TurboTax Tip: In addition to deducting the actual cost of wagers, you can also deduct other expenses connected to your gambling activity, including travel to and from a casino.

https://turbotax.intuit.com/tax-tips/jobs-and-career/can-you-claim-gambling-losses-on-your-taxes/L4lQ3IAWt

https://www.kiplinger.com/taxes/603033/tax-tips-for-gambling-winnings-and-losses.

Having trouble finding what the IRS considers acceptable expenses. Basically I have flights to Vegas, taxi/ubers in Vegas, hotel fees for new casinos, some places are comped but still have to pay resort and tax fees, and gas to locals.

Is anyone taking travel and mileage deduction for locals as loses on Sch. A?

I think I need to be qualified as a pro gambler to use deductions like that though, and who's to say what that even means.

Professional or Casual Gambler? How to Help Your Clients Play Their Cards Right - Tax Pro Center | Intuit https://proconnect.intuit.com/taxprocenter/tax-law-and-news/professional-or-casual-gambler-how-to-help-your-clients-play-their-cards-right/

...Casual gamblers – who make up the vast majority of gamblers – can deduct their losses from gambling on Schedule A of their tax returns, up to the amount of their winnings. Apparently, lady luck was watching out for gamblers when the Tax Cuts and Jobs Act (TCJA) was created; that tax break remains in place, unlike miscellaneous itemized deductions subject to the two percent threshold, which are suspended through 2025.

Professional gamblers report their results on Schedule C. In addition to the gambling losses that all gamblers can deduct, professional gamblers can also deduct business-type expenses. This includes things like travel expenses and educational materials. They pay self-employment tax on any net winnings.

But, in gambling, you win some and you lose some. Prior to tax reform, gamblers could deduct business-type expenses that exceeded their winnings to generate net operating losses. But, the TCJA amended Sec. 165(d) to clarify that total gambling expenses, including business-type expenses, are now limited to income from gambling.

Tax professionals should be aware that some states, including Connecticut, Illinois, Indiana and Wisconsin, do not allow casual gamblers to deduct gambling losses as an itemized deduction. Professional gamblers are allowed to, but their returns may be subject to extra scrutiny.

*************************

I'm not seeing that travel expenses and hotels are disallowed as a deduction for casual gamblers, only that the total of that and gambling losses cannot exceed your gambling winnings, then there's the whole standard deduction stuff. It helps to know what the rules are before you argue with a tax professional though.

**************************

What kind of travel expenses are tax deductible?

You can deduct business travel expenses when you are away from both your home and the location of your main place of business (tax home). Deductible expenses include transportation, baggage fees, car rentals, taxis and shuttles, lodging, tips, and fees.

Can I write off groceries on my taxes?

Food and beverages will be 100% deductible if purchased from a restaurant in 2021 and 2022. This applies to filing your taxes in 2023. But for purchases made in 2023 onwards, the rules revert back to how they were defined in the Tax Cuts and Jobs Act. This means purchases at restaurants are no longer 100% deductible.

Are travel meals 100% deductible?

For many years, meal expenses incurred while traveling for business were only 50% deductible. However, during 2021 and 2022, business meals in restaurants are 100% deductible.

Can I write off both gas and mileage on my taxes?

Actual car expenses.

If you use standard mileage, you cannot deduct other costs associated with your car, including gas, repairs/maintenance, insurance, depreciation, license fees, tires, car washes, lease payments, towing charges, auto club dues, etc.

What can you deduct in addition to mileage?

Qualified expenses for this purpose include gasoline, oil, tires, repairs, insurance, tolls, parking, garage fees, registration fees, lease payments, and depreciation licenses. Report these expenses accurately to avoid an IRS tax audit.

What is the federal mileage rate for 2023?

65.5 cents per mile

The standard mileage rate for transportation or travel expenses is 65.5 cents per mile for all miles of business use (business standard mileage rate).

What expenses does mileage cover?

A mileage reimbursement rate covers a wide range of vehicle expenses: gas, oil, tires, maintenance, insurance, depreciation, taxes, registration, and license fees. All these expenses vary from driver to driver. Without a "standard" employee expense profile, there can be no "standard" mileage reimbursement rate.

*************************************

Tax reform law deals pro gamblers a losing hand - Journal of Accountancy https://www.journalofaccountancy.com/issues/2018/oct/pro-gambling-net-losses.html

************************************

How to Claim Gambling Losses on Your Taxes - TheStreet https://www.thestreet.com/taxes/can-you-claim-gambling-losses-on-your-taxes

Only gambling losses

You can include in your gambling losses the actual cost of wagers plus other expenses connected to your gambling activity, including travel to and from a casino. Keep in mind that the IRS does not permit you to simply subtract your losses from your winnings and report the difference on your tax return. And if you have a particularly unlucky year, you cannot just deduct your losses without reporting any winnings. If the IRS allowed this, then it's essentially subsidizing taxpayer gambling.

The bottom line is that losing money at a casino or the race track does not by itself reduce your tax bill. You must first report all your winnings before a loss deduction is available as an itemized deduction. Therefore, at best, deducting your losses allows you to avoid paying tax on your winnings, but nothing more.

Quote: ALGI was always under the impression to deduct expenses you had to file Sch. C as a pro. These 2 articles state you can deduct loses AND expenses connected to gambling activity including travel.

TurboTax Tip: In addition to deducting the actual cost of wagers, you can also deduct other expenses connected to your gambling activity, including travel to and from a casino.

https://turbotax.intuit.com/tax-tips/jobs-and-career/can-you-claim-gambling-losses-on-your-taxes/L4lQ3IAWt

https://www.kiplinger.com/taxes/603033/tax-tips-for-gambling-winnings-and-losses.

Having trouble finding what the IRS considers acceptable expenses. Basically I have flights to Vegas, taxi/ubers in Vegas, hotel fees for new casinos, some places are comped but still have to pay resort and tax fees, and gas to locals.

