Quote: ChumpChangeI kind of like the idea of winning $50K in one night, taking a check home to the bank, and claiming that as winnings. Just get a few of those, and keep all of the losses under the table.

link to original post

I used to play a lot of a video poker game that paid $50k for a Royal Flush at different bars. I always took the cash instead of a check and just had them put it in a to-go food container on the bar so if the place got robbed they could take my wallet but wouldn't want my leftover food.

Quote: DRichI used email for my log to preserve the dates.

link to original post

Did the irs accept that?

Someone else won $30,500 in a drawing. Wonder who that guy was who he gave the fist bump to at the end when he won $500; looks familiar somehow.

I am Leaving the World Series of Poker for THIS?? WSOP Vlog #12

Quote: 100xOddsQuote: DRichI used email for my log to preserve the dates.

link to original post

Did the irs accept that?

link to original post

Actually, they never asked for backup proof.

Quote: DRichQuote: 100xOddsQuote: DRichI used email for my log to preserve the dates.

link to original post

Did the irs accept that?

link to original post

Actually, they never asked for backup proof.

link to original post

In terms of the practicality of it: if the IRS investigated everyone who had a taxable machine jackpot to see if they also had offsetting losses, how often would they find someone who didn't?

Being casinos are profitable for such a small percentage of the people who frequent them, there has to be some aggregate yearly number, under which it is in no way worth the resources to do anything but assume they have net losses and I would guess that number has 6 or maybe 7 digits in it.

A Black Jack player almost never gets a tax form unless they win big on a Blazing 7's side bet or something like that. If they don't play the side bets, they could still cash out for up to $9K per day and stay under the radar.

If I wanted a serious tax form, I'd play MS Stud for $15 a hand until I won the Royal Flush for $75,000+; and there'd be losses along the way, but I'd just want the tax form and the cash/check, and I'd play all year, lol.

Quote: ChumpChangeI'm gonna say the casual slot player just takes their tax form and doesn't itemize losses. They may have a handful of hand pays that don't amount to more than $10K cumulative and they can pay $2.4K of tax out of that.

A Black Jack player almost never gets a tax form unless they win big on a Blazing 7's side bet or something like that. If they don't play the side bets, they could still cash out for up to $9K per day and stay under the radar.

If I wanted a serious tax form, I'd play MS Stud for $15 a hand until I won the Royal Flush for $75,000+; and there'd be losses along the way, but I'd just want the tax form and the cash/check, and I'd play all year, lol.

link to original post

At 30 hands per hour you would only have to play 21,666 hours on average to get a royal flush.

Like UTH, I'd probably be trying to quadruple a $2,500 buy-in in a session or two.

Quote: ChumpChangeBig One Ugly Bill ...

link to original post

Warning -- political statement.

New Bill - Fair Bet act introduced to remove the 90% of losses from BBB. #taxes #lasvegas #gambling

https://www.youtube.com/shorts/cw3ZFZnNlOE

Quote: ChumpChangeGamble Smart guy is back with new legislation spotted that would reverse the 90% deduction back to 100% in the House. There's also mention of a possibility of raising the hand pay amount, but that just seems like wishful thinking. There's some audio fade-out, so call it tech difficulty.

New Bill - Fair Bet act introduced to remove the 90% of losses from BBB. #taxes #lasvegas #gambling

https://www.youtube.com/shorts/cw3ZFZnNlOE

link to original post

A number of sources, including ESPN, have mentioned this bill. One source says that it will only get rid of the 90% cap on deducting losses - nothing about the hand pay amount, or anything else for that matter.

You can't deduct losses off a 1099 but I suppose if they're filing as a professional gambler, entrance fee to the tourny would be deductible

Winning a big poker tournament can trigger a tax reporting requirement from the casino or tournament organizer. Here's a breakdown:

1. Form W-2G:

If you win more than $5,000 in net winnings from a poker tournament, you should receive a Form W-2G, "Certain Gambling Winnings".

This form reports your winnings to both you and the IRS.

The IRS receives a copy, so it's important to report these winnings on your tax return.

2. 1099 Forms:

While W-2G is the typical form for larger poker tournament wins, some cardrooms may file W-2Gs instead of 1099s for wins between $600 and $5,000.

