Do I have to pay income tax on the free pizza slices I get from my Player's Card points at the Casino Food Court?

Quote: GWAEIf people get a lot less back in taxes this year will it cause a recession? If people are normally getting 5k back and expect it yearly then what happens when they unexpectedly get 1500 back? I can see that being a major issue.

Imagine how much better the economy was and how much more sound our "money" was before the federal income tax was finally deemed constitutional by the Supreme Court.

#freezenking

Quote: RogerKintImagine how much better the economy was and how much more sound our "money" was before the federal income tax was finally deemed constitutional by the Supreme Court.

#freezenking

Yes, indeed. Freeze 'n King!

Quote: ChumpChangeDo I have to pay income tax on the free pizza slices I get from my Player's Card points at the Casino Food Court?

I think, legally, yes, you're supposed to pay taxes on the value of all comps.

Quote: billryanHow about the people who got small refunds in the past who will owe money instead.

eeks didnt even think of that.

Quote: RogerKintImagine how much better the economy was and how much more sound our "money" was before the federal income tax was finally deemed constitutional by the Supreme Court.

#freezenking

Between the Civil War and the imposition of income tax, the U.S. economy had multiple recessions and at least two crashes. Former President Grant, Savior of the Union , even went broke and was reduced to hawking his autobiography town to town.

Do you have any evidence of taxes hurting the economy?

I guess we should make the income tax rate 100% so "economy" can be magically perfect. It's so hard to take the $1 ribeye guy seriously ;)

Quote: RogerKintIt's kinda funny. The income tax was passed and the voter was promised only the top 1%, very wealthy rich folks will have to pay it. Sound familiar? Now, we're all slaves.

I guess we should make the income tax rate 100% so "economy" can be magically perfect. It's so hard to take the $1 ribeye guy seriously ;)

So you sprout nonsense and when called on it, you channel max. Want to compare and contrast the decade before and after the implementation of income tax? Have any evidence that Americans were promised only the top one percent would ever pay taxes?

The voters passed the 16th Amendment, not the courts.

Quote: BillryanSo You Sprout Nonsense And When Called On It, You Channel Max. Want To Compare And Contrast The Decade Before And After The Implementation Of Income Tax? Have Any Evidence That Americans Were Promised Only The Top One Percent Would Ever Pay Taxes?

The Voters Passed The 16th Amendment, Not The Courts.

You have me confused with one of your many employees. It's not my job to educate you. If you don't like my "sprouting" you can block me.

Quote: billryan

The voters passed the 16th Amendment, not the courts.

LOL ... I can't even... So I wont.

Quote: billryanHow about the people who got small refunds in the past who will owe money instead.

Quote: GWAEeeks didnt even think of that.

How about the people who paid in the past that will get refunds?

So much negative speculation.

I'm sure everyone's tax obligation will change this tax year. Some for the better, some for the worse. I am also sure that year to year everyone's tax figures change, such as wages, deductions, capital gains, dividends, gambling wins and losses, etc. etc, etc.

Did you get a refund last year because you had too much federal tax withheld? Did you have to pay because you had too little withheld? Do you withhold too much on purpose in order to receive a large refund (giving the government a tax free loan)? So many factors affecting your tax obligation.

Whether or not I receive a larger or smaller tax refund, or owe taxes does not answer the question if the tax cuts helped me. What is important is whether or not my "total tax" in 2018 will be higher or lower than what I would have had to pay in 2017 using 2018 information.

So here is what I plan to do. Once my 2018 tax forms are completed, I will use all my 2018 information and input it into a 2017 tax form and see the difference in "total tax" amounts.

I see this as the only credible way to compare the years.

Quote: WizardI think, legally, yes, you're supposed to pay taxes on the value of all comps.

I have done the research so let me clarify the IRS positions on comps and taxable income

They split comps into 2 categories. Earned comps (their term) vs. Unencumbered comps (my term to make it more clear)

Unencumbered comps are comps given without having to earn them or make any purchase. Free cheeseburger coupons for McDonald's or $10 freeplay just for signing up as a new member

Earned comps are those given only to people who have made a prior purchase. Frequent flier miles, cereal box tops, free hotel rooms and free play are only given based on past performance of the individual customers

Unencumbered comps are considered taxable income

The IRS considers earned comps to be discounts on purchases and therefore NOT taxable income but savings on the "price of admissions" so to speak

There seems to be no differentiation I can find between earned comps that wind up turning a profit. The IRS does not seem to take that into account and assumed any free earned offers will return only a fractional discount of the original price.

