a video that said breakeven is 79.

if you dont think you'll live till age 79, take SS at age 62

link to original post

I will do my own math but if that is near true makes my decision far easier. I don’t see making it past 70 at best.

Quote: AZDuffman

I will do my own math but if that is near true makes my decision far easier. I don’t see making it past 70 at best.

I don't expect to make it to 65 so I will take it as soon as I can.

Quote: DRichQuote: AZDuffman

I will do my own math but if that is near true makes my decision far easier. I don’t see making it past 70 at best.

I don't expect to make it to 65 so I will take it as soon as I can.

link to original post

So quit saving for retirement, buy the wives an excellent insurance policy, and party like it's 1999.

Quote: SOOPOOGreat day. Portfolio now up 154% from inception. QQQ has been my best idea…..

link to original post

Peeked back at this post. Today up 172% from inception. That’s up around 7% last 1/2 year.

Bought a tad more JEPQ.

Quote: 100xOddsInteresting.. did not know SS was tax free if your overall income was below $x.

ok, then taking SS at 62 does look better

link to original post

That is a partially incorrect statement or conclusion. SS has taxable thresholds. When those thresholds are exceeded, SS funds can be taxed federally. I am not exactly sure what those limits are, but if ones outside income from pensions, interest, dividends, gambling, rentals, etc. exceed around $35k a majority portion of ones SS is taxable. If the outside income exceeds $82k, I believe, then the total amount of SS is taxed. BTW tax-free muni's are considered as outside income for the purpose of taxed SS.

tuttigym

Quote: billryanQuote: DRichQuote: AZDuffman

I will do my own math but if that is near true makes my decision far easier. I don’t see making it past 70 at best.

I don't expect to make it to 65 so I will take it as soon as I can.

link to original post

So quit saving for retirement, buy the wives an excellent insurance policy, and party like it's 1999.

link to original post

With my health issues I can't buy more life insurance at a reasonable rate. I do have some life insurance and with the savings my wife can quit working the day I drop dead. She won't be wealthy but will have more than enough for her to retire before she turns 50.

Quote: tuttigymQuote: 100xOddsInteresting.. did not know SS was tax free if your overall income was below $x.

ok, then taking SS at 62 does look better

link to original post

That is a partially incorrect statement or conclusion. SS has taxable thresholds. When those thresholds are exceeded, SS funds can be taxed federally. I am not exactly sure what those limits are, but if ones outside income from pensions, interest, dividends, gambling, rentals, etc. exceed around $35k a majority portion of ones SS is taxable. If the outside income exceeds $82k, I believe, then the total amount of SS is taxed. BTW tax-free muni's are considered as outside income for the purpose of taxed SS.

tuttigym

link to original post

Your last years of work are usually your peak salary years, yet another factor for consideration.

Quote: billryanQuote: tuttigymQuote: 100xOddsInteresting.. did not know SS was tax free if your overall income was below $x.

ok, then taking SS at 62 does look better

link to original post

That is a partially incorrect statement or conclusion. SS has taxable thresholds. When those thresholds are exceeded, SS funds can be taxed federally. I am not exactly sure what those limits are, but if ones outside income from pensions, interest, dividends, gambling, rentals, etc. exceed around $35k a majority portion of ones SS is taxable. If the outside income exceeds $82k, I believe, then the total amount of SS is taxed. BTW tax-free muni's are considered as outside income for the purpose of taxed SS.

tuttigym

link to original post

Your last years of work are usually your peak salary years, yet another factor for consideration.

link to original post

If you are able to keep a career path. I find many people kind of myself included that do well in something then that ends after which you never get that drive back. After that you end up a journeyman doing ok but never to where you peaked.

Quote: billryan

Your last years of work are usually your peak salary years, yet another factor for consideration.

link to original post

I agree but my experience tends to reveal that the last few years are also the least productive.

