I don't plan on ever buying any personally. Most proponents seem more interested in its increasing value than the other purported reasons, AFAICT.

Quote: rxwineThe two things essential in a pyramid scheme, is to get people to believe they can make money by joining later than you, and that they will make money by an ever-widening pyramid of endless folks.

I don't plan on ever buying any personally. Most proponents seem more interested in its increasing value than the other purported reasons, AFAICT.

link to original post

Most? It's more like all of them are. That's all they talk about or care about, how much they paid for it and how much it's now worth. Just like any other investment.

Those who invested, made a profit and love it.

Those who proclaimed it's a scam, watched others make lots of money and now, having made not one penny, still proclaim it must be a scam.

I admit I was unsure of it when I invested

so I invested a smallish amount

I figured 2 things could happen which in my estimation were about equally likely to happen - I could lose all or most of the smallish amount - or it could boom and I would make decent money

so it was a no brainer

of course, everybody knows what has happened

even, if it crashes and burns - which I think is very unlikely - losing my smallish investment will be no tragedy

millions and millions of people own some amount of crypt

if it is a scam - which of course it isn't - it would easily be the greatest scam in the history of the world

.

Quote: darkozIt seems there are two types of Bitcoin analysts.

Those who invested, made a profit and love it.

Those who proclaimed it's a scam, watched others make lots of money and now, having made not one penny, still proclaim it must be a scam.

link to original post

I think there's only one person on here who made a lot of money comparitively. Based on what they started, and when they started.

If it was such a great low risk investment how much of your overall wealth have you invested in it? A question for anyone actually.

Quote: tuttigymThank you all for the explanations and definitions. I greatly appreciate all of your efforts.

For me, it is so abstract, and I am so old school that I am still not able to embrace those concepts.

I can physically hold $$, gold, "tickets," and most other forms "currencies," but I don't think I can carry the crypto in my pocket like small change.

link to original post

Actually, you sort of can.

Imagine you wealth of bitcoin is stored in a numbered swiss bank account. They don't know you, but with the account secrets, they will deal with you happily. The money never comes into you hands, but you hold the secret account details written on a bit of paper that only you can read. Now, replace piece of paper with a hardware device called a Trezor wallet, which is like a PIN protected USB memory stick. At your leisure, you can plug that Trezor into a laptop and transfer funds to me or to a shop.

Some folks refer to storing Bitcoin on their Trezor Wallet, but you are only storing away the account secret there.

Quote: OnceDear

Some folks refer to storing Bitcoin on their Trezor Wallet,

link to original post

I knew a woman in the 90s who made a special carrier for her most valuable Beanie Babies so she could take them everywhere. Sounds like the same kind of thing as this wallet talking about. She still has the Beanie Babies but she doesn't carry them around anymore. They are in a drawer somewhere forgotten about.

Quote: EvenBobQuote: OnceDear

Some folks refer to storing Bitcoin on their Trezor Wallet,

link to original post

I knew a woman in the 90s who made a special carrier for her most valuable Beanie Babies so she could take them everywhere. Sounds like the same kind of thing as this wallet talking about. She still has the Beanie Babies but she doesn't carry them around anymore. They are in a drawer somewhere forgotten about.

link to original post

Were there Beanie Baby ETFs? Did pension funds invest in them?

Quote: EvenBobQuote: OnceDear

Some folks refer to storing Bitcoin on their Trezor Wallet,

link to original post

I knew a woman in the 90s who made a special carrier for her most valuable Beanie Babies so she could take them everywhere. Sounds like the same kind of thing as this wallet talking about. She still has the Beanie Babies but she doesn't carry them around anymore. They are in a drawer somewhere forgotten about.