So based on current IRS rules freeplay from calenders earned by rated play and other similar gifts and comps are not taxable income.

Examples: I have to look it up but there was a generous new sign-up for bank customers. $500 deposit into new customers bank accounts if memory serves. Those customers who signed up were real angry when they found out they were being sent tax reporting documents

Otoh Discover Card will deposit cash-back into customer bank accounts based on purchases made with their card and the IRS does not consider that taxable income (even though the customers clearly remove it as cash)

Therefore rated play freeplay awards even played through and turned into cash should be non-taxable rebates and not considered income

Of course until its tested in tax court who knows. I was unable to find any casino comps tax court cases in my research

https://www.creditcards.com/credit-card-news/irs-taxable-income-credit-card-rewards-points-gift-1277.php

Professional Video Poker Today Vs Two Decades Ago https://www.gamblingsites.net/blog/professional-video-poker-today-vs-two-decades-ago/

I have hundreds of articles and I almost never mention credentials. I mentioned them in this particular article because I thought that readers might want to see them so they could decide whether to trust the info or not, because readers understandably might not want to trust their taxes to someone they know nothing about. And if someone sees my credentials and thinks, "Not good enough" (e.g., not a CPA), that's fine, I can't argue with that, but I at least wanted to provide *some* reasons that some might consider the article credible enough. The web is filled with articles by people with no experience in the topic they're writing about, and it's a problem. Especially with gambling-related articles. When I read an article on just about any topic, I often look for some background on the author so I can decide whether they really know what they're talking about. I want to provide the same for my own readers on topics where getting it wrong could have serious consequences.Quote: CrystalMathWhat I don’t like is the condescending attitude, and reliance on scholastic achievements that were 20+ years ago. I can see you’re a smart guy, I don’t give a rat what you got on your SAT, that you tested out of college English, that your reading scores are off the chart, or that you got an A in financial accounting.

Well, I agree with you. I just don't think I've done that. I don't consider it berating to ask people if they've read the article (when they ask questions that are directly answered in the article).Quote: CrystalMathThis doesn’t give you the right to berate people.

No, I believe that when someone raises a question that's covered in the article, that they haven't read the article. Especially when that question is directed to me.Quote: CrystalMathHe believes that...anyone who raises a question can’t or hasn’t read his article.

This isn't true, and I think one of the rudest things a person can do is to ascribe actions to others that they didn't do.Quote: CrystalMathWhen he was a moderator, he would just delete other peoples responses that he didn’t like instead of just having an open dialogue.

Early on, when I saw rude posts (rude to other users, not to me), I clicked the "Flag" button, thinking that it would, you know, Flag them, for someone higher up to review. I didn't realize that as a semi-mod, clicking the Flag button would actually *delete* the post. Whoops.

In another thread, I didn't want it to get derailed, and specifically warned that I would delete *off-topic* posts. Of course, some people specifically made off-topic posts just to taunt me. I deleted off-topic posts in my thread, but I absolutely didn't censor because of differences of opinion. That is totally not my style. Incidentally, when I deleted an off-topic post, one of the members PM'd me this: "Hey Old Sport.....just hangout in the bathroom like you normally do.....you'll have your 250 in no time. Fuck you fag."

Well, I'm not the one calling someone else a prick, or saying things about others that are untrue.Quote: CrystalMathMB is a bully...

Quote: darkozI have done the research so let me clarify the IRS positions on comps and taxable income

Good post, thanks. I was doing some research too, to try to challenge you, but this article (Taxation of Gambling: Rakeback and Casino Comps) seems to agree with you.

The original question was whether a slice of pizza paid for with slot points is taxable. It would seem that if it was paid for with points, it's not. However, if it was a no-strings-attached offer, like a coupon to get people through the door, it would be.

If this tangent gets more than a few more posts, I'll split it off.

Negatively affected are those who were just over what was needed to itemized deductions, and now can't. Like me. We had decided to keep our mortgage payment down and now are being punished.

As for Michael Bluejay's webpage, I still think he needs to acknowledge somewhere on that page that the IRS may consider amounts on line 21 less than W2 totals to be a flag. Maybe not a red flag, but a flag. If this claim is still not deemed credible, or the belief that it is easily handled is prevailing, a mention of it at least is very much due, it's owed to those who would read it. Otherwise, yeah, I'd say he is showing he feels he had nothing to learn himself.

Quote: Fleaswatter

So here is what I plan to do. Once my 2018 tax forms are completed, I will use all my 2018 information and input it into a 2017 tax form and see the difference in "total tax" amounts.