Is anyone taking travel and mileage deduction for locals as loses on Sch. A?

link to original post

I think you are mistaken. You can deduct gambling losses against wins but I don't think you can deduct other expenses unless filing as a pro. Ask your CPA but I am pretty sure I would have heard about it if they changed it recently. If you don't have a CPA that specializes in gambling give Russell Fox a call at Clayton financial.

http://claytontax.com/nevada/

Quote: DRichQuote: ALGI was always under the impression to deduct expenses you had to file Sch. C as a pro. These 2 articles state you can deduct loses AND expenses connected to gambling activity including travel.

TurboTax Tip: In addition to deducting the actual cost of wagers, you can also deduct other expenses connected to your gambling activity, including travel to and from a casino.

https://turbotax.intuit.com/tax-tips/jobs-and-career/can-you-claim-gambling-losses-on-your-taxes/L4lQ3IAWt

https://www.kiplinger.com/taxes/603033/tax-tips-for-gambling-winnings-and-losses.

Having trouble finding what the IRS considers acceptable expenses. Basically I have flights to Vegas, taxi/ubers in Vegas, hotel fees for new casinos, some places are comped but still have to pay resort and tax fees, and gas to locals.

Is anyone taking travel and mileage deduction for locals as loses on Sch. A?

link to original post

I think you are mistaken. You can deduct gambling losses against wins but I don't think you can deduct other expenses unless filing as a pro. Ask your CPA but I am pretty sure I would have heard about it if they changed it recently. If you don't have a CPA that specializes in gambling give Russell Fox a call at Clayton financial.

http://claytontax.com/nevada/

link to original post

That is what I thought too but I found this on the IRS website publication 529 that seems to say the same thing as TurboTax and Kiplinger articles.

Gambling Losses Up to the Amount of Gambling Winnings

You must report the full amount of your gambling winnings for the year on your Schedule 1 (Form 1040). You deduct your gambling losses for the year on your Schedule A (Form 1040). Gambling losses include the actual cost of wagers plus expenses incurred in connection with the conduct of the gambling activity, such as travel to and from a casino. You can't deduct gambling losses that are more than your winnings. Generally, nonresident aliens can't deduct gambling losses on your Schedule A (Form 1040-NR).

https://www.irs.gov/publications/p529

A loss on deposits can occur when a bank, credit union, or other financial institution becomes insolvent or bankrupt. If you can reasonably estimate the amount of your loss on money you have on deposit in a financial institution that becomes insolvent or bankrupt, you can generally choose to deduct it in the current year even though its exact amount hasn't been finally determined.

If none of the deposit is federally insured, you could deduct the loss as a nonbusiness bad debt. Report it on your Schedule D (Form 1040). You can no longer deduct the loss as an ordinary loss or as a casualty loss on your Schedule A (Form 1040).

***************

So if I've got a lot of front money at the front desk of the casino and the casino shuts down because of another COVID outbreak and doesn't reopen by the end of the year, it's a nonbusiness bad debt. If it reopens the next year, I'll have to count the recovery of my funds as income again.

****************

So I'm supposed to use a credit card to buy chips at the table now? Maybe FedNow can fix this this summer.

Note that if you never had a winning session then there's no duty to report. There's nothing to deduct anyway, because you can deduct losses only to the extent of your winnings.

However, this does not necessarily mean that the actual return on the game is always less than the stated payback percentage. The payback percentage is based on the expected return over the long term and takes into account all payouts, including those that trigger a W-2G. So, while taxes may reduce the amount of the payout, it does not necessarily mean that the game's payback percentage is inaccurate.

It is important to keep in mind that taxes are just one factor to consider when deciding whether or not to play a particular video poker machine. Other factors, such as the game's payback percentage, the denomination, and the player's own skill level and bankroll should also be taken into account.

Hmm, Gullywin had 6 posts and got suspended, seems sus.

Your information on horse racing is not quite right. The amount has to exceed $600 AND the odds need to be over 300-1. I have cashed many four-figure bets at the track. Only a 700:1 winning $2 trifecta bet required IRS paperwork.Quote: MichaelBluejayMy article on gambling taxes answers just about every question posed about gambling taxes in this forum. (And when one is asked that's not covered in the article, I generally then add the answer to the article.)

link to original post

An article on gambling taxes that doesn't once mention schedule C is of little interest to me.

I subtract off the W-2G totals from each of my sessions. A session where I netted $3000 and had $7500 in W-2Gs would be reported as a $4500 losing session and $7500 of W-2G winnings. This way, my top line income on Schedule C is always greater than my reported gambling wins because many of my sessions are wins net of W-2Gs. This has worked for me and I never receive a CP-2000 from the IRS Automated Underreporter. I am reporting many millions in losing sessions to offset my top line on Schedule C.

I wrote software to handle all my online W-2Gs and match them up with the right session. I found that some casinos have several hours of delay between when I won and when the W-2G was generated. For these casinos, every reportable win that occurred after about 9pm had the wrong date on the W-2G. I had my software flag these W-2Gs and I adjust the dates to match the dates in my W-2G log so they could be automatically matched to the right sessions. Such a PITA!

One chain of online casinos issued one single W-2G for all subsidiary properties for the entire year. The W-2G was for seven figures. There was a two-page addendum listing the total W-2Gs for each property over a given day. I had to reconcile these totals with my W-2G logs which listed each W-2G separately. Another PITA!

Thank you very much for pointing this out! I added all the detail and spun it off into a separate article, What triggers W-2G forms for gambling taxes.Quote: MentalYour information on horse racing is not quite right. The amount has to exceed $600 AND the odds need to be over 300-1.

You're not my target audience. As I say at the top of the article, it's for recreational gamblers, not pros such as yourself. Also, as evidenced by your comments, you're already exceptionally familiar with gambling taxes.Quote: MentalAn article on gambling taxes that doesn't once mention schedule C is of little interest to me.