link to original post

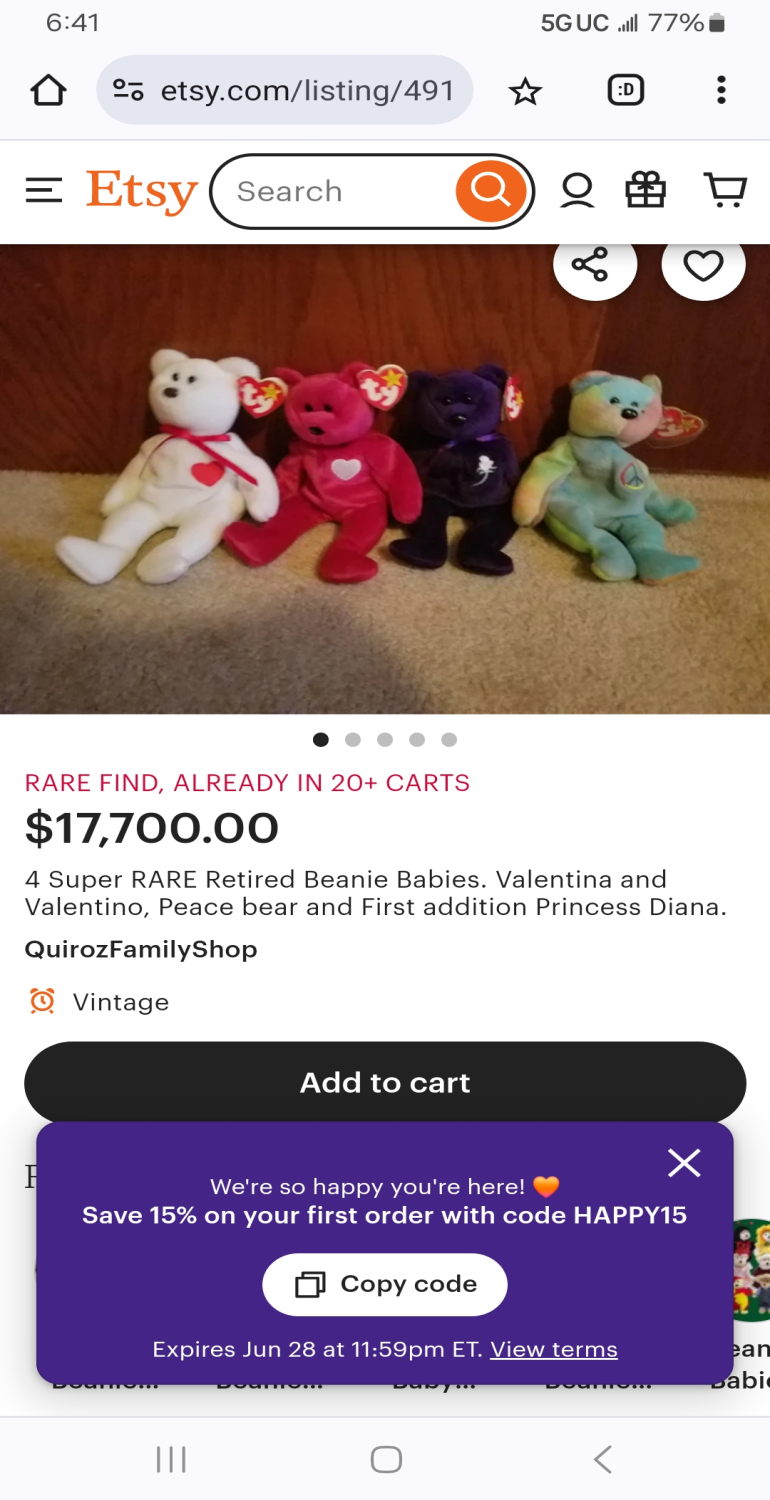

Did she buy the beanie babies for $1 and still have them at $66,000?

Quote: darkozQuote: EvenBobQuote: OnceDear

Some folks refer to storing Bitcoin on their Trezor Wallet,

link to original post

I knew a woman in the 90s who made a special carrier for her most valuable Beanie Babies so she could take them everywhere. Sounds like the same kind of thing as this wallet talking about. She still has the Beanie Babies but she doesn't carry them around anymore. They are in a drawer somewhere forgotten about.

link to original post

Did she buy the beanie babies for $1 and still have them at $66,000?..

link to original post

Once again the point of my good story is lost in the abyss..

Quote: EvenBobQuote: darkozQuote: EvenBobQuote: OnceDear

Some folks refer to storing Bitcoin on their Trezor Wallet,

link to original post

I knew a woman in the 90s who made a special carrier for her most valuable Beanie Babies so she could take them everywhere. Sounds like the same kind of thing as this wallet talking about. She still has the Beanie Babies but she doesn't carry them around anymore. They are in a drawer somewhere forgotten about.

link to original post

Did she buy the beanie babies for $1 and still have them at $66,000?..

link to original post

Once again the point of my good story is lost in the abyss..

link to original post

Because your story belongs in the abyss.

Even your analysis of beanie babies is wrong lol.