However, if a player wins more than $5,000, they will likely receive a W-2G, not a 1099.

A 1099-MISC may be issued for winnings like sweepstakes prizes not involving a wager, or for net winnings of $600 or more from some online platforms like DraftKings or FanDuel.

3. Reporting Winnings and Losses:

Regardless of whether you receive a W-2G or any other form, all gambling winnings, even small amounts, are considered taxable income and must be reported to the IRS.

You should keep accurate records of your poker wins and losses throughout the year.

Gambling losses can be used to offset gambling winnings, but the deduction is limited to the amount of your winnings. You cannot deduct losses that exceed your winnings.

4. Potential Tax Withholding:

In some situations, the casino or tournament organizer may withhold taxes from your winnings, which will be indicated on your W-2G form.

Federal tax is typically withheld at 24% if your winnings from a lottery, wagering pool, or sweepstakes are $5,000 or more or if your winnings are 300 times the amount of your bet or more.

In summary, winning a significant poker tournament will likely lead to receiving a W-2G form, and these winnings must be reported on your tax return. You can offset your winnings with losses, but you can only deduct losses up to the amount of your winnings.

AGI is Adjusted Gross Income. If somebody wants to explain in more detail what that means in relation to their total wins, total losses, and net wins.

$6,000 Tax Break for Seniors: How Much YOU Save at EVERY Income Level

Quote: ChumpChangeRan across an explanation of how 65 year-olds can claim their new $6,000 senior deduction for tax years 2025-2028. Yeah, it's not lasting long.

AGI is Adjusted Gross Income. If somebody wants to explain in more detail what that means in relation to their total wins, total losses, and net wins.

$6,000 Tax Break for Seniors: How Much YOU Save at EVERY Income Level

link to original post

Right now, 64% of Seniors don't pay federal taxes because their income isn't high enough. This new deduction does nothing to reduce the taxes for the lowest two-thirds of seniors. It does nothing for high-income Seniors, as they aren't eligible for it, so it primarily benefits the portion of the population between the 65% and 88% bracket, with those in the 80%+ brackets receiving reduced benefits.

It reduces every senior's taxable income, which may be beneficial to some individuals applying for income-based programs. For example, Arizona offers assistance with utility bills to seniors with a taxable income of approximately $30,000. Being able to deduct an additional $6,000 opens this up to people earning $36,000.

If Iím in the workforce and the only gambling I do in 2026 is to go to the casino everyday and make one $1000 bet on an inside number in roulette and I hit 10 out of 365, in addition to losing $5000 to the casino, I also have to pay the treasury department an extra $7320 on that gambling "income".

And it gets even more insane at higher numbers or professional level gamblers. Consider the people who are better roulette players than I am:

-someone understands that it is possible to make even money bets at roulette and win more than 50% of the time.

-they decide to use this information to earn an income.

-they go to the casino everyday in 2026 and make one bet and end up winning just over 50% (183 wins and 182 losses).

-to make that an income commensurate with other jobs they bet $100,000 each spin and theyíve earned $100,000 for the year.

-they now owe the IRS $422,400 on $100,000 of income.

[(183 · 100000) - 0.9(182 · 100000)] · 0.22

Picture what would happen if firemen had to pay taxes on 110% of their salary. Who would accept those jobs?

Quote: billryanHas anyone considered that this tax might be designed to discourage gambling, rather than being a mistake? It will certainly make being a professional gambler less desirable.

Picture what would happen if firemen had to pay taxes on 110% of their salary. Who would accept those jobs?

link to original post

What does it mean to be a professional gambler? How many different things can it mean?

Last night when I slithered into a casino, bought in for $500 and a half hour later slithered out with $627.50, who was counting?

For this discussion, I'd say a professional gambler is anyone with gambling wins over $100,000. Below that level, the penalty is milder.

For this discussion, I'd say a professional gambler is anyone with gambling wins over $100,000. Below that level, the penalty is milder.

If you are grinding a living on 99.6% machines and freeplay, the 90% deduction is a game changer. If you are a small-time hustler who plays fast and loose with your taxes, this probably won't change much.

Just remember that when one door closes, a window opens.

