https://www.fool.com/investing/2020/02/05/drinkers-are-confusing-corona-beer-with-the-corona.aspx

Since the virus began to take on global proportions in the middle of January, online searches for the phrase " beer coronavirus" surged over 3,200% globally while "corona beer virus" rocketed 2,300%.

Quote: SOOPOONIO up 11% today. Now 4.51

Of note I had 61 shares of Tesla. Has around DOUBLED the past week. Sold 11 shares today at $940. I like owning an even number of shares.

It makes no sense, actually. They make cars. And they don't sell that many.

I like concept of BTI. Now 44.74. They sell cigarettes. They sell enough to make a big profit. Price makes sense to me.

Portfolio now up 73% since inception.

Tessa is not a car company. It's many things but I'd say it's an energy/ software/technology company.

Quote: 100xOddsAnyone short Corona beer?

https://www.fool.com/investing/2020/02/05/drinkers-are-confusing-corona-beer-with-the-corona.aspx

Since the virus began to take on global proportions in the middle of January, online searches for the phrase " beer coronavirus" surged over 3,200% globally while "corona beer virus" rocketed 2,300%.

Quote: billryanTessa is not a car company. It's many things but I'd say it's an energy/ software/technology company.

You are correct. It was valued as a car company two weeks ago. Now it is valued as a tech company.

I was asked about MGP. Own none. Not Interested in MGM. Only gaming stock left is GLXZ.

My point is that if Tesla kept going up to 1000+and didnt come back his puts would have eventually been worth zero. How did he know that 900 was the 'silly' number and it wasn't 700, or a week before 500? If he bought puts when Tesla was 500, they would be almost worthless now.

Mostly what he does is find a stock, figure its 'real' value, say $40 a share..... Buy when it is 38, sell when it is 42, rinse and repeat. I always ask how do you KNOW when it is 38 it wont have the bottom fall out and have it drop to 20.....?

How certain are you that his overall results are in the black?Quote: SOOPOOFor those interested.... my B in L follows a few stocks closely and feels he "knows" them. He does not day trade, but rather will try and 'buy low' and 'sell high' over the course of a few days or weeks or rarely longer. We were texting during the ridiculous Tesla run up, and when it hit the 900's he bought puts (betting TSLA would go down). He risked $6k, and sold them the next day when Tesla dropped into the 700's, at a profit of $2k. He felt it was like 'free money'.

My point is that if Tesla kept going up to 1000+and didnt come back his puts would have eventually been worth zero. How did he know that 900 was the 'silly' number and it wasn't 700, or a week before 500? If he bought puts when Tesla was 500, they would be almost worthless now.

Mostly what he does is find a stock, figure its 'real' value, say $40 a share..... Buy when it is 38, sell when it is 42, rinse and repeat. I always ask how do you KNOW when it is 38 it wont have the bottom fall out and have it drop to 20.....?

Quote: AxelWolfHow certain are you that his overall results are in the black?

Certain. He is doing it for a living. He had a low paying job and made a deal with my sister that he would have to make a minimum of 6 figures to not look for a 'real' job again. My sister makes decent money and has a job that has full benefits.

But my point is this..... since the overall trajectory of the market over the past 5 years has been up, in essence when he has bought a stock it was +EV, as any random stock was +EV. So buying ANY stock at 40 it had a greater chance to go to 42, than 38.

I think he does overextend and does not use an actual Kelly Criterion, but more likely makes one up in his head.

He does have to pay real taxes on almost all of his profits; it is just like any other business that makes a profit. (A small amount of trading is done in a retirement account, so tax deferred).

I think that if the overall market turns south, he might not be as successful. Kind of like you, Axel, he sees opportunities where others do not. I'm betting with him on a VERY LOW scale. As I mentioned earlier, I now own NBEV on his advice. It's under 2 now. I'll be selling half if it makes 4.

that means next month's Future's contracts are cheaper than this month.

great time for shorting oil (ie: buying dwt) and holding past this month's Future's expiration date of Feb 21??

Quote: 100xOddsso oil is now in contango.

that means next month's Future's contracts are cheaper than this month.

great time for shorting oil (ie: buying dwt) and holding past this month's Future's expiration date of Feb 21??

I don't do futures/puts/calls/shorting etc.... I got to figure there are others smarter than me on the other side of whatever I do. I sold 1/4 of my MA today as it has more than tripled from inception and thus I had a disproportionate amount compared to other stocks. Bought some A rated bonds paying around 3% for the next 12 years.

I may sell 1/4 of my Apple as well later in the week, same concept.