Yes, you make that clear in the first paragraph.Quote: MichaelBluejayYou're not my target audience. As I say at the top of the article, it's for recreational gamblers, not pros such as yourself. Also, as evidenced by your comments, you're already exceptionally familiar with gambling taxes.Quote: MentalAn article on gambling taxes that doesn't once mention schedule C is of little interest to me.

link to original post

I think you did a great job of explaining the tax issues for recreational gamblers. Your explanation of the unfairness of the 2017 changes in tax law was good. I don't think many people understand how much money this cost non-professional gamblers. With the SALT cap, very few people's itemized deductions exceed the standard deduction, so taxes bite hard on the first 10-20K of W2-Gs each year.

I am guessing that this 2017 increased the tax liability of gamblers by $20B per year. I don't know how much of this liability they actually collect. I am not sure the AUR unit is sending CP-2000s for every unreported W-2. They might have a threshold total below which they let it slide.

Quote: MichaelBluejayThank you very much for pointing this out! I added all the detail and spun it off into a separate article, What triggers W-2G forms for gambling taxes.Quote: MentalYour information on horse racing is not quite right. The amount has to exceed $600 AND the odds need to be over 300-1.

link to original post

from your page on W2-G's: https://easy.vegas/gambling/taxes#w2g

"You might be increasing your Adjusted Gross Income (AGI), which could result in:

Reducing the amount you can deduct for 19 different deductions. (source)

Increase your Medicare premiums. (source)

Your owing lots more in state taxes.

So, here's how to handle it:

Prepare draft returns (federal + state) listing your session wins as income on Schedule 1, and your session losses as a deduction on Schedule A."

This is Schedule 1: https://www.irs.gov/pub/irs-pdf/f1040s1.pdf

You enter you gambling wins on line 8b.

How does doing this instead of entering w2-G's reduce your AGI?

or did i miss something?

There are two methods for reporting your gambling income:Quote: 100xOddsHow does doing this instead of entering w2-G's reduce your AGI? or did i miss something?

(1) the total of the W-2Gs (which is wrong, but which the IRS will likely accept), or

(2) the total of winning sessions (which is correct, but which the IRS might not accept anyway, because staff and their computers might not know it's correct).

Whichever method is higher increases your AGI. So, some gamblers might choose the wrong method (#1) because it results in a lower AGI, and the IRS will probably accept it.

Is that clearer?

UPDATE: I just rewrote the section in question. See if it's clearer now.

Quote: MichaelBluejayThere are two methods for reporting your gambling income:Quote: 100xOddsHow does doing this instead of entering w2-G's reduce your AGI? or did i miss something?

(1) the total of the W-2Gs (which is wrong, but which the IRS will likely accept), or

(2) the total of winning sessions (which is correct, but which the IRS might not accept anyway, because staff and their computers might not know it's correct).

Whichever method is higher increases your AGI. So, some gamblers might choose the wrong method (#1) because it results in a lower AGI, and the IRS will probably accept it.

Is that clearer?

UPDATE: I just rewrote the section in question. See if it's clearer now.

link to original post

First, I did not read the whole article as the "weeds" were a bit high and somewhat convoluted, but i do have some questions:

1. Can you please define the term "recreational gambler" which you stated was your "target audience."? Please be as specific as possible.

2. Would you consider MDawg to be a "recreational gambler"?

3. While the IRS considers gambling winnings as taxable income, at what point does one, in your opinion, self-report such earnings?

4. The vast majority, (possibly 95+%) of gambling winners never receive a W-2G which is something, I believe, you did not mention in your article, so how could it even be possible for the IRS to even know about the "recreational gambler's" session winnings?

5. How does unreported (to the IRS) winnings become a taxable event?

More to follow based on your responses.

tuttigym

If you file a Schedule C for your gambling income, you are a professional in the business of gambling. Otherwise, your gambling might be considered recreational or a hobby.Quote: tuttigymFirst, I did not read the whole article as the "weeds" were a bit high and somewhat convoluted, but i do have some questions:

1. Can you please define the term "recreational gambler" which you stated was your "target audience."? Please be as specific as possible.

2. Would you consider MDawg to be a "recreational gambler"?

3. While the IRS considers gambling winnings as taxable income, at what point does one, in your opinion, self-report such earnings?

4. The vast majority, (possibly 95+%) of gambling winners never receive a W-2G which is something, I believe, you did not mention in your article, so how could it even be possible for the IRS to even know about the "recreational gambler's" session winnings?

5. How does unreported (to the IRS) winnings become a taxable event?

More to follow based on your responses.

tuttigym

link to original post

https://www.irs.gov/pub/irs-pdf/i1040sc.pdf "Use Schedule C (Form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity. For example, a sporadic activity, a not-for-profit activity, or a hobby does not qualify as a business."

There are reasons a professional gambler might not want to File Schedule C. In several years, my self-employment tax was so high that I paid less taxes by letting my AGI get inflated by the W-2G totals. However, I think MBJ only targets people who are not Schedule-C filers, and uses the term 'recreational gambler' to make this distinction.

The tax code is pretty clear. If you have income, you are supposed to report it. Unreported (to the IRS) winnings becomes a taxable event at the end of your session. I will never offer an opinion on how likely you are to get caught not reporting any of your income from any activity. How would I or MBJ know how to advise you about that?

NOTE - I do NOT claim to speak for MichaelBluejay. These are my own answersQuote: tuttigymQuote: MichaelBluejayThere are two methods for reporting your gambling income:Quote: 100xOddsHow does doing this instead of entering w2-G's reduce your AGI? or did i miss something?

(1) the total of the W-2Gs (which is wrong, but which the IRS will likely accept), or

(2) the total of winning sessions (which is correct, but which the IRS might not accept anyway, because staff and their computers might not know it's correct).

Whichever method is higher increases your AGI. So, some gamblers might choose the wrong method (#1) because it results in a lower AGI, and the IRS will probably accept it.

Is that clearer?

UPDATE: I just rewrote the section in question. See if it's clearer now.

link to original post

First, I did not read the whole article as the "weeds" were a bit high and somewhat convoluted, but i do have some questions:

1. Can you please define the term "recreational gambler" which you stated was your "target audience."? Please be as specific as possible.