Quote: DRichQuote: billryan

Your last years of work are usually your peak salary years, yet another factor for consideration.

link to original post

I agree but my experience tends to reveal that the last few years are also the least productive.

link to original post

But that doesn't affect your SS. A couple of years ago, my sister's annual report told her she could get X at retirement. She was very happy getting 70% of X and put in her papers as soon as she could. By retiring early, she not only lost those last years of income but ended up getting 70% of X-18% as some of her low-paying years were used in the formula instead of the higher ones. I'm unsure exactly how it works, but she was very disappointed with the final amount. She'd maxed out her payments most of her career and expected to get max SS.

Quote: SOOPOOQuote: Mental

I never liked paying fees to mutual companies. Have any of you ever added up the amounts you have paid to these leaches over the years?

link to original post

When I first started 35 years ago I bought Twentieth Century and Janus mutual funds. Once I paid attention I got rid of all of them except Ultra, which has FAR exceeded any benchmark. I would never buy more but for whatever reason am keeping it.

I have also never intentionally paid a ‘manager’ to pick stocks or bonds or mutual funds. What they charge is nothing short of ridiculous. I did have to use one for a specific pension I had and hated it. We got him to ‘only’ charge us 0.5%. But on $400k that was still $2k a year. What did he do? He’d plug the money into 6 or 7 different mutual funds that could only be bought through an ‘advisor’. So in addition to that $2k I was also paying internal fees on the mutual funds.

I guess if you are financially illiterate a manager makes sense. I only know they have the nicest car and biggest house!

link to original post

In the mid-1990s, I parked $150,000 into two 20th Century funds- Ultra and Vista. One had back-to-back years of nearly 40%. The other did better the one year but tanked the next, barely going up 20%. It all seemed so simple.

Quote: billryanBut that doesn't affect your SS. A couple of years ago, my sister's annual report told her she could get X at retirement. She was very happy getting 70% of X and put in her papers as soon as she could.

By retiring early, she not only lost those last years of income but ended up getting 70% of X-18% as some of her low-paying years were used in the formula instead of the higher ones. I'm unsure exactly how it works, but she was very disappointed with the final amount. She'd maxed out her payments most of her career and expected to get max SS.

link to original post

Why was the final amount she got so different than the annual report that she based her decisions on?

whats the point of the annual report then?

Quote: 100xOddsQuote: billryanBut that doesn't affect your SS. A couple of years ago, my sister's annual report told her she could get X at retirement. She was very happy getting 70% of X and put in her papers as soon as she could.

By retiring early, she not only lost those last years of income but ended up getting 70% of X-18% as some of her low-paying years were used in the formula instead of the higher ones. I'm unsure exactly how it works, but she was very disappointed with the final amount. She'd maxed out her payments most of her career and expected to get max SS.

link to original post

Why was the final amount she got so different than the annual report that she based her decisions on?

whats the point of the annual report then?

link to original post

The report assumes you will work to retirement age and make at least as much money as you are currently making. IF you do X, you will get Y. Retiring early means you didn't accomplish X so you no longer get Y.

Quote: billryanQuote: 100xOddsQuote: billryanBut that doesn't affect your SS. A couple of years ago, my sister's annual report told her she could get X at retirement. She was very happy getting 70% of X and put in her papers as soon as she could.

By retiring early, she not only lost those last years of income but ended up getting 70% of X-18% as some of her low-paying years were used in the formula instead of the higher ones. I'm unsure exactly how it works, but she was very disappointed with the final amount. She'd maxed out her payments most of her career and expected to get max SS.

link to original post

Why was the final amount she got so different than the annual report that she based her decisions on?

whats the point of the annual report then?

link to original post

The report assumes you will work to retirement age and make at least as much money as you are currently making. IF you do X, you will get Y. Retiring early means you didn't accomplish X so you no longer get Y.

link to original post

When I go to the SS website it shows me options for collecting at 62, at 65, and at 67. It shows the estimated amount at each age.

Quote: DRichQuote: billryanQuote: 100xOddsQuote: billryanBut that doesn't affect your SS. A couple of years ago, my sister's annual report told her she could get X at retirement. She was very happy getting 70% of X and put in her papers as soon as she could.