By the way, there is an AP play available to parents of kids in college who are financially able to pay for the kids college. Have the kids take out as large a loan as allowed that will be called a student loan. Do what you want with the money......., save it, invest it, etc...... If a normal person becomes President pay it off.... if Sanders or Warren or any other 'eliminate student loan debt' candidate wins you are PLUS gobs of money.

Wife has some student loan debt from Dental School...... was considering paying it off but will wait at least until after the Democrat candidate is clear.

Quote: 100xOddsWhy is the stock market skyrocketing these past 2 months like it was the tech gold rush of the 2000's?

In my uninformed opinion, it's due to burning the candle at 14 ends with current short-term policy gains, overinflating the value of the market.

As you say, just like the tech market bubble, or the housing market bubble.

I don't think any further speculation can avoid being political and so would suggest you open the discussion of this at DT instead.

Quote: ontariodealermarket is on fire because hedge fund managers missed the boat in 2019 and now are playing catch up to keep their jobs and clients.

Explain this to me, please! On December 31 the worried hedge fund manager had a percentage gain or loss for last year and anything they do now does not change it. You don't believe there are still guys buying Tesla today to say, "see, I own Tesla, the hottest stock!" And a single investor will care about that compared to actual results which are easily quantifiable?

As you all know I do my own investing, as paying a percent or so for someone to guess instead of me guessing just isn't worth it!

Quote: billryanMarkets on fire, at least partially because interest rates suck. Where should I park my billions in pension funds?

I kind of agree. If interest rates were a little higher I’d be moving much more into bonds than I am now. I hate buying a two year bond paying less than 2%.

ATT ,for the dividend alone, is a better choice, in my opinion.

Quote: billryanBefore buying 2% bonds, I'd use the cash to pay off any and all debts, pre pay some funeral expenses and kids tuition and look into a couple collectibles.

ATT ,for the dividend alone, is a better choice, in my opinion.

I don't owe anyone a penny. I paid off mortgage as soon as I could against wishes of financial advisors, friends, accountants. I just hate the idea of owing anyone anything. My kids are all graduated so no more tuition for me. Funny you should say collectibles. I have coin and baseball card collections worth somewhere in the mid 5 figures. My kids will sell them after I'm dead. I do own some AT and T, plus lots of similar type stocks. Just that in a market crash they go down like everything else. Dividends are never guaranteed. If the stock is crashing the dividend dries up. 30 years ago I owned GM because it paid a great dividend. You know the end of that story.....

As far as actually investing in collectibles, it is my impression that the 'spread' on buy and sell is huge. You may have the knowledge to know a good buy; I would be the fish to your shark.....

If the stock price goes down, the dividend yield goes up.

As far as being a minnow, just use reputable dealers. Vincent, from Metropolis, recently negotiated a low seven figure purchase of Golden Age comics for an Arab Prince. A few years ago, he did a purchase for Nick Cage that at the time was the biggest sale in hobby history. Sir Paul McCartney has quietly put together what may be the finest comic collection in existence, although that Arab Prince may surpass it.

Suggestions? What kind of return would you expect and how long do you think it would take before they mature?Quote: billryanand look into a couple collectibles.

I sold a lot of stuff at the top of the market, now it will be time to buy some back. But time to remember 1000 pts is not what it used to be, about 3.4% drop at 1000. So unless things get really crazy dollar cost averaging will be the way to go, in other words if the market keeps going down, you should still be buying with that kind of still modest drop in my view

And, yes, for a little alarmism, this could be the big one!

PS: Gold is up to $1681 at the moment. Wish I had bought more of that

(So now 25% stocks,50% bonds, 25% international)

My portfolio right now after the 1900 point drop this week is equal to the portfolio of I never switched.

???Quote: 100xOddsOnce again, will this be the stock market meltdown that I've been expecting since 2 years ago when I switched 1/2 of my stocks into more bonds?

(So now 25% stocks,50% bonds, 25% international)

My portfolio right now after the 1900 point drop this week is equal to the portfolio of I never switched.

the way it should work is the value of your bonds you already own should be going up; the current new bonds pay a terrible interest rate in comparison. Stocks have gone down of course, so to rebalance now you would need to buy stocks.

Quote: SOOPOOI sold a little last week in a lucky move. But still by any standard overexposed to equities. Probably a dribble under 70%. I still have faith that I am correct in guessing I have no place better to park my money. Time will tell. If I need to move to Vegas to be a full time AP then ........

The last week has cost me about 15% of my portfolio. I ended up bailing on my Six Flags stock today as it was down about 45% and bankruptcy may be soon to follow.

Quote: DRichThe last week has cost me about 15% of my portfolio. I ended up bailing on my Six Flags stock today as it was down about 45% and bankruptcy may be soon to follow.