I see this as the only credible way to compare the years.

Quit trying to make sense in this thread. Clearly this thread is just evolving into political garbage.

Quote: WizardI think, legally, yes, you're supposed to pay taxes on the value of all comps.

My understanding is that the free pizza, booze, and hotel rooms are exempt from federal taxes. IRS recognizes those as "inducements to play" offered by the casino, and not winnings, per se. But, I'm no attorney.

Quote: NathanHere is my tax slot question. Do you get reimbursed for paying taxes on slot wins in different Countries? Let's say you win $10,000 on Fu Doa Le while playing in England. You live in Miami, Florida, ;) If you have to pay English tax even if you don't live in England, does the IRS reimburse you the tax come tax season time?(I originally posted Canada but changed it last second because IIRC, Canada doesn't have a Jackpot tax, ;)

English tax authorities have no interest in your (or my) slots or casino winnings. Nor will you be issued a W2-G or whatever if you win here. That's between you, the IRS and your conscience to deal with when you get home, always assuming you are able to import your winnings to the US, legally. So.... You declare it and pay : Nothing to be reimbursed.

Similarly if I, a Brit, win big while in Vegas, I fill out a form and pay no tax to the IRS and no tax to HMRC (UK tax authority)

Bringing the cash home might involve a bit of US side banking or a declaration at UK point of entry.

Quote: NathanHere is my tax slot question. Do you get reimbursed for paying taxes on slot wins in different Countries? Let's say you win $10,000 on Fu Doa Le while playing in England. You live in Miami, Florida, ;) If you have to pay English tax even if you don't live in England, does the IRS reimburse you the tax come tax season time?(I originally posted Canada but changed it last second because IIRC, Canada doesn't have a Jackpot tax, ;)

The real problem is carrying all the money home

Its extremely heavy. You might not be able to lift it

Each note of currency in England is a pound

Anybody get any tax forms from the casino for cashing in more than $20 or $600 worth of slot points for gift shop items, room and/or board?

Yeah a pound of Gold. Very heavy especially now we've gone metric. We've done away with paper pound notes $:o) You need to watch your baggage allowance.Quote: darkozThe real problem is carrying all the money home

Its extremely heavy. You might not be able to lift it

Each note of currency in England is a pound

Quote: RSWhat happens if you hit a jackpot with free play?

I'm not an expert on this, but I believe when you use free play to play a game, any income from that session is still taxable, you just don't have any "basis" in the session. E.g., your net win doesn't include a deduction for your buy-in, since your buy-in was free. I.e., your jackpot is still taxed. Sorry.

Quote: AcesAndEightsI'm not an expert on this, but I believe when you use free play to play a game, any income from that session is still taxable, you just don't have any "basis" in the session. E.g., your net win doesn't include a deduction for your buy-in, since your buy-in was free. I.e., your jackpot is still taxed. Sorry.

That is where most of the people go wrong. People believe that you only pay taxes on those w2g wins. Even Nathan should be paying taxes on her $3 wins.

Quote: AcesAndEightsI'm not an expert on this, but I believe when you use free play to play a game, any income from that session is still taxable, you just don't have any "basis" in the session. E.g., your net win doesn't include a deduction for your buy-in, since your buy-in was free. I.e., your jackpot is still taxed. Sorry.

I have not done my research, either, just what was said here so far. However...that seems to be a major, positive change in the tax law. What you said is how it has been until this year. The question is, whether the law has changed to allow comps/fp earned, and the proceeds from same, to be tax-free. IMO, that question has not been definitively answered either way.

It is a long-standing rule with the IRS that you can file in whatever way best benefits you. I don't know that casinos will stop issuing W2Gs on comp wins on Jan 1, though, and so the IRS will still probably use them to gauge people's gambling income, regardless of offsets.

Too bad the political threads pi$$ed off the only CPA I know of on here. He might be able to tell us.

Quote: WizardGood post, thanks. I was doing some research too, to try to challenge you, but this article (Taxation of Gambling: Rakeback and Casino Comps) seems to agree with you.

The original question was whether a slice of pizza paid for with slot points is taxable. It would seem that if it was paid for with points, it's not. However, if it was a no-strings-attached offer, like a coupon to get people through the door, it would be.

If this tangent gets more than a few more posts, I'll split it off.

Many casino eateries do not charge sales tax when you pay with club points.

