Quote: billryanBest economy ever, but running budget deficits.

Really just a continuation of what was happening during Obama's presidency. If Trump had more power and was able to eliminate Obamacare do you really think the deficits would be as high as they are? Basically you are blaming Trump for something he did not have ultimate control of. The majority of Republicans were not unified enough to repeal Obamacare. You can argue back-and-forth whether eliminating Obama care would be good for the country, but clearly eliminating it would have decreased the deficit

Quote: billryanBest economy ever, but running budget deficits.

Stock market performance under Trump has been pretty on par with Obama, Gerald Ford, and several other Presidents under the same time period, so it's kind of odd he keeps bragging about that.

His approval rating has remained fairly steady since his inauguration, which I find surprising, but he's still one of the most unpopular Presidents in modern history based on those polls, so that's not much to brag about, either.

Quote: SOOPOOReally just a continuation of what was happening during Obama's presidency. If Trump had more power and was able to eliminate Obamacare do you really think the deficits would be as high as they are? Basically you are blaming Trump for something he did not have ultimate control of. The majority of Republicans were not unified enough to repeal Obamacare. You can argue back-and-forth whether eliminating Obama care would be good for the country, but clearly eliminating it would have decreased the deficit

Interesting logic, especially considering that Obama inherited a 1.2 trillion deficit before implementing Obamacare. After Obamacare was implemented, the deficit was shrinking.

Quote: SteverinosInteresting logic, especially considering that Obama inherited a 1.2 trillion deficit before implementing Obamacare. After Obamacare was implemented, the deficit was shrinking.

So if you really believe that the deficit was shrinking even after Obamacare was instituted, you don't think it would have shrunk more if it hadn't been instituted? You don't understand that Obamacare is a huge cost to the federal government? Really?

Quote: SOOPOOReally just a continuation of what was happening during Obama's presidency. If Trump had more power and was able to eliminate Obamacare do you really think the deficits would be as high as they are? Basically you are blaming Trump for something he did not have ultimate control of. The majority of Republicans were not unified enough to repeal Obamacare. You can argue back-and-forth whether eliminating Obama care would be good for the country, but clearly eliminating it would have decreased the deficit

Did the deficit-exploding Trump tax cuts just not happen in your universe or something?

Quote: ams288Did the deficit-exploding Trump tax cuts just not happen in your universe or something?

As usual you ignore my point. My point is that if Trump's plan to scuttle Obamacare had occurred, the deficit would be far lower than it is now. You know I'm right so you conveniently decide not to address the issue. So in my universe under Trumps tax plan im paying more than under Obama. (I live in NY, which Trump has targeted to punish for not voting for him)

Quote: SOOPOOAs usual you ignore my point. My point is that if Trump's plan to scuttle Obamacare had occurred, the deficit would be far lower than it is now. You know I'm right so you conveniently decide not to address the issue. So in my universe under Trumps tax plan im paying more than under Obama. (I live in NY, which Trump has targeted to punish for not voting for him)

I think this entire conversation is silly.

If the end all and be all goal is to reduce the deficit, then the answer to that is simple: Eliminate every single Government program, grant, etc. etc. etc. except those needed for defense, certain law enforcement, and most importantly, IRS tax payment enforcement. Increase the taxes to 80% for all people. The deficit should be completely eliminated in a few months.

Every President and/or Legislature is going to make decisions that will result in a deficit increase, or in the alternative, a budget surplus to not be as high as it theoretically could have been. It's really a question of priorities.

You guys can't just point at something that happened and say, "But, the deficit would be lower but for...etc." The deficit would be infinitesimally lower if they closed all national parks that didn't run profitably, if any apply. Like, "Oh, this is a liberal policy that I don't like and IT raised the deficit." Or, "Oh, this is a conservative policy that I don't like and IT raised the deficit."

It's just such a pointless framework for a discussion. Any spending or measure that reduces Government revenues is going to have a negative impact on the deficit. So what? Just argue whether or not the policy itself is a positive, really.

I guess it's possible to have a hard stance on not running at a deficit. That's fine. But, if that's going to be someone's position, then they should hate EVERYTHING that contributes to the deficit and is not strictly necessary. Otherwise, it's just a pointlessly divisive talking point.

Quote: SOOPOOSo if you really believe that the deficit was shrinking even after Obamacare was instituted, you don't think it would have shrunk more if it hadn't been instituted? You don't understand that Obamacare is a huge cost to the federal government? Really?