2. Would you consider MDawg to be a "recreational gambler"?

3. While the IRS considers gambling winnings as taxable income, at what point does one, in your opinion, self-report such earnings?

4. The vast majority, (possibly 95+%) of gambling winners never receive a W-2G which is something, I believe, you did not mention in your article, so how could it even be possible for the IRS to even know about the "recreational gambler's" session winnings?

5. How does unreported (to the IRS) winnings become a taxable event?

More to follow based on your responses.

tuttigym

link to original post

1. Can you please define the term "recreational gambler" which you stated was your "target audience."? Please be as specific as possible. For tax purposes a recreational gambler is usually defined as any gambler who is not a professional gambler. Professional gamblers are in the business of gambling and are able to claim net-negative income from gaming. They can also exclude their business expenses via Schedule C. Non-professional gamblers may not. They can only recover their gaming losses, up to their earnings, via schedule A itemized deductions.

2. Would you consider MDawg to be a "recreational gambler"? Depends on whether he files as a professional gambler and files a Schedule C for his gambling business. If not, he’s a recreational gambler.

3. While the IRS considers gambling winnings as taxable income, at what point does one, in your opinion, self-report such earnings. The US has a voluntary-compliance tax system. Recreational gamblers, just like any other income earner, should claim all their income.

4. The vast majority, (possibly 95+%) of gambling winners never receive a W-2G which is something, I believe, you did not mention in your article, so how could it even be possible for the IRS to even know about the "recreational gambler's" session winnings? The IRS will most likely not know about it. However, even in the absence of any W-2Gs, the IRS may be able to prove gaming winnings for an individual via additional facts and circumstances.

5. How does unreported (to the IRS) winnings become a taxable event? Just because an event is not reportable, does not mean it’s not taxable. If you drive 100 mph in a 50 mph zone, you’ve still broken the law, even if you're not caught. If you win $1,000 in a gaming session and it is not reported to the IRS, you’ve still earned income under US tax law, even if the IRS never knows about it.

"Substantial Understatement of Income Tax Penalty

For individuals, a substantial understatement of tax applies if you understate your tax liability by 10% of the tax required to be shown on your tax return or $5,000, whichever is greater.

If you claim a Section 199A Qualified Business Income Deduction on your tax return, the penalty applies if you understate your tax liability by 5% of the tax required to be shown on your return or $5,000, whichever is greater.

How You Know You Owe the Penalty

We send you a notice or letter if you owe an Accuracy-Related Penalty. For more information, see Understanding Your IRS Notice or Letter.

How We Calculate the Penalty

In cases of negligence or disregard of the rules or regulations, the Accuracy-Related Penalty is 20% of the portion of the underpayment of tax that happened because of negligence or disregard."

So that is a guideline. Of course, no one is going to tell you to cheat on your taxes, but I would argue that many people fudge the definition of "session" to beyond a day. I itemize so W-2G's don't affect me, I have enough interest and state and local tax to go beyond the threshold and so I deduct the losses. It's also interesting about the definition of professional gambler, which is more strict than other professions. I drive for Lyft, for instance, and only make a few hundred a year net after expenses and the mileage deduction, but I always file the Schedule C and pay some self employment tax.

I would fudge the definition of a session to however long I make $1,000 last at the BJ table, it could be 2 hours or 20 hours or more over up to several days 4 hours at a time. It would lower my sessions wins & losses total by some amount. The casino win/loss statements only give me a monthly breakdown, so each session could be a calendar month.

Not sure I should be reporting how many slices of pizza I bought with rewards points, Mr. Bluejay thinks I should. Will I get a tax form when I spend over $600 a year on pizza with points?

MBJ did not write the tax code nor did he classify your comps as income. I never reported the donuts in the conference room as income at my old day job. I don't report food comps as income. However, someone has to fund the government. I choose to pay taxes on my income. Folks with wage income generally don't have much choice, and I don't feel I am above them or deserve some special break on my income..Quote: ChumpChangeI can't figure out how gamblers estimate their taxes. At some point you have to pay tax quarterly and compare it to the previous year's tax liability. If you're having significantly better or worse luck, you'll fall outside of the tolerances the IRS put up.

I would fudge the definition of a session to however long I make $1,000 last at the BJ table, it could be 2 hours or 20 hours or more over up to several days 4 hours at a time. It would lower my sessions wins & losses total by some amount. The casino win/loss statements only give me a monthly breakdown, so each session could be a calendar month.

Not sure I should be reporting how many slices of pizza I bought with rewards points, Mr. Bluejay thinks I should. Will I get a tax form when I spend over $600 a year on pizza with points?

link to original post

On a purely technical level, a taxpayer could choose to define their winnings this way. Session reporting as it's described in the IRS regs and publications is essentially a safe harbor method, meaning if someone does it the way it's described, the IRS will accept it. Safe harbor methods are utilized by the IRS in instances when the tax code is not 100% clear, as it is in the definition of gambling winnings, or when a practical application of the law is just too complicated, as it is for example in the computation of the non-taxable portion of a pension annuity. It's basically the IRS saying "Well, we don't know exactly what the heck this is, or this thing is just too damn complicated, so if you do it this way, we won't bother you". On the flip side of this is that in instances where a safe harbor has been published and a taxpayer chooses to use another method, the taxpayer runs the risk of being questions by the IRS.Quote: ChumpChange...I would fudge the definition of a session to however long I make $1,000 last at the BJ table, it could be 2 hours or 20 hours or more over up to several days 4 hours at a time. It would lower my sessions wins & losses total by some amount. The casino win/loss statements only give me a monthly breakdown, so each session could be a calendar month.

link to original post

As for the question of points bought food from Mr. Bluejay's site:

7. Comps are sometimes taxable, sometimes not. This is a gray area, since the IRS hasn't defined it, but tax professionals advise that if the casino gives the comp as a gift, it's not taxable (e.g., free room offer you got in the mail, where the casino hopes you'll play, but doesn't require you to), while if you earned it through your play, it is taxable (e.g., cashback or a buffet that you got from accumulating points through slot play).