Quote: AcesAndEightsI'm not an expert on this, but I believe when you use free play to play a game, any income from that session is still taxable, you just don't have any "basis" in the session. E.g., your net win doesn't include a deduction for your buy-in, since your buy-in was free. I.e., your jackpot is still taxed. Sorry.

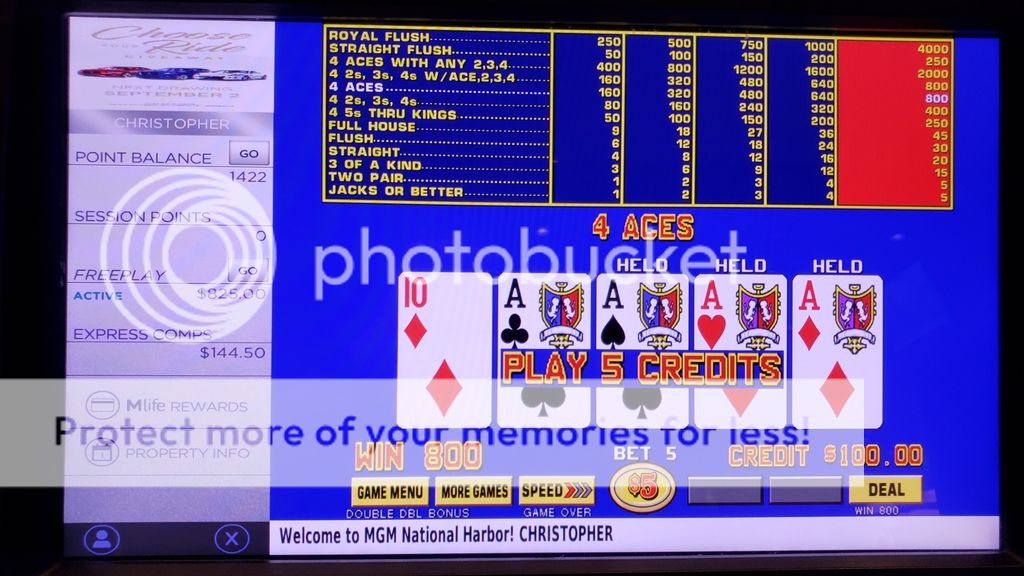

I got a W2-G when I hit 4 Aces for $4,000 on $5 DDB single line.

This was second hand on free play that day. I put $25 in to start must have hit something on first hand to get credits up which is why I had $100 left on machine after they paid me the 4K. Had to have been 3 of a kind which would have bumped it to $100 credit. This was on September 4th of this year when I still played all my free play on $5 single line.

I cant really say not to get a jackpot on freeplay because of this because hey, it's losing $25 to win 4 grand. Technically I got screwed but it had a happy ending. (Double entendre intended)

Quote: beachbumbabs

Too bad the political threads pi$$ed off the only CPA I know of on here. He might be able to tell us.

That's what the political threads here have done to many "good" posters on the forum, imo.

Quote: ChumpChangeDo slot machines go cold when you’re given free play? https://www.freep.com/story/entertainment/nightlife/2015/08/19/mark-pilarksi-casinos-free-play-slots/31913489/

Wow really?

Absolutely not!

I play thousands of dollars of freeplay a day. It has no affect on the machines

Quote: GWAEI do wonder if you could fight a w2g saying the session resulted in a zero gain, even though you have a w2g. In that case your agi would not be affected. My guess is the IRs employee would not understand the difference and it wouldn't matter.

I self filed and I didn't list a single W2G in 2016. Earlier this year I got a letter saying "What about these 80 W2-G's we have? Please send us $30,000." Russ Fox the Vegas tax attorney told me what to write to the IRS in my letter and what numbers had to change on my Schedule C.

Basically I had listed $50,000 gambling income and no losses. They wanted to see $255,000 gambling winnings and $205,000 losses on my forms. That's all I did was change those two numbers and explain what I did. A month later night got a letter saying I owed $0. I was surprised they understood it right away.

hopefully they stay away forever on that one and do not come back to you in another year wanting to see your records of losses adding up to $205,000. IF I was IRS, I would want to see your documents showing you lost $205,000 as most can not produce thatQuote: BTLWIBasically I had listed $50,000 gambling income and no losses. They wanted to see $255,000 gambling winnings and $205,000 losses on my forms. That's all I did was change those two numbers and explain what I did. A month later night got a letter saying I owed $0.

not a very good assumption that IRS did understand it.Quote: BTLWII was surprised they understood it right away.

I have had 6 rounds over my lifetime with IRS and won them all.