By retiring early, she not only lost those last years of income but ended up getting 70% of X-18% as some of her low-paying years were used in the formula instead of the higher ones. I'm unsure exactly how it works, but she was very disappointed with the final amount. She'd maxed out her payments most of her career and expected to get max SS.

link to original post

Why was the final amount she got so different than the annual report that she based her decisions on?

whats the point of the annual report then?

link to original post

The report assumes you will work to retirement age and make at least as much money as you are currently making. IF you do X, you will get Y. Retiring early means you didn't accomplish X so you no longer get Y.

link to original post

When I go to the SS website it shows me options for collecting at 62, at 65, and at 67. It shows the estimated amount at each age.

link to original post

If I understand correctly, SS is based on your best 35 years of income. Because she spent years in school pursuing higher degrees, she didn't start working full-time until she was in her thirties. In her case, she had thirty-one years of full-time employment at 62, so they counted four years of income when she was a full-time student. Most adults start working young and have 35 top-paying years before they turn 62. In her case, instead of five more years of max income, they used years when she was a waitress.

She thought she'd get around 2600 and got several hundred less.

She may have misread the papers, I wasn't involved, but she was very unhappy with the result.

Quote: billryan

If I understand correctly, SS is based on your best 35 years of income. Because she spent years in school pursuing higher degrees, she didn't start working full-time until she was in her thirties. In her case, she had thirty-one years of full-time employment at 62, so they counted four years of income when she was a full-time student. Most adults start working young and have 35 top-paying years before they turn 62. In her case, instead of five more years of max income, they used years when she was a waitress.

She thought she'd get around 2600 and got several hundred less.

She may have misread the papers, I wasn't involved, but she was very unhappy with the result.

link to original post

I have only worked for 34 years so my numbers might not be accurate. Actually, only 33 with income as one year I worked all year and never got paid.

As far as the SS question, I’m not sure if people are adequately figuring in inflation. The ‘early’ dollars are worth more than the ‘later’ dollars.

Quote: SOOPOONew ATH this am (I think!) at +174%. Since this is the WoV portfolio, I bought some FOUR instead of plowing the money into the money market fund. When it goes down I can bitch at DRich!

As far as the SS question, I’m not sure if people are adequately figuring in inflation. The ‘early’ dollars are worth more than the ‘later’ dollars.

link to original post

Good luck. I bought most of mine between $45 and $65. They have been speculated as a company that will likely get bought out. About six months or so ago a company made an offer for around $93 but it was turned down.

Quote: SOOPOONew ATH this am (I think!) at +174%. Since this is the WoV portfolio, I bought some FOUR instead of plowing the money into the money market fund. When it goes down I can bitch at DRich!

As far as the SS question, I’m not sure if people are adequately figuring in inflation. The ‘early’ dollars are worth more than the ‘later’ dollars.

link to original post

I'm unclear about that. Lets say you and your twin are turning 62 and can collect $700 now or $,1000 in six years.

If you start collecting, you get COLA every year so in six years you get 800. Your twin starts collecting. does he get the original $1,000 or does he get the benefit of all those COLAs?

Quote: DRichQuote: billryan

If I understand correctly, SS is based on your best 35 years of income. Because she spent years in school pursuing higher degrees, she didn't start working full-time until she was in her thirties. In her case, she had thirty-one years of full-time employment at 62, so they counted four years of income when she was a full-time student. Most adults start working young and have 35 top-paying years before they turn 62. In her case, instead of five more years of max income, they used years when she was a waitress.

She thought she'd get around 2600 and got several hundred less.

She may have misread the papers, I wasn't involved, but she was very unhappy with the result.

link to original post

I have only worked for 34 years so my numbers might not be accurate. Actually, only 33 with income as one year I worked all year and never got paid.

link to original post

In my sisters case, they went back and used a few years where she worked part-time, if I understand it correctly.

Quote: DRichQuote: billryanQuote: 100xOddsQuote: billryanBut that doesn't affect your SS. A couple of years ago, my sister's annual report told her she could get X at retirement. She was very happy getting 70% of X and put in her papers as soon as she could.