Of course I recognize that Obamacare costs money. However, what needs to be debated is if NOT implementing Obamcare would cost even more money in the long run.

https://www.thebalance.com/cbo-report-obamacare-3305627

Blaming Obamacare for the deficit without even mentioning military spending, tax cuts for people that didn't need them, Medicare, Social Security, etc. is a non-starter for anybody serious about debating the fiscal situation we're in.

My point in my original post was that under Obama, the Republicans found the deficit to be the number one thing that would destroy America, next to tan suits. Now, under Trump (and really, throughout history, republicans have NEVER been fiscally conservative), it's not only okay to deficit spend, it's okay to deficit spend in a growing economy.

They hypocrisy of these people knows no bounds.

Quote: Mission146If the end all and be all goal is to reduce the deficit, then the answer to that is simple:

The answer IS simple.

Go back to the era BEFORE the myth of trickle-down economics was ever implemented. A farce that has NEVER worked and has NEVER trickled down. Anybody that can objectively look at the income inequality data over the last 35 years can come to that conclusion.

Quote: SOOPOOAs usual you ignore my point.

Not really.

You said:

Quote:Really just a continuation of what was happening during Obama's presidency. If Trump had more power and was able to eliminate Obamacare do you really think the deficits would be as high as they are? Basically you are blaming Trump for something he did not have ultimate control of.

Emphasis added.

I chose to ignore the Obamacare stuff (I couldn’t care less about your views on Obamacare).

Trump did have control of the tax cuts, which are exploding the deficit.

So you can try to blame Obama all you want, but ignoring the effects of those dumb tax cuts is just silly.

Quote: SOOPOOI agree with Mission above. I look at it this way. Decide what we want to spend money on and how much. Then devise a tax plan that will take in that much money. If it would cause taxes to be 'too high', then spend less. Simple really.

But what is "too high"? The top marginal tax rate in 1950 was 91%. Nobody was crying socialism in 1950. When Barack Obama wants to put us on par with the rest of the civilized world with universal health care for all citizens, NOW socialism is going to destroy us? (Let's pretend that the ACA and the invididual mandate didn't have roots within the republican party and garnered support from the GOP for 25 years before Barack Obama abandoned the public option and supported it).

I hope the next Dem President somehow finds a way to pass Medicare for all. I don’t care if it’s not paid for.

I just don’t like the blatant hypocrisy of the righties pretending to care about it when they’re out of power, and then exploding it when they’re in power.

Quote: ams288And for the record: I don’t give a s**+ about the deficit.

Same here. I only pointed it out because of the hypocrisy.

Inflation is another story.

Step 1: The Purchase

Kushner Companies buys a property. The majority of the money for the purchase comes in the form of mortgages and personal loans from banks.

Step 2: The Write-Off

Under the federal tax code, real estate investors can write off the purchase price of the building — excluding the cost of the land — over a period of decades. Although Kushner Companies has spent little or no cash of its own, the firm takes large annual deductions based on the theoretical depreciation of the building.

Step 3: The Loss

The property generates cash for the Kushners. But any earnings, which would be subject to the federal income tax, are swamped by the amount that the company is taking in write-offs for depreciation. The result is that Kushner Companies records a net loss for tax purposes.

Step 4: The Investors

The company passes on that loss to its owners, including Mr. Kushner and his father, Charles.

Step 5: The Offset

The loss can be used to offset the Kushners’ income in the year it is recorded, and it can be carried forward to cancel out future income or to get refunds for taxes they paid in previous years.

Step 6: The Deferral

When Kushner Companies sells a property, it can use the proceeds to finance a new acquisition. If done within the right time frame, the company can indefinitely defer any capital-gains taxes it might owe on the sale of the original property.

Step 7: The Result

The outcome is apparent in Jared Kushner’s tax returns, which were summarized in the documents reviewed by The New York Times. Here’s an example from 2015.

IncomeW-2 income: $198,000.

Taxable interest: $536,000.

Dividends: $1,000.

Capital gains: $974,000.

Deductions

Tax losses from real estate and other partnerships: $3.5 million.

Tax losses carried forward from previous years: $4.8 million.

Total adjusted gross income

Negative $6.6 million.