They, each time, in writing, said they were right and I had to show proof I was right, making them wrong.

easy to do when you do have the proof as I did each time.

and they wanted the proof every time.

I am not a professional gambler according to the IRS rules and guidelines on that.

sounds like you fell into a crack

Enjoy the win!

whoa what?!!Quote: BTLWII self filed and I didn't list a single W2G in 2016.

Earlier this year I got a letter saying "What about these 80 W2-G's we have? Please send us $30,000."

Russ Fox the Vegas tax attorney told me what to write to the IRS in my letter and what numbers had to change on my Schedule C.

Basically I had listed $50,000 gambling income and no losses.

They wanted to see $255,000 gambling winnings and $205,000 losses on my forms.

That's all I did was change those two numbers and explain what I did.

A month later night got a letter saying I owed $0. I was surprised they understood it right away.

why didn't you list any of those 80 w2-g's?!

they totaled $255k?

the IRS just wanted the gambling losses line on the tax form to say $205k and that was all it took for your return to be ok with them?

Quote: 100xOddswhoa what?!!

why didn't you list any of those 80 w2-g's?!

they totaled $255k?

the IRS just wanted the gambling losses line on the tax form to say $205k and that was all it took for your return to be ok with them?

He's a pro, don't get confused. Pros can net wins and loses on schedule C. Which is nice. But the IRS still expects to see that W-2G total somewhere.

Quote: GWAEYou are going to report a 364k win and a loss of 364k on schedule A. Now you are a 1% er and you get crushed at a higher tax bracket and your 50k a year income gets destroyed.

Isn't the tax bracket based on net income?

I think the 364k losses offset the 364k wins, so the original 50k income is still at the low-end bracket.

Quote: WangSanJoseIsn't the tax bracket based on net income?

I think the 364k losses offset the 364k wins, so the original 50k income is still at the low-end bracket.

Hmmm maybe

Just looked, tax bracket is based on net. I was wrong. However in that example your agi would be effected. It wont change your tax bracket but it does affect other things that are based on agi.

Quote: OnceDearSimilarly if I, a Brit, win big while in Vegas, I fill out a form and pay no tax to the IRS and no tax to HMRC (UK tax authority)

Bringing the cash home might involve a bit of US side banking or a declaration at UK point of entry.

Wow, you don't need to pay tax to both ends if you win big in the US.

I thought if you made money in the US, you have to pay tax, or at least state tax?

Quote: GWAEQuote: WangSanJoseIsn't the tax bracket based on net income?

I think the 364k losses offset the 364k wins, so the original 50k income is still at the low-end bracket.

Hmmm maybe

Just looked, tax bracket is based on net. I was wrong. However in that example your agi would be effected. It wont change your tax bracket but it does affect other things that are based on agi.

My AGI last year was well over 400k due to jackpots while my net income was well under 100k. When I was putting all the w2gs into turbo tax I noticed I was paying a higher percentage of tax. I would say your tax bracket is based on agi not net income based on what I observed.

I believe not for gambling winnings. As a Brit on vacation in the US, I would have to provide my proof of ID (UK passport) to the casino. They'd assist with a bit of paperwork and there would be no witholding and no liability. On return home, the winnings would be of no interest to the UK Tax authorities (HMRC)Quote: WangSanJoseWow, you don't need to pay tax to both ends if you win big in the US.

I thought if you made money in the US, you have to pay tax, or at least state tax?

What happens when a Brit won the WSOP, or lottery in the US, no tax at all?

That's my understanding. NO TAX LIABILITY, anywhere.Quote: WangSanJosehttp://www.taxabletalk.com/2018/07/15/the-real-winners-of-the-2018-world-series-of-poker/

What happens when a Brit won the WSOP, or lottery in the US, no tax at all?

By international treaty, a Brit resident and citizen visiting the US would only have to pay his normal taxes to our HMRC and none to the IRS. Since HMRC do not collect or have any interest in gambling or lottery profits or losses, then there would be no tax to pay to HMRC or IRS. Now, if I were to attract other income such as sponsorship or appearance fees, then HMRC would tax that income the same as if I'd earned it back home.

Physical location wouldn't matter either. If I enter a US lottery through the mail or on-line, I'm still not obliged to pay tax anywhere if I win.

Such winnings don't even have to be declared here at all on my annual tax return. That said, one day, I might have to explain my massive wealth under anti-money laundering laws.. E.g. I might have to explain to my legal advisor how I afford to pay cash for a mansion.