Quote: billryanThe government collects a federal excise tax on every sports bet wagered. The issue is that the way the government taxes them doesn't account for free bets.

A new member joins and gets $100 in free bets. He wins $20 and never bets again. The casino lost $20 and has to pay a tax on the entire $100 It is a bookkeeping nightmare. I'm not sure, but I think this law is only from 2018 , give or take a year.

link to original post

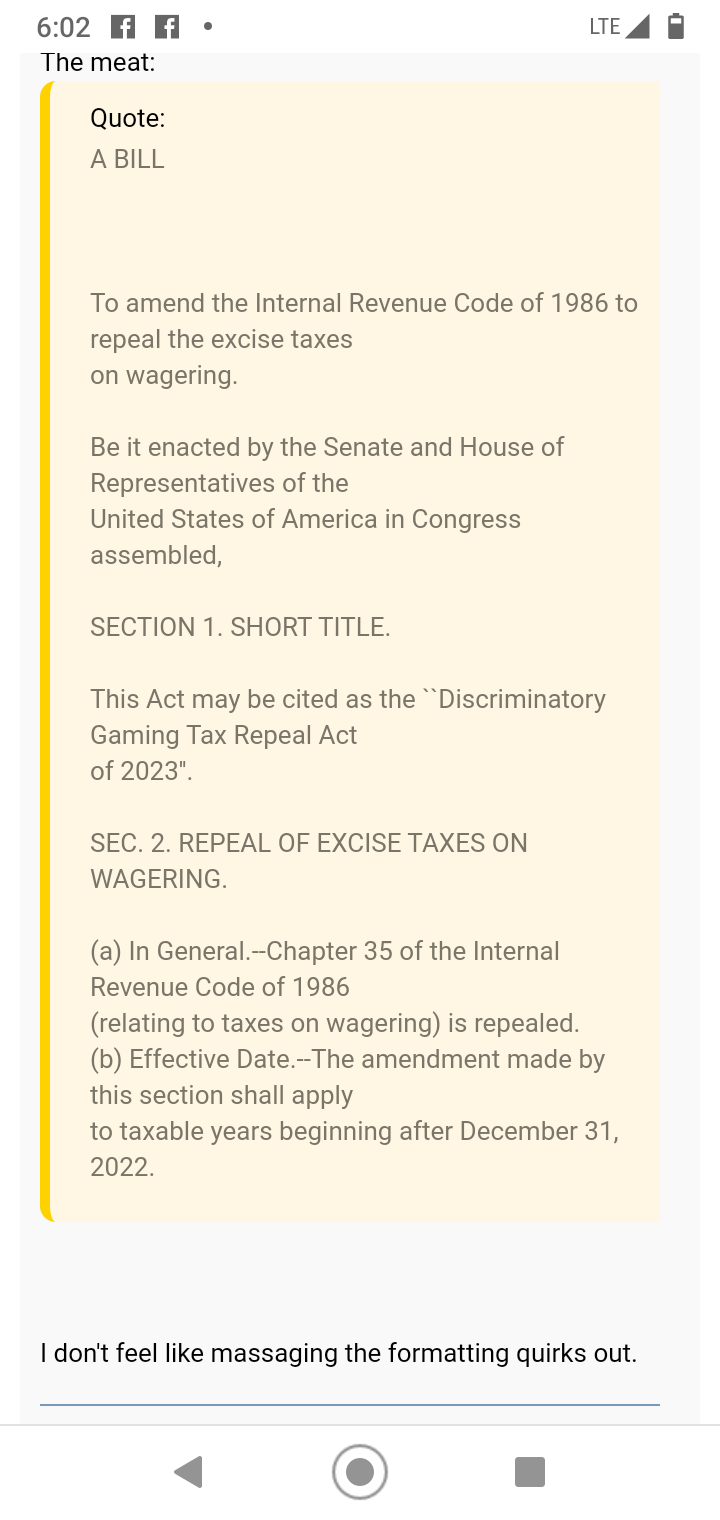

You are referring to a different tax code.

This one is from 1986.

Quote: billryanThe government collects a federal excise tax on every sports bet wagered. The issue is that the way the government taxes them doesn't account for free bets.

A new member joins and gets $100 in free bets. He wins $20 and never bets again. The casino lost $20 and has to pay a tax on the entire $100 It is a bookkeeping nightmare. I'm not sure, but I think this law is only from 2018 , give or take a year.

link to original post

So, slots, VP, table games, poker are not considered 'wagers' under this law? Poker rooms standardly rake 5-10% of every bet at the table, I could understand if they had to pay 0.25% of every cash game wager. But blackjack or craps would be a nightmare.

If the outcome of a sports wager is a push, does the book actually suffer a loss of 0.25% due to this excise tax?

Quote: gordonm888Quote: billryanThe government collects a federal excise tax on every sports bet wagered. The issue is that the way the government taxes them doesn't account for free bets.

A new member joins and gets $100 in free bets. He wins $20 and never bets again. The casino lost $20 and has to pay a tax on the entire $100 It is a bookkeeping nightmare. I'm not sure, but I think this law is only from 2018 , give or take a year.

link to original post

So, slots, VP, table games, poker are not considered 'wagers' under this law? Poker rooms standardly rake 5-10% of every bet at the table, I could understand if they had to pay 0.25% of every cash game wager. But blackjack or craps would be a nightmare.

If the outcome of a sports wager is a push, does the book actually suffer a loss of 0.25% due to this excise tax?

link to original post

Another great question. I would bet not. My books refer to those as ‘voided bets’, not ‘pushes’. Maybe that’s why?

Quote: gordonm888Quote: billryanThe government collects a federal excise tax on every sports bet wagered. The issue is that the way the government taxes them doesn't account for free bets.

A new member joins and gets $100 in free bets. He wins $20 and never bets again. The casino lost $20 and has to pay a tax on the entire $100 It is a bookkeeping nightmare. I'm not sure, but I think this law is only from 2018 , give or take a year.

link to original post

So, slots, VP, table games, poker are not considered 'wagers' under this law?link to original post

No, they are not.

Title 26, Section 4421(1), United States Code:

"The term “wager” means—

(A) any wager with respect to a sports event or a contest placed with a person engaged in the business of accepting such wagers,

(B) any wager placed in a wagering pool with respect to a sports event or a contest, if such pool is conducted for profit, and

(C) any wager placed in a lottery conducted for profit."