Tax refund

$4,000.

https://www.nytimes.com/2018/10/13/business/kushner-paying-taxes.html

"Shrinking" to $20 trillion. Hmmm.Quote: SteverinosInteresting logic, especially considering that Obama inherited a 1.2 trillion deficit before implementing Obamacare. After Obamacare was implemented, the deficit was shrinking.

Was any of that illegal? Apparently not.Quote: rxwinemaybe trump could do something about this

Step 1: The Purchase

Kushner Companies buys a property. The majority of the money for the purchase comes in the form of mortgages and personal loans from banks.

Step 2: The Write-Off

Under the federal tax code, real estate investors can write off the purchase price of the building — excluding the cost of the land — over a period of decades. Although Kushner Companies has spent little or no cash of its own, the firm takes large annual deductions based on the theoretical depreciation of the building.

Step 3: The Loss

The property generates cash for the Kushners. But any earnings, which would be subject to the federal income tax, are swamped by the amount that the company is taking in write-offs for depreciation. The result is that Kushner Companies records a net loss for tax purposes.

Step 4: The Investors

The company passes on that loss to its owners, including Mr. Kushner and his father, Charles.

Step 5: The Offset

The loss can be used to offset the Kushners’ income in the year it is recorded, and it can be carried forward to cancel out future income or to get refunds for taxes they paid in previous years.

Step 6: The Deferral

When Kushner Companies sells a property, it can use the proceeds to finance a new acquisition. If done within the right time frame, the company can indefinitely defer any capital-gains taxes it might owe on the sale of the original property.

Step 7: The Result

The outcome is apparent in Jared Kushner’s tax returns, which were summarized in the documents reviewed by The New York Times. Here’s an example from 2015.

IncomeW-2 income: $198,000.

Taxable interest: $536,000.

Dividends: $1,000.

Capital gains: $974,000.

Deductions

Tax losses from real estate and other partnerships: $3.5 million.

Tax losses carried forward from previous years: $4.8 million.

Total adjusted gross income

Negative $6.6 million.

Tax refund

$4,000.

https://www.nytimes.com/2018/10/13/business/kushner-paying-taxes.html

Quote: ams288And for the record: I don’t give a s**+ about the deficit. I hope the next Dem President somehow finds a way to pass Medicare for all. I don’t care if it’s not paid for.

Quote: amsTrump did have control of the tax cuts, which are exploding the deficit.

Do we have to choose between A and B as to which one states the true position or do we just have to keep hearing this rhetoric?

Quote: SanchoPanza"Shrinking" to $20 trillion. Hmmm.

Are you saying that the deficit that Barack Obama inherited was larger when he left office?

Quote: SanchoPanzaWas any of that illegal? Apparently not.

Apparently not, but it highlights the problem in the tax codes. When you have objectively very wealthy people who can duck taxes, I think it's fair to say that's not ideal.

The most, "Fair," tax system would just be a Universally-applied Federal Sales Tax. Everything would count, including purchases of property. I think it accomplishes a few things:

1.) Rich individuals as well as companies spend more money than do poorer people, so in terms of net proceeds, they will pay more taxes.

2.) Other than underground economies, the tax would be essentially inescapable.

3.) It should be satisfactory to the Conservatives that poorer people would also be paying this tax at the same percentage rate. Granted, the social safety nets would still exist, but it doesn't change that everyone must pay tax on what they are buying.

4.) Conservatives will really enjoy the fact that the taxes will be a higher percentage of total income for poorer people based on the same items purchased, as is always the case with the purchase itself.

The biggest argument against is the fact that a slumping economy kind of begets an even worse slumping economy because people are going to tighten their spending, therefore, fewer sales taxes collected. Fortunately, there is something of a baseline for minimal spending on goods that are absolutely necessary, such as foodstuffs.

Quote: SOOPOOI agree with Mission above. I look at it this way. Decide what we want to spend money on and how much. Then devise a tax plan that will take in that much money. If it would cause taxes to be 'too high', then spend less. Simple really.

Almost

In your own personal house it works

When the "house" is an entire country the problem becomes who decides what is the important expenses

Every body will have a different opinion on on it

Quote: SanchoPanzaWas any of that illegal? Apparently not.

Not illegal for TRUMP to lie everyday either. Doesn't make something automatically good if it's not illegal.

It really is a great podcast. Season 1 was dedicated to Watergate.

It does happen to be illegal to lie on tax returns. The millions of taxpayers who file their returns regularly have to sign such a statement acknowledging that.Quote: rxwineNot illegal for TRUMP to lie everyday either. Doesn't make something automatically good if it's not illegal.