Just two listing's currently on Etsy and Ebay.

Quote: darkoz

Because your story belongs in the abyss.

Even your analysis of beanie babies is wrong lol.

link to original post

Just comparing one collectible with no intrinsic value to another. The end is always the same, they are both eventually worthless because they were worthless to begin with. Duh.. Perceived value and actual value are two different things.

Quote: EvenBobQuote: darkoz

Because your story belongs in the abyss.

Even your analysis of beanie babies is wrong lol.

link to original post

Just comparing one collectible with no intrinsic value to another. The end is always the same, they are both eventually worthless because they were worthless to begin with. Duh.. Perceived value and actual value are two different things.

link to original post

But really nothing has intrinsic value.

A steak dinner from 1993 is worth a lot less than a beanie baby from 1993. Because the steak dinner spoiled decades ago. The steak dinners intrinsic value went to zero. And yet you seem to believe the steak dinner had more lasting value than a beanie baby.

Quote: darkozQuote: EvenBobQuote: darkoz

Because your story belongs in the abyss.

Even your analysis of beanie babies is wrong lol.

link to original post

Just comparing one collectible with no intrinsic value to another. The end is always the same, they are both eventually worthless because they were worthless to begin with. Duh.. Perceived value and actual value are two different things.

link to original post

But really nothing has intrinsic value.

A steak dinner from 1993 is worth a lot less than a beanie baby from 1993. Because the steak dinner spoiled decades ago. The steak dinners intrinsic value went to zero. And yet you seem to believe the steak dinner had more lasting value than a beanie baby.

link to original post

Here's an example. The USD is backed by the incredible wealth of the United States. Just pay attention the next time you drive to whatever store you're going to. Look at the houses you're going by and the cars that are on the road, you're passing multi millions of dollars of wealth just on your way to the store. In some countries you could drive for 30 miles and not go past almost any wealth at all. Bitcoin is not backed by anything at all except a hope and a prayer. With a hope and a prayer and $15 you can get a Big Mac Dinner in the new economy.

Quote: EvenBobQuote: darkozQuote: EvenBobQuote: darkoz

Because your story belongs in the abyss.

Even your analysis of beanie babies is wrong lol.

link to original post

Just comparing one collectible with no intrinsic value to another. The end is always the same, they are both eventually worthless because they were worthless to begin with. Duh.. Perceived value and actual value are two different things.

link to original post

But really nothing has intrinsic value.

A steak dinner from 1993 is worth a lot less than a beanie baby from 1993. Because the steak dinner spoiled decades ago. The steak dinners intrinsic value went to zero. And yet you seem to believe the steak dinner had more lasting value than a beanie baby.

link to original post

Here's an example. The USD is backed by the incredible wealth of the United States. Just pay attention the next time you drive to whatever store you're going to. Look at the houses you're going by and the cars that are on the road, you're passing multi millions of dollars of wealth just on your way to the store. In some countries you could drive for 30 miles and not go past almost any wealth at all. Bitcoin is not backed by anything at all except a hope and a prayer. With a hope and a prayer and $15 you can get a Big Mac Dinner in the new economy.

link to original post

Most of America is living in poverty unfortunately. A few rich fat cats.

But if you think that same $5 you obtained in 1990 buys you the same amount of supplies go right ahead and believe.

In 1990 a $5 bill brought you two big mac meals. Today a $5 bill from 1990 wouldn't even buy you a single big mac.

Hardly what is considered a good investment.

Quote: darkozQuote: EvenBobQuote: darkozQuote: EvenBobQuote: darkoz

Because your story belongs in the abyss.

Even your analysis of beanie babies is wrong lol.

link to original post

Just comparing one collectible with no intrinsic value to another. The end is always the same, they are both eventually worthless because they were worthless to begin with. Duh.. Perceived value and actual value are two different things.

link to original post

But really nothing has intrinsic value.

A steak dinner from 1993 is worth a lot less than a beanie baby from 1993. Because the steak dinner spoiled decades ago. The steak dinners intrinsic value went to zero. And yet you seem to believe the steak dinner had more lasting value than a beanie baby.

link to original post

Here's an example. The USD is backed by the incredible wealth of the United States. Just pay attention the next time you drive to whatever store you're going to. Look at the houses you're going by and the cars that are on the road, you're passing multi millions of dollars of wealth just on your way to the store. In some countries you could drive for 30 miles and not go past almost any wealth at all. Bitcoin is not backed by anything at all except a hope and a prayer. With a hope and a prayer and $15 you can get a Big Mac Dinner in the new economy.

link to original post

Most of America is living in poverty unfortunately. A few rich fat cats.