I've read others on this forum refer to points as a kind of cash back so it's not taxable. So what MJB wrote is counter to what I thought before I read it.

Quote: ChumpChangeI just saw a video that stated the IRS tax income was down about 30% year to date so far, but there's still another month to process the tax returns from April 18th. So the debt default will become a market crash in early June or 6 weeks from now at this rate. So why are tax receipts down 30%? Are we in a depression?

As for the question of points bought food from Mr. Bluejay's site:

7. Comps are sometimes taxable, sometimes not. This is a gray area, since the IRS hasn't defined it, but tax professionals advise that if the casino gives the comp as a gift, it's not taxable (e.g., free room offer you got in the mail, where the casino hopes you'll play, but doesn't require you to), while if you earned it through your play, it is taxable (e.g., cashback or a buffet that you got from accumulating points through slot play).

I've read others on this forum refer to points as a kind of cash back so it's not taxable. So what MJB wrote is counter to what I thought before I read it.

link to original post

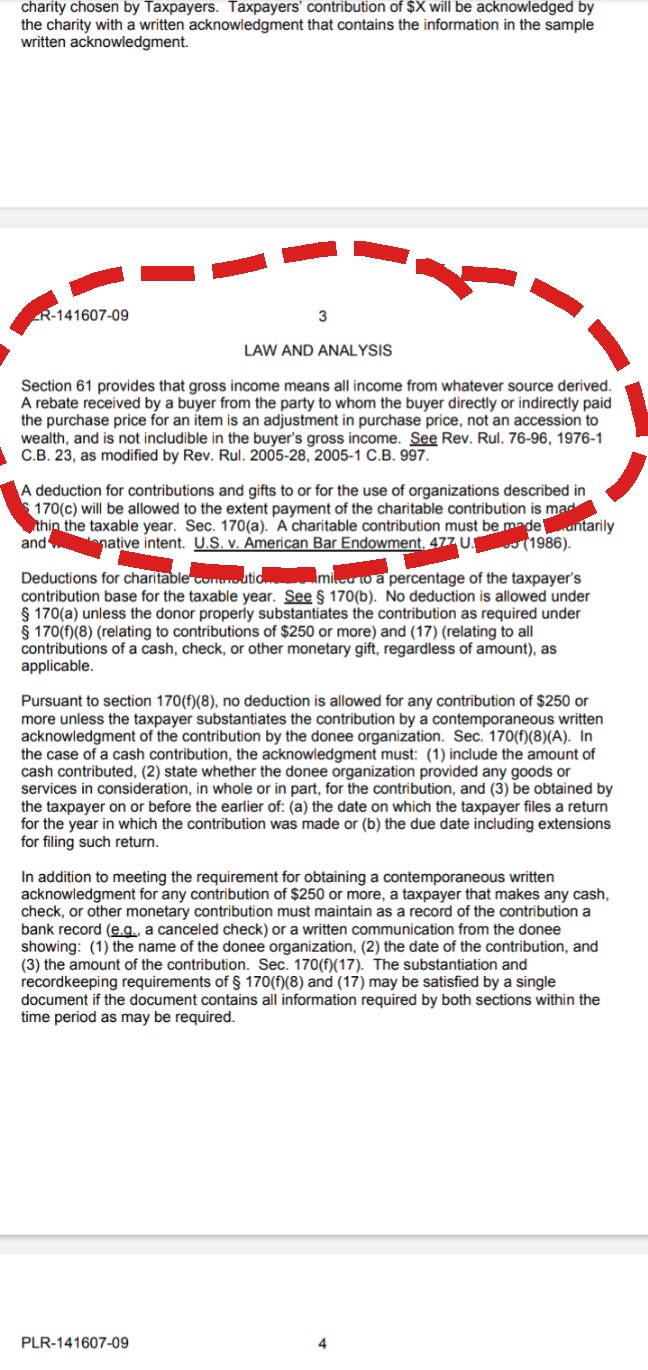

MJB got it completely backwards.

Comps given as gifts are taxable as income. Anything earned through play like Freeplay from prior play or points or free rooms are considered REBATES on prior purchases and are not taxable.

These fall under the same rules as credit cards and banks. When you earn Cashback from purchases with a credit card that's a non-taxable rebate and not considered income.

Likewise if you simply join a bank and receive $500 just for sign-up that IS taxable income as it's not based on any actual purchases but a free gift outright.

New members signups at Casinos are taxable. Usually they are so small ($10) no one would bother but someone getting a rare $1000 Freeplay for joining a casino membership program is likely going to be held on the hook for taxes.

I believe cash back / free slot play is clearly like a coupon for a discount on future purchases. If I have $100 in FSP and I play 4 hands of video poker at $25 a spin, then my out-of-pocket cost is $0. If I cash out $100, then the FSP is not taxable but during the gambling session I netted $100 which is clearly a taxable gambling win. How does that change anything?Quote: darkozMJB got it completely backwards.

Comps given as gifts are taxable as income. Anything earned through play like Freeplay from prior play or points or free rooms are considered REBATES on prior purchases and are not taxable.

These fall under the same rules as credit cards and banks. When you earn Cashback from purchases with a credit card that's a non-taxable rebate and not considered income.

link to original post

Quote: MentalI believe cash back / free slot play is clearly like a coupon for a discount on future purchases. If I have $100 in FSP and I play 4 hands of video poker at $25 a spin, then my out-of-pocket cost is $0. If I cash out $100, then the FSP is not taxable but during the gambling session I netted $100 which is clearly a taxable gambling win. How does that change anything?Quote: darkozMJB got it completely backwards.

Comps given as gifts are taxable as income. Anything earned through play like Freeplay from prior play or points or free rooms are considered REBATES on prior purchases and are not taxable.