You said, "After Obamacare was implemented, the deficit was shrinking." Got any numbers that verify that?Quote: SteverinosAre you saying that the deficit that Barack Obama inherited was larger when he left office?

It does mean that the insinuation that crime or some other malfeasance was committed is totally unwarranted. As The New York Times has now learned.Quote: rxwineNot illegal for TRUMP to lie everyday either. Doesn't make something automatically good if it's not illegal.

Has anybody ever heard of the U.S. tax system accused of being "fair" or "ideal"?Quote: Mission146Apparently not, but it highlights the problem in the tax codes. When you have objectively very wealthy people who can duck taxes, I think it's fair to say that's not ideal.

Quote: SanchoPanzaIt does happen to be illegal to lie on tax returns. The millions of taxpayers who file their returns regularly have to sign such a statement acknowledging that.

Yup, lying on your tax returns is illegal. So is hiding transactions with shell companies, undervaluing properties, creating invoices with fake charges, and conducting hundreds of subsidiary schemes and scams, all of which Trump and his family is under suspicion of doing.

Maybe some day we'll get to the bottom of this, but not until we actually elect representatives that do their jobs.

Don't worry though folks, with all these posts about taxes and deficits, the worthless (actually let's hope she is only worthless after the hoe pays) c has to pay YOUR PRESIDENTS legal bills. This is not going to be a burden on the taxpayer.

Get back up on that pole stormy, you are gonna need a whole lot of $1's in that g-string to pay this tab.

And to thing some people in this world honestly believe the creepy porn lawyer is presidential material. he can't even win a "slam dunk" case against "the worst man in the world," in one of the most liberal areas of the country! Keep picking winners liberals (like it matters).

Quote: SanchoPanzaDo we have to choose between A and B as to which one states the true position or do we just have to keep hearing this rhetoric?

A is my true position.

B is me pointing out that Donald has exploded the deficit, something that would normally upset the righties. But they’re dirty hypocrites* so it doesn’t bother them because.... reasons!

It’s not rocket science to figure that out ya know...

*the GOP congressmen who voted for the tax bill. Not referring to anyone on this board of course

Quote: Maverick17

And to thing some people in this world honestly believe the creepy porn lawyer is presidential material.

Sure, why not? I mean, Trump won, ffs.

Congress does not prosecute criminal cases. For taxes it would have to be the I.R.S. and the D.O.J. or both together.Quote: SteverinosYup, lying on your tax returns is illegal. So is hiding transactions with shell companies, undervaluing properties, creating invoices with fake charges, and conducting hundreds of subsidiary schemes and scams, all of which Trump and his family is under suspicion of doing.

Maybe some day we'll get to the bottom of this, but not until we actually elect representatives that do their jobs.

The so-called "suspicion" has clearly been processed, just as it has been in aligned cases.