But if you think that same $5 you obtained in 1990 buys you the same amount of supplies go right ahead and believe.

In 1990 a $5 bill brought you two big mac meals. Today a $5 bill from 1990 wouldn't even buy you a single big mac.

Hardly what is considered a good investment.

link to original post

So what. The USD at the time was backed by the wealth of the United States. What keeps Bitcoin alive is its the playtoy of the super rich like The TwinkleToes Brothers and without them you don't have anything. They keep it alive when it's failing because it has no intrinsic value of its own. Sounds like you read the Pyramid Scheme Salesman's Handbook too often.

Let's talk about the next 10-30 years.

Thousands, possibly 7,000 online casinos take Bitcoin. Many other legitimate public companies take Bitcoin.

The value of Bitcoin is using it as a tool to make more "money/value" and then you can choose what poor or great investment you decide to invest in... therefore Bitcoin is invaluable.

Quote: darkoz

Most of America is living in poverty unfortunately. A few rich fat cats.

American "poverty" is wealth in most of the rest of the world, Even in "The Grapes of Wrath" set in the depression it showed people having a car. However, so much of this is going to start to end as the USD loses its status. The petrodollar just ended. Mr and Mrs America don't even know what it was and how it propped things up. If only we could get the petro bitcoin or petro shiba inu!

Quote: darkoz

Most of America is living in poverty unfortunately. A few rich fat cats.

But if you think that same $5 you obtained in 1990 buys you the same amount of supplies go right ahead and believe.

That is ridiculous. How far below average does one have to be to be considered in poverty? The average income is around $1400 a month so if we assume that is true then I would guess poverty would be less than $1000 a month. Very few Americans are living on less than $1000 a month. A minimum wage job pays more than that.

We are still one of the richest countries with one of the highest standards of living of any country in the world so it is ridiculous to say most of America is living in poverty.

Quote: DRichQuote: darkoz

Most of America is living in poverty unfortunately. A few rich fat cats.

But if you think that same $5 you obtained in 1990 buys you the same amount of supplies go right ahead and believe.

That is ridiculous. How far below average does one have to be to be considered in poverty? The average income is around $1400 a month so if we assume that is true then I would guess poverty would be less than $1000 a month. Very few Americans are living on less than $1000 a month. A minimum wage job pays more than that.

We are still one of the richest countries with one of the highest standards of living of any country in the world so it is ridiculous to say most of America is living in poverty.

link to original post

What do you mean by ‘the average income is around 1400 a month’? Average including those too young to work, those retired, those incarcerated, etc…? Amongst full time workers the average has to be MUCH higher than $1400 a month here in the USA. Just picked up fast food. ‘Hiring starting at $17.50 an hour’. That is slightly more than DOUBLE $1400 a month.

Bitcoin has been around since 2009 - it's already 15 years old

although it didn't attract a lot of attention until much more recently

the linked article from Wiki is pretty interesting

from the article:

"the first notable transaction involving physical goods was paid on May 22, 2010 by exchanging 10,000 mined Btc or two pizzas delivered from a Papa John's in Jacksonville, Florida.

the 10,000 Bitcoins were worth about $40 USD at that time"_______________________-:)

Bitcoin was originated by Satoshi Nakamoto - but that name is a pseudonym - nobody knows which person or persons are responsible for originating it - there is a great deal of speculation about this

.

https://en.wikipedia.org/wiki/History_of_bitcoin

.

When full time people can't even pay for all their rent and utilities then it doesn't matter the minimum wage.

Every time the minimum wage goes up so do all the prices. So no one really is getting a raise at all.

Everyone is still living at the same levels as 50 years ago.

I was just watching Alfred Hitchcock's The Trouble with Harry. The guy is in the candy store and the lady adds up a whole grocery cart of items and says "That's $2.80" The guy says we'll I need a pack of cigarettes too. The lady says ten cents extra. He complains about the high cost of cigarettes.

It's laughable but we live in a world where no one can afford anything no matter how much they make.

I'm talking in general of course. There are well off people but most of America can't afford their bills without some form of government help.