These fall under the same rules as credit cards and banks. When you earn Cashback from purchases with a credit card that's a non-taxable rebate and not considered income.

link to original post

link to original post

But the IRS says it's not!

It's a rebate on prior purchases.

Proof is the amount of your offers are based on PRIOR play and adjusted in the future on current play(I e. More purchases).

Money won from Freeplay is not taxable as it's a rebate up to the amount of the purchase price

So if you lost $1000 and won $1200 off the resulting calendar Freeplay then you have taxable income of $200.

I suppose if you won $1000 and then got comped Freeplay such that you won $1200 then it would all be taxable under IRS rules.

Are you saying that when you receive $100 in FSP, then you adjust your gambling records to reflect the reduction in your buy-in on the previous sessions thereby increasing your stated profit by $100?Quote: darkozQuote: MentalI believe cash back / free slot play is clearly like a coupon for a discount on future purchases. If I have $100 in FSP and I play 4 hands of video poker at $25 a spin, then my out-of-pocket cost is $0. If I cash out $100, then the FSP is not taxable but during the gambling session I netted $100 which is clearly a taxable gambling win. How does that change anything?Quote: darkozMJB got it completely backwards.

Comps given as gifts are taxable as income. Anything earned through play like Freeplay from prior play or points or free rooms are considered REBATES on prior purchases and are not taxable.

These fall under the same rules as credit cards and banks. When you earn Cashback from purchases with a credit card that's a non-taxable rebate and not considered income.

link to original post

link to original post

But the IRS says it's not!

It's a rebate on prior purchases.

Proof is the amount of your offers are based on PRIOR play and adjusted in the future on current play(I e. More purchases).

Money won from Freeplay is not taxable as it's a rebate up to the amount of the purchase price

So if you lost $1000 and won $1200 off the resulting calendar Freeplay then you have taxable income of $200.

I suppose if you won $1000 and then got comped Freeplay such that you won $1200 then it would all be taxable under IRS rules.

link to original post

The FSP is not cash. Cash accounting comes in when you redeem the coupon for credits, play until it credits are cashable and then convert the credits to cash or the cash equivalent. Effectively, the FSP is income after it is converted cash. It makes no difference if I account for it as cash as soon as it is converted to credits or only after the session is over and I account for it as a reduction of the cost of buying the credits on the game.

I think it is odd that you claim to make a very good living without generating any income.

Quote: MentalAre you saying that when you receive $100 in FSP, then you adjust your gambling records to reflect the reduction in your buy-in on the previous sessions thereby increasing your stated profit by $100?Quote: darkozQuote: MentalI believe cash back / free slot play is clearly like a coupon for a discount on future purchases. If I have $100 in FSP and I play 4 hands of video poker at $25 a spin, then my out-of-pocket cost is $0. If I cash out $100, then the FSP is not taxable but during the gambling session I netted $100 which is clearly a taxable gambling win. How does that change anything?Quote: darkozMJB got it completely backwards.

Comps given as gifts are taxable as income. Anything earned through play like Freeplay from prior play or points or free rooms are considered REBATES on prior purchases and are not taxable.

These fall under the same rules as credit cards and banks. When you earn Cashback from purchases with a credit card that's a non-taxable rebate and not considered income.

link to original post

link to original post

But the IRS says it's not!

It's a rebate on prior purchases.

Proof is the amount of your offers are based on PRIOR play and adjusted in the future on current play(I e. More purchases).

Money won from Freeplay is not taxable as it's a rebate up to the amount of the purchase price

So if you lost $1000 and won $1200 off the resulting calendar Freeplay then you have taxable income of $200.

I suppose if you won $1000 and then got comped Freeplay such that you won $1200 then it would all be taxable under IRS rules.

link to original post

The FSP is not cash. Cash accounting comes in when you redeem the coupon for credits, play until it credits are cashable and then convert the credits to cash or the cash equivalent. Effectively, the FSP is income after it is converted cash. It makes no difference if I account for it as cash as soon as it is converted to credits or only after the session is over and I account for it as a reduction of the cost of buying the credits on the game.

I think it is odd that you claim to make a very good living without generating any income.

link to original post

Freeplay has no cash value.

It's only the cash that you leave with if anything from the Freeplay that's reportable and only above the amount you "spent" or lost to get it.

I also didn't claim to make a very good living without generating any income. My income is the amount of cash out that is more than my losses to achieve it.

If you think I get Freeplay without any prior play or losses you are wrong.

Yes, and to amplify the example for illustration purposes...if you hit a 12X Royal on a $25 Ult X VP spin and won $240,000, that $240,000 in winnings clearly would be taxable. The original $100 FSP is not taxable.Quote: MentalI believe cash back / free slot play is clearly like a coupon for a discount on future purchases. If I have $100 in FSP and I play 4 hands of video poker at $25 a spin, then my out-of-pocket cost is $0. If I cash out $100, then the FSP is not taxable but during the gambling session I netted $100 which is clearly a taxable gambling win. How does that change anything?Quote: darkozMJB got it completely backwards.

Comps given as gifts are taxable as income. Anything earned through play like Freeplay from prior play or points or free rooms are considered REBATES on prior purchases and are not taxable.

These fall under the same rules as credit cards and banks. When you earn Cashback from purchases with a credit card that's a non-taxable rebate and not considered income.

link to original post

link to original post

Quote: darkoz

If you think I get Freeplay without any prior play or losses you are wrong.

link to original post

I have no idea what your experience has been. Not all FSP is cash back.

I have received tens of thousands of dollars of free play for depositing money into online accounts. I have never played at the property at any prior time and I get FSP. This deposit-bonus FSP is only convertible to cash by future play. I have received FSP from hosts looking to bring me in to a property where I have never played before. After I was established at one casino, I got additional deposit bonuses up to $5000 in FSP contingent on my future play. It is totally unrelated in any direct way to past play. Someone in the promotions department just decides it is worth sending me FSP with a certain play-through requirement.

The existence of FSP that is a percentage of past play does not prove that all FSP is a rebate on past purchases.