Quote: MaxPenSenator Warren's DNA results

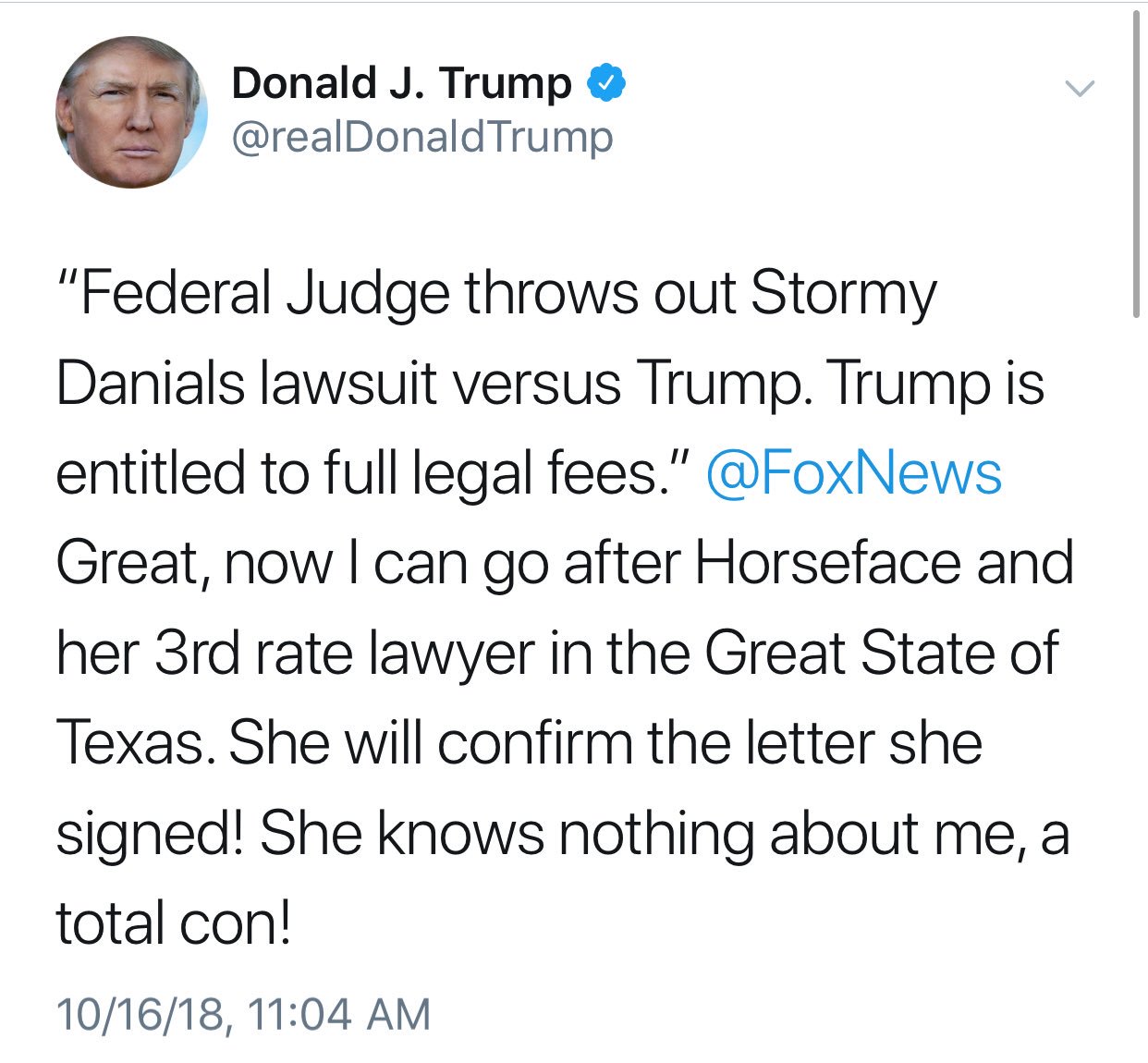

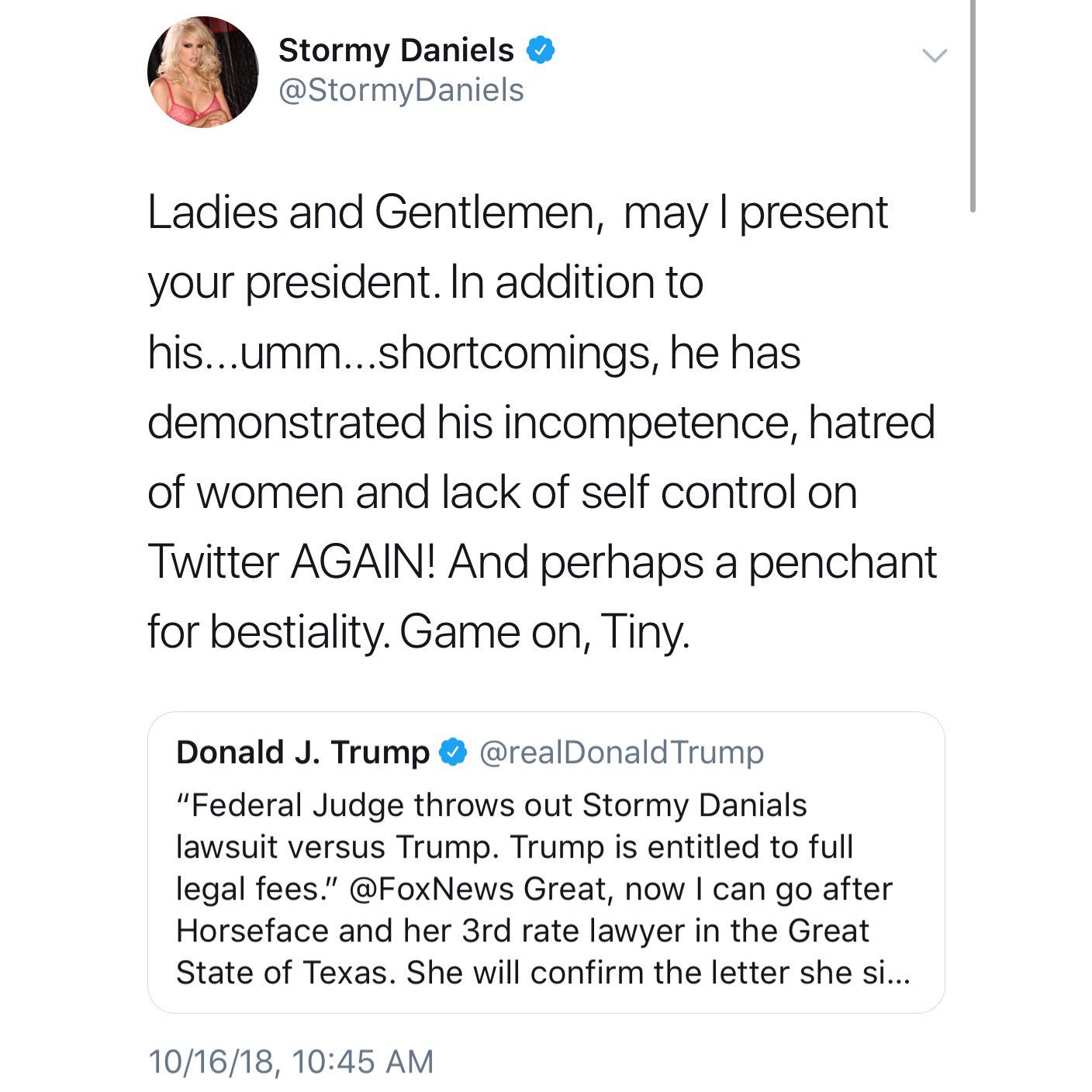

Quote: politicoThe adult-film actress Stormy Daniels’ libel suit against President Donald Trump was thrown out Monday by a federal judge, who also ordered Daniels to pay Trump's legal fees in the case.

https://www.politico.com/story/2018/10/15/stormy-daniels-trump-libel-suit-903152

https://www.youtube.com/watch?v=e3uOMCfopR8

Quote: darkozAlmost

In your own personal house it works

When the "house" is an entire country the problem becomes who decides what is the important expenses

Every body will have a different opinion on on it

That's why we elect people (Senators, Congressmen, and a President). They already decide what we spend money on. They just don't care if they keep borrowing more instead of just spending what we collect in taxes.

This is seriously on the official White House website.

Sounds like something a 65-year-old conspiracy theorist would write and spam his "friends" with on Facebook.

Lord help us.

Quote: TigerWuLOL

This is seriously on the official White House website.

Sounds like something a 65-year-old conspiracy theorist would write and spam his "friends" with on Facebook.

Lord help us.

Why should she?

Quote: billryanWhy should she?

I don't know, but I could probably find a chicken to sacrifice, if that would help.