Quote: DRich

The real chances of the U.S. dollar failing are also almost 100%. No fiat currency has ever survived over time.

link to original post

That is such a meaningless metric. Most fiat currencies don't "fail," they are simply replaced with something else that is either more efficient or more conducive to domestic and international economics. Most European currencies were replaced with the Euro, but no one would argue they "failed." You could also probably argue the US dollar has already been replaced at least once when we got off the gold standard.

Additionally, there are currently approximately 176 fiat currencies out of 775 that have ever existed, so it is also disingenuous to say that "no fiat currency has ever survived over time" when almost a quarter of them are still in existence.

Quote: SOOPOOQuote: DRichQuote: darkoz

Most of America is living in poverty unfortunately. A few rich fat cats.

But if you think that same $5 you obtained in 1990 buys you the same amount of supplies go right ahead and believe.

That is ridiculous. How far below average does one have to be to be considered in poverty? The average income is around $1400 a month so if we assume that is true then I would guess poverty would be less than $1000 a month. Very few Americans are living on less than $1000 a month. A minimum wage job pays more than that.

We are still one of the richest countries with one of the highest standards of living of any country in the world so it is ridiculous to say most of America is living in poverty.

link to original post

What do you mean by ‘the average income is around 1400 a month’? Average including those too young to work, those retired, those incarcerated, etc…? Amongst full time workers the average has to be MUCH higher than $1400 a month here in the USA. Just picked up fast food. ‘Hiring starting at $17.50 an hour’. That is slightly more than DOUBLE $1400 a month.

link to original post

I am guessing that you are just looking at the U.S. rates. World wide income is around $1400 a month.

Quote: SOOPOOWhat do you mean by ‘the average income is around 1400 a month’? Average including those too young to work, those retired, those incarcerated, etc…? Amongst full time workers the average has to be MUCH higher than $1400 a month here in the USA. Just picked up fast food. ‘Hiring starting at $17.50 an hour’. That is slightly more than DOUBLE $1400 a month.

per the link -

"NYC rentals average $3,600 for a studio rental to $8,295 for 4 bedroom rental. The median price for all currently available listings is $4,500"

the guy living in small town America will have a much easier time with the same income - re the purchase of many other necessities too

the income of a person living and working in NYC is surely higher too for doing the same type of work - but still - even so

it's not possible for a great many to live well when the costs are that high

.

https://www.renthop.com/average-rent-in/new-york-ny#:~:text=New%20York%20rentals%20average%20%243%2C600,unchanged%20over%20the%20last%20year.

.

Quote: OnceDearQuote: tuttigymThank you all for the explanations and definitions. I greatly appreciate all of your efforts.

For me, it is so abstract, and I am so old school that I am still not able to embrace those concepts.

I can physically hold $$, gold, "tickets," and most other forms "currencies," but I don't think I can carry the crypto in my pocket like small change.

link to original post

Actually, you sort of can.

Imagine you wealth of bitcoin is stored in a numbered swiss bank account. They don't know you, but with the account secrets, they will deal with you happily. The money never comes into you hands, but you hold the secret account details written on a bit of paper that only you can read. Now, replace piece of paper with a hardware device called a Trezor wallet, which is like a PIN protected USB memory stick. At your leisure, you can plug that Trezor into a laptop and transfer funds to me or to a shop.

Some folks refer to storing Bitcoin on their Trezor Wallet, but you are only storing away the account secret there.

link to original post

Thanks for the input. I guess, after reading everything here, I find that crypto is not going to be an investment for me. My simplistic nature and lack of technical insights doesn't lead me in a direction toward crypto. For me, it is so abstract it defies my understanding.

So again, thank you all for indulging my interest.

tuttigym

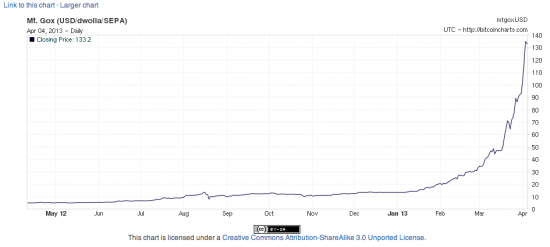

Quote: AhighWell, I bought the coins for "research" just to learn more about how it works but putting some equity in the spot so I could stir it around and see what happens.

I got in a 134.99 earlier this morning for 2.06 units.

To me:

* It's simply the first viable platform for a currency outside of a fiat currency.