Quote: darkozQuote: MentalI believe cash back / free slot play is clearly like a coupon for a discount on future purchases. If I have $100 in FSP and I play 4 hands of video poker at $25 a spin, then my out-of-pocket cost is $0. If I cash out $100, then the FSP is not taxable but during the gambling session I netted $100 which is clearly a taxable gambling win. How does that change anything?Quote: darkozMJB got it completely backwards.

Comps given as gifts are taxable as income. Anything earned through play like Freeplay from prior play or points or free rooms are considered REBATES on prior purchases and are not taxable.

These fall under the same rules as credit cards and banks. When you earn Cashback from purchases with a credit card that's a non-taxable rebate and not considered income.

link to original post

link to original post

But the IRS says it's not!

It's a rebate on prior purchases.

Proof is the amount of your offers are based on PRIOR play and adjusted in the future on current play(I e. More purchases).

Money won from Freeplay is not taxable as it's a rebate up to the amount of the purchase price

So if you lost $1000 and won $1200 off the resulting calendar Freeplay then you have taxable income of $200.

I suppose if you won $1000 and then got comped Freeplay such that you won $1200 then it would all be taxable under IRS rules.

link to original post

I don't think the question is whether free-play is taxable, which I would argue it is not. The question is about the taxable status of money won from freeplay.

Before electronic downloadable FSP, we took paper FSP coupons to the cage and got rolls of tokens which we could take directly to a token redemption booth and receive cash.Quote: DRichI don't think the question is whether free-play is taxable, which I would argue it is not. The question is about the taxable status of money won from freeplay.

link to original post

The slip of paper is not cash or income. The tokens are not cash. The process of converting the offer to cash is what creates income. In this case, it is not even a question is about the taxable status of money won from the FSP.

I track FSP in a separate column of my spreadsheet so I can understand how much FSP I am getting as a percentage of my action. If I have $100 FSP and simply lose it all, I prefer to record it as +$100 FSP and a gambling loss of $100. My session total is zero. I record the session total in another column. If you prefer to just directly record this as a session with zero gambling income, who can argue with you?

I derive my gambling W/L from my cash-out minus my buy-in. For accounting purposes, I treat the FSP as income the instant it is turned to credits. After all, anyone looking over my shoulder can no longer tell if whether my starting credits were purchased with cash or the FSP.

If you prefer to only look at cash in and cash out, you will arrive at the same result, because no cash went in and no cash came out of the session and no income needs to be reported.

On the other hand, if you put no cash in but took $100 out, then you earned $100 of income. You can call this income from FSP or income from gambling with credits that you paid nothing for. There is no one instant when this income was realized. From the point of view of the IRS, the only thing that is important is that the your wealth increased by $100 in the session.

$100 FSP buy-in, $300 cash-out = +$200 session?

Quote: ChumpChangeSo my second-thoughts about exempting the FSP amount from the win amount is in error?

$100 FSP buy-in, $300 cash-out = +$200 session?

link to original post

I'd call it a $300 session but I would be happy to be wrong.

Quote: billryanWhen would the free slot play become taxable? If a casino sends me $10 a week in free play, I most certainly don't have to report $520 in free play. how would I report it if I wanted to? Estimate the cash value and report that?

link to original post

I would say just what you cash out from the free play. If you end up cashing out $5 of the $10 that would be what I think you should report. The free play itself is not income, just what you cash out from it is.

Your cash buy-in is zero. By cash accounting, this is a +$300 session. If you are playing online, there is no cash involved at any point in the session. Your balance has just increased by $300. Seems like gambling income to me.Quote: ChumpChangeSo my second-thoughts about exempting the FSP amount from the win amount is in error?

$100 FSP buy-in, $300 cash-out = +$200 session?

link to original post

Quote: MentalYour cash buy-in is zero. By cash accounting, this is a +$300 session. If you are playing online, there is no cash involved at any point in the session. Your balance has just increased by $300. Seems like gambling income to me.Quote: ChumpChangeSo my second-thoughts about exempting the FSP amount from the win amount is in error?

$100 FSP buy-in, $300 cash-out = +$200 session?

link to original post

link to original post

Your definition of gambling income is incorrect.

In your example the promo credits caused your balance to go up by $300. Now can you cash that out with zero playthrough? If so you are correct.

If not then you haven't had any income yet! I don't know of any online or B&M casino currently where Freeplay can simply be downloaded and then cashed out with zero play. Because it's not cash nor income yet.

Quote: MentalQuote: darkoz

If you think I get Freeplay without any prior play or losses you are wrong.

link to original post

I have no idea what your experience has been. Not all FSP is cash back.

I have received tens of thousands of dollars of free play for depositing money into online accounts. I have never played at the property at any prior time and I get FSP. This deposit-bonus FSP is only convertible to cash by future play. I have received FSP from hosts looking to bring me in to a property where I have never played before. After I was established at one casino, I got additional deposit bonuses up to $5000 in FSP contingent on my future play. It is totally unrelated in any direct way to past play. Someone in the promotions department just decides it is worth sending me FSP with a certain play-through requirement.

The existence of FSP that is a percentage of past play does not prove that all FSP is a rebate on past purchases.

link to original post

For the 3rd or 5th time I will again state that FSP based on PRIOR PLAY is a rebate.

And FSP not based on PRIOR PLAY is considered taxable income.

Maybe you aren't reading my posts fully.

If you are receiving Freeplay simply for depositing money then you are correct that's a taxable income (cash derived) not a rebate.

I even gave the example of banks giving a bonus for opening an account (income) versus Cashback on credit cards (rebates).

I've been saying all along there are two different types of FSP.

But MBJ got which is income vs a rebate backwards. Which was my original point

Quote: ChumpChangeSo nobody gets a tax form for winning $2,000 of free play at the kiosk game? Just take that over to the quarter VP machine, play it through, cash-out, then call it a session win?

link to original post

This sounds correct to me.