Quote: TomGDina Titus, legislator from Las Vegas, is trying to undo the new laws on gambling taxes in the obbb or whatever itís called. I think she should be able to get it done just because of how insane it is, but having this in the law just singed proves that sanity is not always a reason to make changes in our laws.

link to original post

The bill is co-sponsored by Ro Khanna of California. I posted a link to the bill a few posts above. Whether or not it gets anywhere before next April 15 is anybody's guess.

If you get the odd tax form, you can pay tax on the total amount of those and not worry about losses as casual gamblers may do who rely on a standard deduction instead of itemizing losses.

But for gamblers who rely on itemizing their losses, this new bill needs to pass, and this month would be good.

I would imagine heís not very happy. I would guess that if heís still actively playing he probably gets over $1M in w2Gís a year. Currently thatís no problem cause he can write off $1M if he loses that. Next year he would owe tax on $100k. That would probably necessitate a huge change in his playing style. I have also had years where I got several hundred thousand in W2Gís.Quote: billryanI'd love to hear Bob Dancer's thoughts on this.

link to original post

I have to read the legislation again. Is it 90% of all losses or losses up to 90% of your wins? Big difference. If you have wins of $1M and losses of 900k for a 100k profit can you still write off 100% up to $900k? Or is it you can only write off $810k regardless?

Quote: SandybestdogI would imagine heís not very happy. I would guess that if heís still actively playing he probably gets over $1M in w2Gís a year. Currently thatís no problem cause he can write off $1M if he loses that. Next year he would owe tax on $100k. That would probably necessitate a huge change in his playing style. I have also had years where I got several hundred thousand in W2Gís.Quote: billryanI'd love to hear Bob Dancer's thoughts on this.

link to original post

I have to read the legislation again. Is it 90% of all losses or losses up to 90% of your wins? Big difference. If you have wins of $1M and losses of 900k for a 100k profit can you still write off 100% up to $900k? Or is it you can only write off $810k regardless?

link to original post

In that case, you'd earn $100,000 and owe taxes on $ 190,000, as you could only deduct $ 810,000.

Quote: ThatDonGuyQuote: TomGDina Titus, legislator from Las Vegas, is trying to undo the new laws on gambling taxes in the obbb or whatever itís called. I think she should be able to get it done just because of how insane it is, but having this in the law just singed proves that sanity is not always a reason to make changes in our laws.

link to original post

The bill is co-sponsored by Ro Khanna of California. I posted a link to the bill a few posts above. Whether or not it gets anywhere before next April 15 is anybody's guess.

link to original post

Is it possible for a new bill to affect a tax year that is already half over? I had assumed that the earliest tax year that this could affect would be TY 2026Ö

Quote: camaplQuote: ThatDonGuyQuote: TomGDina Titus, legislator from Las Vegas, is trying to undo the new laws on gambling taxes in the obbb or whatever itís called. I think she should be able to get it done just because of how insane it is, but having this in the law just singed proves that sanity is not always a reason to make changes in our laws.

link to original post

The bill is co-sponsored by Ro Khanna of California. I posted a link to the bill a few posts above. Whether or not it gets anywhere before next April 15 is anybody's guess.

link to original post

Is it possible for a new bill to affect a tax year that is already half over? I had assumed that the earliest tax year that this could affect would be TY 2026Ö

link to original post

In theory, it is possible for a bill passed in early 2026 to affect the 2025 tax year. I see all sorts of warnings about this when I do my taxes with H&R Block.

I am under the impression that this is a strong reason that some people wait until the last minute to file.

Quote: SandybestdogA pro gambler (small business owner) making $75k a year is already taxed at like 40%. Meanwhile billionaires pay 20% capital gains rate.

I think that is what formed capitalism. To beat the system, just become a billionaire. It is as easy as that.

Quote: SandybestdogWow if thatís the case itís really bad. So someone who legitimately wins and claims their net profit is being hit extra now. What business literally makes you claim more profit than you actually had? A pro gambler (small business owner) making $75k a year is already taxed at like 40%. Meanwhile billionaires pay 20% capital gains rate.

link to original post

So much misinformation here. $75k taxable income at its highest level is 12%, I believe, and the capital gains rate is at ordinary income rates up to 39%, I believe.

tuttigym

Quote: DRichQuote: SandybestdogA pro gambler (small business owner) making $75k a year is already taxed at like 40%. Meanwhile billionaires pay 20% capital gains rate.