By retiring early, she not only lost those last years of income but ended up getting 70% of X-18% as some of her low-paying years were used in the formula instead of the higher ones. I'm unsure exactly how it works, but she was very disappointed with the final amount. She'd maxed out her payments most of her career and expected to get max SS.

link to original post

Why was the final amount she got so different than the annual report that she based her decisions on?

whats the point of the annual report then?

link to original post

The report assumes you will work to retirement age and make at least as much money as you are currently making. IF you do X, you will get Y. Retiring early means you didn't accomplish X so you no longer get Y.

link to original post

When I go to the SS website it shows me options for collecting at 62, at 65, and at 67. It shows the estimated amount at each age.

link to original post

The SS payment increases by 7% per year until you reach the age of 70. You can receive up to 130% of the standard payment amount.

I decided to wait until I was 70 to collect. My four highest years of income all came after I reached the age of 65. Waiting for these higher income years also boosted my SS payment. These years replace some earlier years where I made much less than I do now.

Quote: MentalQuote: DRichQuote: billryanQuote: 100xOddsQuote: billryanBut that doesn't affect your SS. A couple of years ago, my sister's annual report told her she could get X at retirement. She was very happy getting 70% of X and put in her papers as soon as she could.

By retiring early, she not only lost those last years of income but ended up getting 70% of X-18% as some of her low-paying years were used in the formula instead of the higher ones. I'm unsure exactly how it works, but she was very disappointed with the final amount. She'd maxed out her payments most of her career and expected to get max SS.

link to original post

Why was the final amount she got so different than the annual report that she based her decisions on?

whats the point of the annual report then?

link to original post

The report assumes you will work to retirement age and make at least as much money as you are currently making. IF you do X, you will get Y. Retiring early means you didn't accomplish X so you no longer get Y.

link to original post

When I go to the SS website it shows me options for collecting at 62, at 65, and at 67. It shows the estimated amount at each age.

link to original post

The SS payment increases by 7% per year until you reach the age of 70. You can receive up to 130% of the standard payment amount.

I decided to wait until I was 70 to collect. My four highest years of income all came after I reached the age of 65. Waiting for these higher income years also boosted my SS payment. These years replace some earlier years where I made much less than I do now.

link to original post

Mental: You have posted that you have won large amounts of $$$ through your on-line casino play. You have received W2G's. Do you pay Medicare taxes and SS when you file your tax returns? Do you file as a professional gambler and therefore pay self-employment also?

tuttigym

Quote: MentalI decided to wait until I was 70 to collect. My four highest years of income all came after I reached the age of 65. Waiting for these higher income years also boosted my SS payment. These years replace some earlier years where I made much less than I do now.

link to original post

Also, Social Security benefits can be reduced if a person earns too much before reaching full retirement age.

Earnings limit: In 2024, the earnings limit for people under full retirement age is $22,320.

I think that's 140% of Poverty levels.

(Incidentally, thats also the max amount you can earn and still get full obamacare subsidies if under age 65)

So for you, there's GREAT incentive to wait even if you don't think you'll live past age 79.

Quote: tuttigymQuote: Mental

The SS payment increases by 7% per year until you reach the age of 70. You can receive up to 130% of the standard payment amount.

I decided to wait until I was 70 to collect. My four highest years of income all came after I reached the age of 65. Waiting for these higher income years also boosted my SS payment. These years replace some earlier years where I made much less than I do now.

link to original post

Mental: You have posted that you have won large amounts of $$$ through your on-line casino play. You have received W2G's. Do you pay Medicare taxes and SS when you file your tax returns? Do you file as a professional gambler and therefore pay self-employment also?

tuttigym

link to original post

Yes, you can infer that I reported the gambling income on Schedule C and paid SS and Medicare taxes because otherwise I would not get boost to average SS earnings. This includes the self-employment portion.

Looking a my SS statement, I actually reported less SS income on average as a B&M gambler than I did when I had a full-time professional job. Part of that is because I did not file on Schedule C during my biggest winning years. I reduced my tax bill that way, but it reduced my future SS payments. The math of the tax situation depends on the ratio of total reported W2G income to net gambling income. In my good B&M years, the ratio was rather low.