* It's the only electronic cash that is possible to use without paying any fees or overhead to anyone

* It's gives you speculative power to go in and out without worry for overhead and fees related to trading (or excessive trading if you like to gamble by trading)

* It's open and the author continues to be anonymous and the code is open and available

* It's decentralized

To everyone else:

* It's easily "hacked" -- (wrong really at least depending on how you define "hacked")

* It isn't really a "safe" place to put your money (So far at least it has been from my perspective!)

* It's too complicated to get coins (I had to dig a little bit, but I figured out how to get set up for $6.00 taking cash to a bank where I don't even have an account!)

* It can't possibly work long term

What I predict is that soon, more and more people will start telling the real story about bitcoin and as more people realize that technology is a better way to have a currency than a government or even gold, all money will go towards technology (maybe even ala Revelations in the Bible?)

Anyway, I may start putting more of my short-term free cash into BitCoin just for shits and giggles because it's sort of fun to do.

Right now, it seems like the media wants to write it off as sort of "hackable" .. but the prices will be more stable as the network gets more tolerant of attacks.

I'm not worried about the hacks. I think those that are just aren't that smart about the long term viability of bitcoin.

There are some interest analysis on the system here that are worth a read on the technical side of things. So much of the mass media has done a crappy job of explaining how it all works.

http://ftalphaville.ft.com/2013/04/03/1425292/the-problem-with-bitcoin/?

link to original post

Wow that went up!