Quote: ams288This is an actual tweet, not a spoof. The POTUS literally took time out of his schedule (“executive time,” I guess) to call a porn star “Horseface.”

I approve this message (Trump’s not yours).

Although his last sentence is a little wonky — is he saying he himself is a total con? Con? Coincidence?

COINCIDENCE?? YOU DECIDE!!!

Quote: RS

I approve this message (Trump’s not yours).

Me approve too.

B) "She knows nothing about me, a total con!" Well, it's nice to see he's at least admitting he's a con artist.

Quote: RSAlthough his last sentence is a little wonky — is he saying he himself is a total con? Con? Coincidence?

Good catch, RS. In the old days, we called that a Freudian slip.

Quote:She knows nothing about me, a total con!

The exclamation point is like he's shouting at us. I'm a conman! I'm a future convict! I belong in jail!.

too funny, if it weren't probably true

It *might* not be a good idea to get into a name calling back-and-forth with a woman who knows your penis is smaller than average:

"No amount of spin or commentary by Stormy Daniels or her lawyer, Mr. Avenatti, can truthfully characterize today's ruling in any way other than total victory for President Trump and total defeat for Stormy Daniels."

Getting into a pissing contest on social media with a porn star and calling her Horseface isn't exactly the definition of "total victory," especially when you're the President of the United States. But whatever... I guess when you're Donald Trump, you take any "win" you can get.