Market set to open down another 1% today. I’m down less than 10% but mostly due to bonds mitigating losses. But one of my biggest holdings (not in WoV portfolio) is O. Set to open down 6% because they are issuing tons of new stock to raise money. NOT a good sign!

Quote: 100xOddsOnce again, will this be the stock market meltdown that I've been expecting since 2 years ago when I switched 1/2 of my stocks into more bonds?

(So now 25% stocks,50% bonds, 25% international)

My portfolio right now after the 1900 point drop this week is equal to the portfolio of I never switched.

Are you including the stock dividends you missed out on in this comparison?

Quote: SOOPOOI sold a little last week in a lucky move. But still by any standard overexposed to equities. Probably a dribble under 70%. I still have faith that I am correct in guessing I have no place better to park my money. Time will tell. If I need to move to Vegas to be a full time AP then ........

With the NPV of your future fixed income streams, you are fine. Way beyond fine :P

stocks went down alot, bonds stayed the same.Quote: odiousgambit???

the way it should work is the value of your bonds you already own should be going up; the current new bonds pay a terrible interest rate in comparison. Stocks have gone down of course, so to rebalance now you would need to buy stocks.

My 50% bonds portfolio is up 20% since I switched 2 years ago.

My theorectical portfolio of not switching to Bonds went down to only being up 20% since 2 years ago.

I will rebalance when my 50% bond portfolio is worth 10%-15% more than the theorectical portfolio. (Go back to 50% stock, 25% bonds, 25% intl)

Twice in the past 2 years the 50% bond portfolio was about +7% more than the theorectical.

never imagined six flags failing with Disney theme park tickets reaching new highs.Quote: DRichThe last week has cost me about 15% of my portfolio. I ended up bailing on my Six Flags stock today as it was down about 45% and bankruptcy may be soon to follow.

lucky that Dan synder still has the Redskins to keep him in the billionaire category.

Quote: AxelWolfSuggestions? What kind of return would you expect and how long do you think it would take before they mature?

I look for opportunities to make 25-33% in a year or two. It's a tricky field but that's what makes success so much better. This month I was in a collectible/ tourist trap and saw something I'd never seen before. A toy car made by Revell, which is famous for their models, not their toys.

A little research showed it was one of the first and only toys the company made, and more importantly, it was one of the very first plastic toys sold in America.

Went back and found out the guy had two more. He was asking $50 each, I got the three for $100. Sold one the same day for $250, and consigned one to a friend in Vegas where he is asking $400, and have the last on display in my shop.

and the freefall continues.Quote: 100xOddsstocks went down alot, bonds stayed the same.

My 50% bonds portfolio is up 20% since I switched 2 years ago.

My theorectical portfolio of not switching to Bonds went down to only being up 20% since 2 years ago.

I will rebalance when my 50% bond portfolio is worth 10%-15% more than the theorectical portfolio. (Go back to 50% stock, 25% bonds, 25% intl)

Twice in the past 2 years the 50% bond portfolio was about +7% more than the theorectical.

my bonds are holding steady.

my 50% bond portfolio is still up 20% since 2 years ago when i gambled the stock market would crash.

the theo portfolio is now only up 14% since 2 years ago.

Quote: 100xOddsand the freefall continues.

We were overdue. Wonder if this is going to be the next recession or just another temporary blip. Either way, I'm not close to retirement so I'll be buying all the way down.

Quote: TigerWuWe were overdue. Wonder if this is going to be the next recession or just another temporary blip. Either way, I'm not close to retirement so I'll be buying all the way down.

Buying into a falling market is foolish,imo. If you think it is going to continue falling, wait and buy on the rebound.

Quote: billryanBuying into a falling market is foolish,imo. If you think it is going to continue falling, wait and buy on the rebound.

That's timing the market. You'll never know when the rebound is until after the fact. Just buy all the way down, and back up.

how do you know when the market is in rebound?Quote: billryanBuying into a falling market is foolish,imo. If you think it is going to continue falling, wait and buy on the rebound.

We suspended the only guy with the foresight needed.Quote: 100xOddshow do you know when the market is in rebound?

Oh hum. Our loss. $:o)

Quote: 100xOddshow do you know when the market is in rebound?