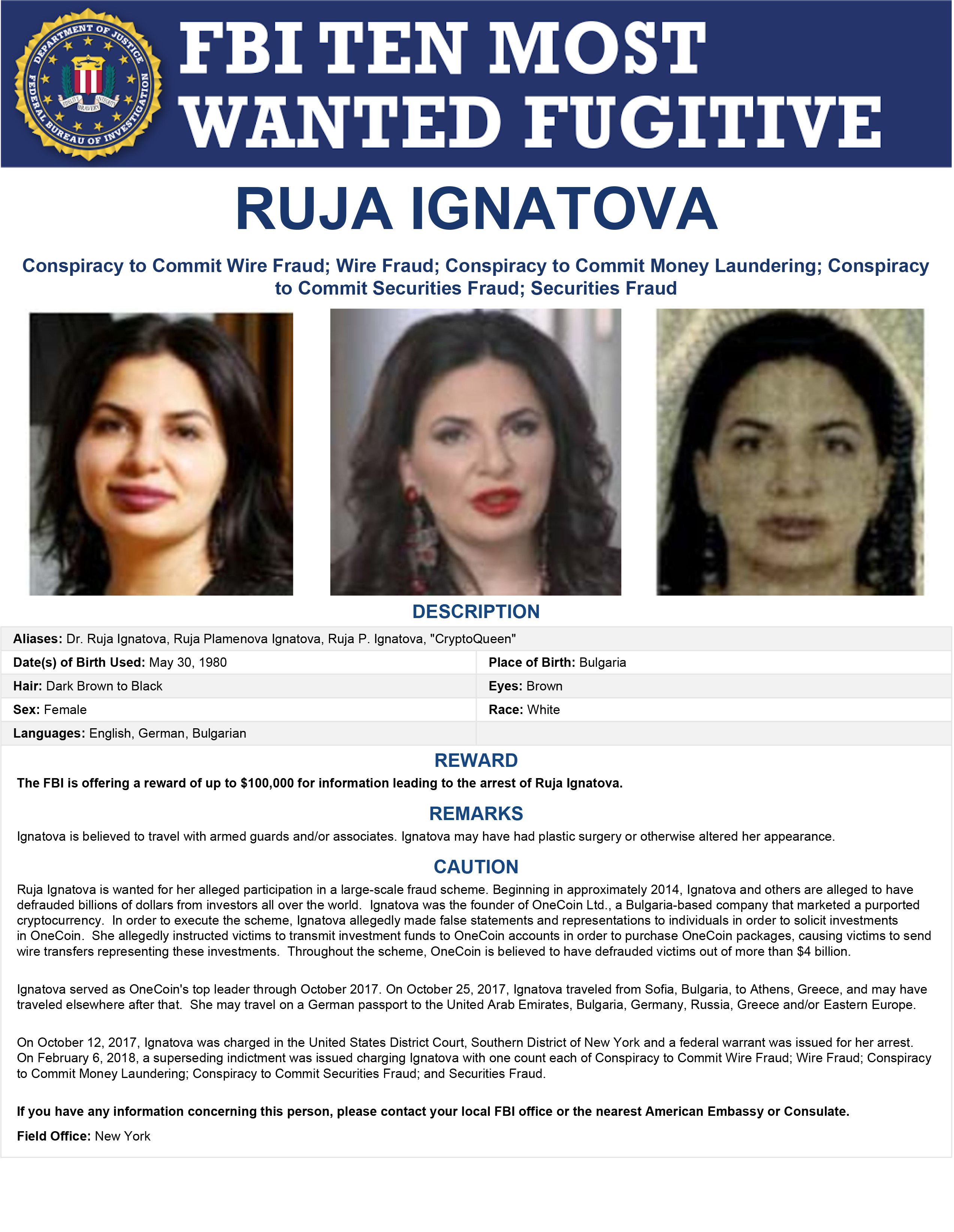

Quote:A $5million reward has been offered in the hunt for the world's most wanted woman as the FBI say 'cryptoqueen' Ruja Ignatova scammed investors out of more than $4billion in 'one of the largest global fraud schemes in history' before vanishing in 2017. Today's huge reward offer was authorized by the Secretary under the Department of State's Transnational Organized Crime Rewards Program after Bulgaria set out plans to file charges in absentia against the Bulgarian-born entrepreneur.

Quote: rxwineMoney making opportunity.

Quote:A $5million reward has been offered in the hunt for the world's most wanted woman as the FBI say 'cryptoqueen' Ruja Ignatova scammed investors out of more than $4billion in 'one of the largest global fraud schemes in history' before vanishing in 2017. Today's huge reward offer was authorized by the Secretary under the Department of State's Transnational Organized Crime Rewards Program after Bulgaria set out plans to file charges in absentia against the Bulgarian-born entrepreneur.

link to original post

She was most probably murdered and fed to the fish years ago.

Quote: EvenBobQuote: darkozQuote: EvenBobQuote: darkozQuote: EvenBobQuote: darkoz

Because your story belongs in the abyss.

Even your analysis of beanie babies is wrong lol.

link to original post

Just comparing one collectible with no intrinsic value to another. The end is always the same, they are both eventually worthless because they were worthless to begin with. Duh.. Perceived value and actual value are two different things.

link to original post

But really nothing has intrinsic value.

A steak dinner from 1993 is worth a lot less than a beanie baby from 1993. Because the steak dinner spoiled decades ago. The steak dinners intrinsic value went to zero. And yet you seem to believe the steak dinner had more lasting value than a beanie baby.

link to original post

Here's an example. The USD is backed by the incredible wealth of the United States. Just pay attention the next time you drive to whatever store you're going to. Look at the houses you're going by and the cars that are on the road, you're passing multi millions of dollars of wealth just on your way to the store. In some countries you could drive for 30 miles and not go past almost any wealth at all. Bitcoin is not backed by anything at all except a hope and a prayer. With a hope and a prayer and $15 you can get a Big Mac Dinner in the new economy.

link to original post

Most of America is living in poverty unfortunately. A few rich fat cats.

But if you think that same $5 you obtained in 1990 buys you the same amount of supplies go right ahead and believe.

In 1990 a $5 bill brought you two big mac meals. Today a $5 bill from 1990 wouldn't even buy you a single big mac.

Hardly what is considered a good investment.

link to original post

So what. The USD at the time was backed by the wealth of the United States. What keeps Bitcoin alive is its the playtoy of the super rich like The TwinkleToes Brothers and without them you don't have anything. They keep it alive when it's failing because it has no intrinsic value of its own. Sounds like you read the Pyramid Scheme Salesman's Handbook too often.

link to original post

https://www.youtube.com/live/vZTrrLo9psw?t=1921 Start at 32:00 listen to 35.

The Federal Reserve is now approving banks to custody Bitcoin. The next step is to allow banks to provide regulated loans against Bitcoin collateral.

I don't get it, do you actively try to be unknowledgeable?

Quote: EvenBobBitcoin crashes below $53K wiping out $600M

link to original post

Wasn't it at less than $15,000 less than a year ago?

So what you are saying is after creating several billions in wealth, $600 million got raked back? And that's what you consider a bad investment?

And it's only 11:00 a.m. Eastern time, the Market's already down more than a thousand. The recession which has been here for months is finally being realized.

What a beanie baby.