Once I started playing online, I started making good money again and I decided to report it all on Schedule C every year since. My total W2Gs are running about seven times higher than my reported gambling income. I don't want to report my gross gambling income as Other Income and then deduct losing sessions on Schedule A. My AGI before the deduction would be insanely high.

Quote: SOOPOONew ATH this am (I think!) at +174%. Since this is the WoV portfolio, I bought some FOUR instead of plowing the money into the money market fund. When it goes down I can bitch at DRich!

As far as the SS question, I’m not sure if people are adequately figuring in inflation. The ‘early’ dollars are worth more than the ‘later’ dollars.

link to original post

This is an interesting video that just dropped today about the private air force that the CEO of FOUR started. Pretty interesting to me since he was never in any of the branches of the military services,

.

i consider it part of my Bonds of my asset allocation.

ie: use it to buy more total bond etf?

Quote: 100xOddsWhen interest rates drop, should i do something else with my 3month treasury bills ladder?

i consider it part of my Bonds of my asset allocation.

ie: use it to buy more total bond etf?

link to original post

Yikes! There are none of us here who know the details of your life (salary, job stability, dependents, lifestyle, risk tolerance, etc..) that can answer that for you.

My not truly informed guess…. why not park the money in a money market fund presently earning more than a 3 month T Bill, by around 1/2%.

Quote: SOOPOOMy not truly informed guess…. why not park the money in a money market fund presently earning more than a 3 month T Bill, by around 1/2%.

link to original post

I have Ally as my MM acct. It pays 4.2%.

Tbills are 4.75% and state/local tax free.

Oh, tbill ladder is after tax acct

Quote: 100xOddsQuote: SOOPOOMy not truly informed guess…. why not park the money in a money market fund presently earning more than a 3 month T Bill, by around 1/2%.

link to original post

I have Ally as my MM acct. It pays 4.2%.

Tbills are 4.75% and state/local tax free.

Oh, tbill ladder is after tax acct

link to original post

Why would you pick Ally if the pay a full percent less than everyone else?

(Not ‘everyone’ else, but not hard to find over 5%)

Going to casino today to risk less than 1/2 % of yesterdays market gains.

DK on inexorable upward trend.

Quote: MentalQuote: DRichDonald trump media stock DJT down 15% this morning.

link to original post

It is not easy to bet that DJT will decline. It is a very expensive stock to short due to high borrow costs. This translates through to the options premiums. The options premiums for selling calls (betting on DJT price falling) were actually negative for far OTM calls. My brokerage actually suspended my privilege to be short DJT calls after I sold too many DJT calls short. These got exercised early quite often, causing the brokerage to have to call me to cover the position. I am still allowed to by DJT puts, but the ITM and near-ITM premiums are outrageous.

I am currently holding 20 contracts of $80 ITM puts equivalent to being short 2000 shares DJT. I have another 10 contracts of a short straddle. The puts tie up a lot of capital until November, but I think it is the best remaining way for me to stay short DJT. My short DJT positions gained $6K in value this morning. I am expecting the trend to continue through lockup expiration next week.

link to original post

DJT had a brief spike up to $20.86 on Friday the 13th. I hope DJT longs took the chance to unload their positions. I was out on a bike ride and missed a chance to short more DJT. DJT closed at $12.30 today.

I gained over $3000 on my options today and the total position is up over $15K in four weeks. I have a lot of successful short trades from this summer and back in 2022 when it was still DWAC stock. I am not tempted to take profits yet. All these short positions expire after the election.

By way of explanation, the first two positions are part of a short call vertical spread. My brokerage now forbids me to sell naked calls on DJT. The other two positions are naked long put positions. My brokerage is fine with that.

so how did you do at the casino?Quote: SOOPOOUp 177% before market opens. I ‘made’ more in one day by doing nothing than I ever made in month by working. (Of course it could all go away today).

Going to casino today to risk less than 1/2 % of yesterdays market gains.

DK on inexorable upward trend.

link to original post