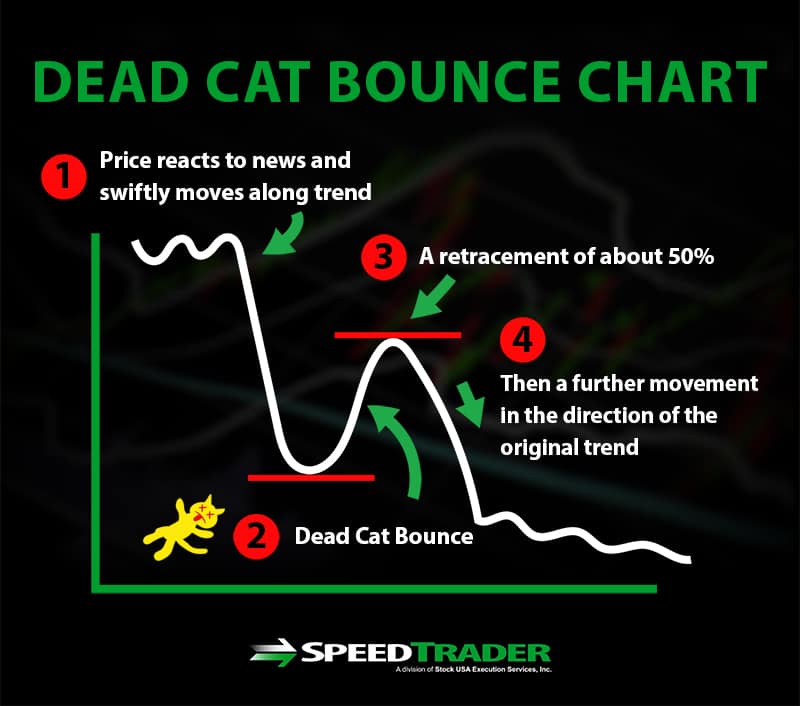

Three up sessions after five or more down sessions. Buy during session 4.

Quote: 100xOddshow do you know when the market is in rebound?

Three up sessions after five or more down sessions. Buy during session 4.

Quote: 100xOddshow do you know when the market is in rebound?

Three up sessions after five or more down sessions. Buy during session 4.

I’ve got some gun powder but I wouldn’t pull the trigger yet. Those who said buy when there is fear saw that fear last Friday. They’ve been burned pretty badly this week.

Quote: billryanThree up sessions after five or more down sessions. Buy during session 4.

I do think you need to see some follow thru strength. One day pops don’t mean much. I might be willing to nibble on 2 strong days in a row.

Quote: TDVegasI do think you need to see some follow thru strength. One day pops don’t mean much. I might be willing to nibble on 2 strong days in a row.

https://speedtrader.com/what-is-a-dead-cat-bounce/

https://speedtrader.com/what-is-a-dead-cat-bounce/But...... I retired 9/1/19. It is up 4% from 9/1. If on 9/1 I was told I'd be up 4% on 3/1 I'd say that's fine. I've been 'planning' on 5% a year and that is 4% over half a year.

I have NO IDEA whether we are at the bottom, or near the bottom, or about to gain back the 10% over the next month if the virus is contained and Bernie looks unelectable.....

With bonds paying barely 2% if they are 'safe', I really don't want to take money out of stocks.

I feel like I need a casino AP to remind me that if a play is +EV, you have to stay with it.

Quote: OnceDearWe suspended the only guy with the foresight needed.

Like he said “The best time to buy stocks is when you have the money.”

Despite the hysteria, leading economic indicators were up in the latest Conference Board report.

"Economic expansion will continue through the first half of 2020"

Good enough for me.

Quote: SOOPOOOk. Time for a sobering update. Was up 75% from inception at peak. Now up 58%. (So was at 1.75, now at 1.58---- down around 10% from peak.)

But...... I retired 9/1/19. It is up 4% from 9/1. If on 9/1 I was told I'd be up 4% on 3/1 I'd say that's fine. I've been 'planning' on 5% a year and that is 4% over half a year.

I have NO IDEA whether we are at the bottom, or near the bottom, or about to gain back the 10% over the next month if the virus is contained and Bernie looks unelectable.....

With bonds paying barely 2% if they are 'safe', I really don't want to take money out of stocks.

I feel like I need a casino AP to remind me that if a play is +EV, you have to stay with it.

Nothing political here, right?

Quote: billryanNothing political here, right?

Ouch... he would have been fine without that one reference.

Personally, I'm about to put more money into stocks AND bonds.

Quote: billryanNothing political here, right?

You know, I'll be happy to take a suspension. I flip back and forth between here and DT. My comment was totally about the market and its decline, and future prospects. there areju st some things that you CANNOT have a coherent conversation about without mentioning something political. If I'm going to discuss my investments and why I buy or sell, it would be MISLEADING to ignore the point I made.

But I don't make the rules, and had I thought about which board I was posting I would have left out the most important point because it clearly is political in nature. I try not to be disrespectful to our host.

Quote: TigerWuOuch... he would have been fine without that one reference.

Personally, I'm about to put more money into stocks AND bonds.

Out of curiosity, why invest in bonds? I've always looked at bonds as a means to preserve money, not to grow it. If you are a long way from retiring, why tie up money in a long term low interest investment?