I'd say that is correct. The 2K of freeplay awarded has no cash value, per the casino, so no tax due. However, the proceeds from using that freeplay are taxable, just as if you won a sweepstakes despite not paying for the sweepstakes ticket. You don't need to be gambling per se (putting your cash at risk) to create taxable income. But if you gamble all the freeplay and don't get a penny back, the IRS doesn't treat the freeplay as income, despite it working just like you put cash in the machine to make a wager. That's the "rebates are non-taxable" part. If a person takes the position that the proceeds from gambling the freeplay, if any, are non-taxable because they are simply extensions of the freeplay rebate, I sincerely hope that person never gets audited by a competent examiner, because they will be headed to tax court, if not the District Court.Quote: ChumpChangeSo nobody gets a tax form for winning $2,000 of free play at the kiosk game? Just take that over to the quarter VP machine, play it through, cash-out, then call it a session win?

link to original post

Note that certain methods of redeeming freeplay make sure that the freeplay itself is treated as a rebate; think MGM Freeplay, which requires you to put up your cash for a bet, then rebates the wager back with a Bonus Payment equal to the wager after the game ends.

EDIT: Which means that all MGM slot winnings are taxable, as you are gambling your own money, and getting a rebate after.

Quote: LoquaciousMoFWI'd say that is correct. The 2K of freeplay awarded has no cash value, per the casino, so no tax due. However, the proceeds from using that freeplay are taxable, just as if you won a sweepstakes despite not paying for the sweepstakes ticket. You don't need to be gambling per se (putting your cash at risk) to create taxable income. But if you gamble all the freeplay and don't get a penny back, the IRS doesn't treat the freeplay as income, despite it working just like you put cash in the machine to make a wager. That's the "rebates are non-taxable" part. If a person takes the position that the proceeds from gambling the freeplay, if any, are non-taxable because they are simply extensions of the freeplay rebate, I sincerely hope that person never gets audited by a competent examiner, because they will be headed to tax court, if not the District Court.Quote: ChumpChangeSo nobody gets a tax form for winning $2,000 of free play at the kiosk game? Just take that over to the quarter VP machine, play it through, cash-out, then call it a session win?

link to original post

Note that certain methods of redeeming freeplay make sure that the freeplay itself is treated as a rebate; think MGM Freeplay, which requires you to put up your cash for a bet, then rebates the wager back with a Bonus Payment equal to the wager after the game ends.

EDIT: Which means that all MGM slot winnings are taxable, as you are gambling your own money, and getting a rebate after.

link to original post

If you won $2000 of Freeplay at a kiosk game that would fall under Freeplay not from former purchases (gambling) and that's why cash derived from it would be taxable.

It's really frustrating that the difference between Freeplay won vs versus Freeplay awarded based on prior gambling is so difficult to differentiate.

Cash won from Freeplay that was awarded based on prior gambling is a rebate and not considered income by the IRS

Cash from your bank account that was awarded as cashback from prior purchases on your credit card are rebates and not income

If you guys are getting 2% Cashback on say Discover card purchases and reporting that 2% cash as income you guys are over reporting your income.

Quote: ChumpChangeSo if I win $50 on the kiosk game and play $1 VP and win a $4K JP, I'll get a tax form on that win, but I wouldn't get a tax form on the $4K win if I paid for my free play with 10,000 points for $50 of free play? I fail to see how the machines or the staff would be able to tell the difference.

link to original post

They wouldn't be able to. It's how you would report your winnings to the IRS at years end

Also you can only claim the rebate up to the amount of your purchase.

Take the 2% Cashback on credit card purchases. Let's say they ran a special of 150% Cashback. So you purchase a $1000 refrigerator using your credit card and get back $1500 Cashback on the purchase (this is just a hypothetical.).

You would report $500 income NOT $1500 Income.

It's the same with winnings from Freeplay that are earned from prior play. You report as income any amount in cash you receive from the Freeplay ABOVE the amount you paid to get the rebate.

If all wins from the points bought free play are tax exempt, and I wind up the session at $25 + a $4K JP, I'd mark it down as a $4,075 session loss and add-in a W-2G win of $4K?

If only wins over the $100 buy-in are counted, I'd mark it down as a $75 loss and add-in a W-2G win of $4K.

I'm trying to distinguish regular sessions from ones with a W-2G involved with W-2G wins reported separately.

And also trying to distinguish tax free wins because they were made with points bought free play. If only the $100 of points is counted as a buy-in and winnings to over $100 are taxable, I'd write down $100 buy-in, $4,025 cash-out, for a +$3,925 session.

Bah, I'll keep the W-2G wins within the session win amounts and count up the many (≥1) W-2G's in a separate column which doesn't affect my current bankroll balance. I get paid the same day and they are not checks I'm waiting 3 months to cash.

I have darkoz blocked, but when someone is quoted two levels deep the blocked post still shows, so I saw the above.Quote: UP84Quote: MentalQuote: darkozMJB got it completely backwards.

Comps given as gifts are taxable as income. Anything earned through play like Freeplay from prior play or points or free rooms are considered REBATES on prior purchases and are not taxable.link to original post

Anyway, If I got it completely backwards, then so did CPA Marissa Chien, the Wizard, and tax attorney Brad Polizzano. Those are the sources I cite.

I don't believe I got it backwards, as I haven't seen any credible sources to the contrary.

Quote: MichaelBluejayI have darkoz blocked, but when someone is quoted two levels deep the blocked post still shows, so I saw the above.Quote: UP84Quote: MentalQuote: darkozMJB got it completely backwards.

Comps given as gifts are taxable as income. Anything earned through play like Freeplay from prior play or points or free rooms are considered REBATES on prior purchases and are not taxable.link to original post

Anyway, If I got it completely backwards, then so did CPA Marissa Chien, the Wizard, and tax attorney Brad Polizzano. Those are the sources I cite.

I don't believe I got it backwards, as I haven't seen any credible sources to the contrary.

link to original post

Unfortunately MBJ has me blocked so will continue with incorrect information.

Credible source:. How about the IRS and Forbes!