Quote: EvenBob"Bitcoin has lost nearly a quarter of its value in just seven days."

your great hero loves Bitcoin

quote from the article: "they hooted with joy as he claimed credit for bitcoin's meteoric rise in value during his administration"

https://www.wired.com/story/donald-trump-bitcoin-reserve-promises/

.

Quote: EvenBob"Bitcoin has lost nearly a quarter of its value in just seven days."

And it's only 11:00 a.m. Eastern time, the Market's already down more than a thousand. The recession which has been here for months is finally being realized.

link to original post

Bitcoin

$

7

1

,

0

5

8

.

5

8

At the start of April 2013 BTC was around $139, on April 30, 2013. It was up 49.4%Quote: EvenBobBitcoins are like collector Elvis plates. There's a limited

number made and they go up in value till they hit a

plateau. They're only worth the price because the

demand sets the price. If collectors lose interest,

prices plummet.

Just think Beanie Babies. Remember those?

link to original post

BTC now just shy of $71,000

Quote: MDawgAnd now with Trump prospects waning, BTC is dropping.

link to original post

Is there some new poll or are you just making a political statement?

Quote: MDawgA.Wolf posted about how BTC was pushing an all time high. I posted that this was because Trump was expected to win and is viewed as pro crypto. Now that he is no longer expected to win, BTC is dropping.

link to original post

No longer expected to win where? He has been ahead in all the swing state polls since about when early voting began. Most of last weeks polls are last polls.

I have no doubt the election is helping drive the price either way.

Meh....Quote: vegasBitcoin is going to explode. One day you will say " I could of got Bitcoin under 70,000" Much better investment than stocks and I have many stocks. But crypto is my big investment.

link to original post

I don't know about that. I don't disagree or agree (I have no Fing clue). There are way too many unknowns.

I would love to hear your theory as to why you think that.

The only times I was super confident and put my money where my mouth was... when it dropped from around 20k to 5k as COVID-19 started.

I use Crypto as a tool for online +EV gambling. Sometimes I buy it, and sometimes I sell it. I sell it on a whim/guess or when I accumulate way more than I think I need. I buy it if I am short and need it for a good deposit bonus on sports.

I have a bunch of sh*TTT coins for fun, some have done well, and some have done bad.

When it comes down to it, I am an investor since I hold BTC instead of converting or selling it.

Had I never sold any Bitcoin, I would be much, much better off.

Any thoughts?

Quote: AxelWolfI think BTC will go back down to 65k before it will hit 85k.

Any thoughts?

link to original post

If you made me bet on it, I’d go 85 before 65. Trump has signaled in vague terms that his administration wants to lead in crypto. As with most of my 50-50 type predictions, I’m right around 49% of the time…

Quote: SOOPOOQuote: AxelWolfI think BTC will go back down to 65k before it will hit 85k.

Any thoughts?

link to original post

If you made me bet on it, I’d go 85 before 65. Trump has signaled in vague terms that his administration wants to lead in crypto. As with most of my 50-50 type predictions, I’m right around 49% of the time…

link to original post

So far as I can tell, there's no sign yet it's adoption won't continue to increase over time. So, in a way, I'd consider it at least a safe bet to stay in, even if you don't ever hit some amazing big surge. So, it could be considered a win win either way. At least that's what I think for now.

Blackrock hold the largest bitcoin ETF. They do sometimes manipulate the bitcoin market by selling a large chunk of bitcoin. This causes the price to drop. When that happens many small investors sell to realize a profit fearing bitcoin will freefall to really low prices. Then Blackrock scoops up all the shares at a lower price sending bitcoin prices way up again.

Bitcoin will go up and down again just like stocks. It could hit 65k before it hits 85k. However it will keep hitting new highs and the lows will also get higher. There was a time when I, like many others thought crpto was a scam but I was wrong. I just didn't understand it. Most meme coins will be worthless. A crypto has to have a use to become valuable in the future. Did you know that governments around the world in most countries are also hording bitcoin?

I hold just three and that is bitcoin, solana and chainlink. I used to hold ethereum but sold it as it was not getting the same gains as the others cryptos in its class, but still it will do ok. I have a lot of chainlink. Link will be how we move money around the world soon. Swift has already adopted chainlink on a pilot project and it was a success.

Many people are negative towards crypto as they don't fully understand it. However big firms are scooping up all they can get for a reason.

My advice is whatever you do.....don't sell or trade any of your bitcoin.