I think that is what formed capitalism. To beat the system, just become a billionaire. It is as easy as that.

link to original post

Iíll have to up my bets Öor start playing more than 24 hours a day!

Quote: tuttigymQuote: SandybestdogWow if thatís the case itís really bad. So someone who legitimately wins and claims their net profit is being hit extra now. What business literally makes you claim more profit than you actually had? A pro gambler (small business owner) making $75k a year is already taxed at like 40%. Meanwhile billionaires pay 20% capital gains rate.

link to original post

So much misinformation here. $75k taxable income at its highest level is 12%, I believe, and the capital gains rate is at ordinary income rates up to 39%, I believe.

tuttigym

it's not as simple as has been described above

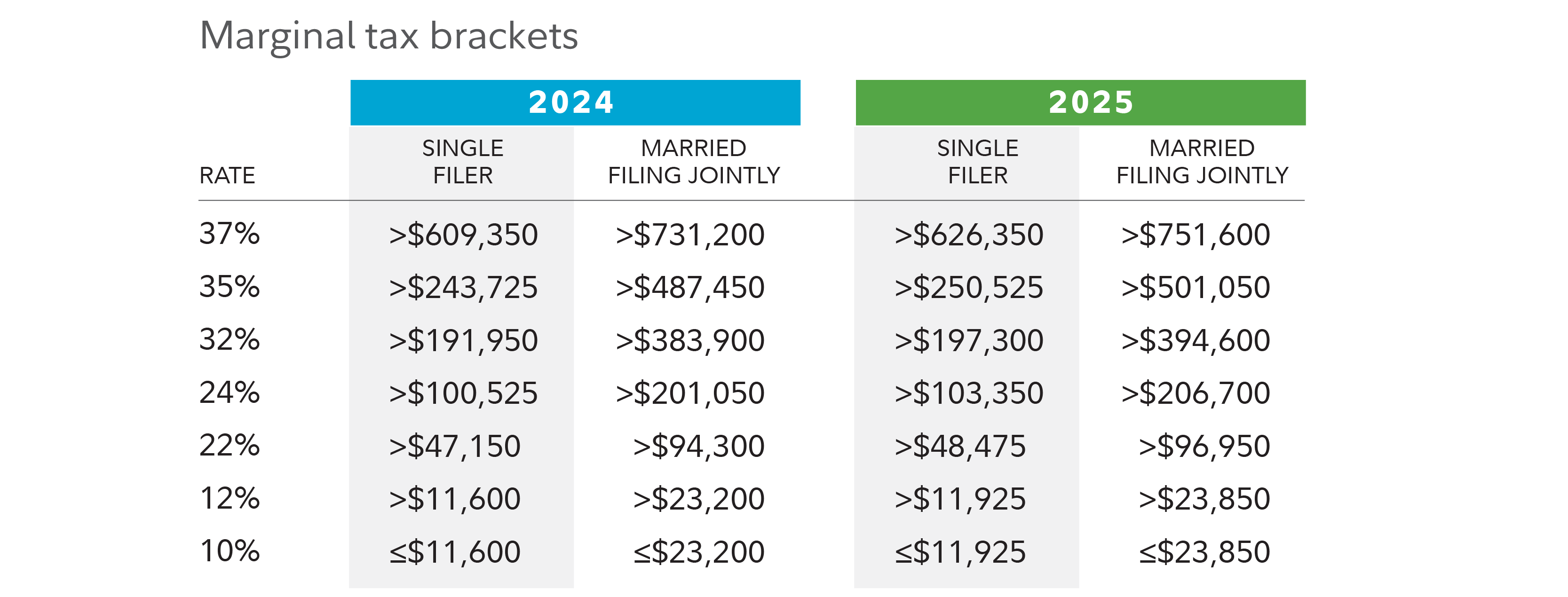

here is correct info about how $75K of ordinary income is taxed by the Feds - of course there may also be State taxes - followed by correct info on how capital gains are taxed:

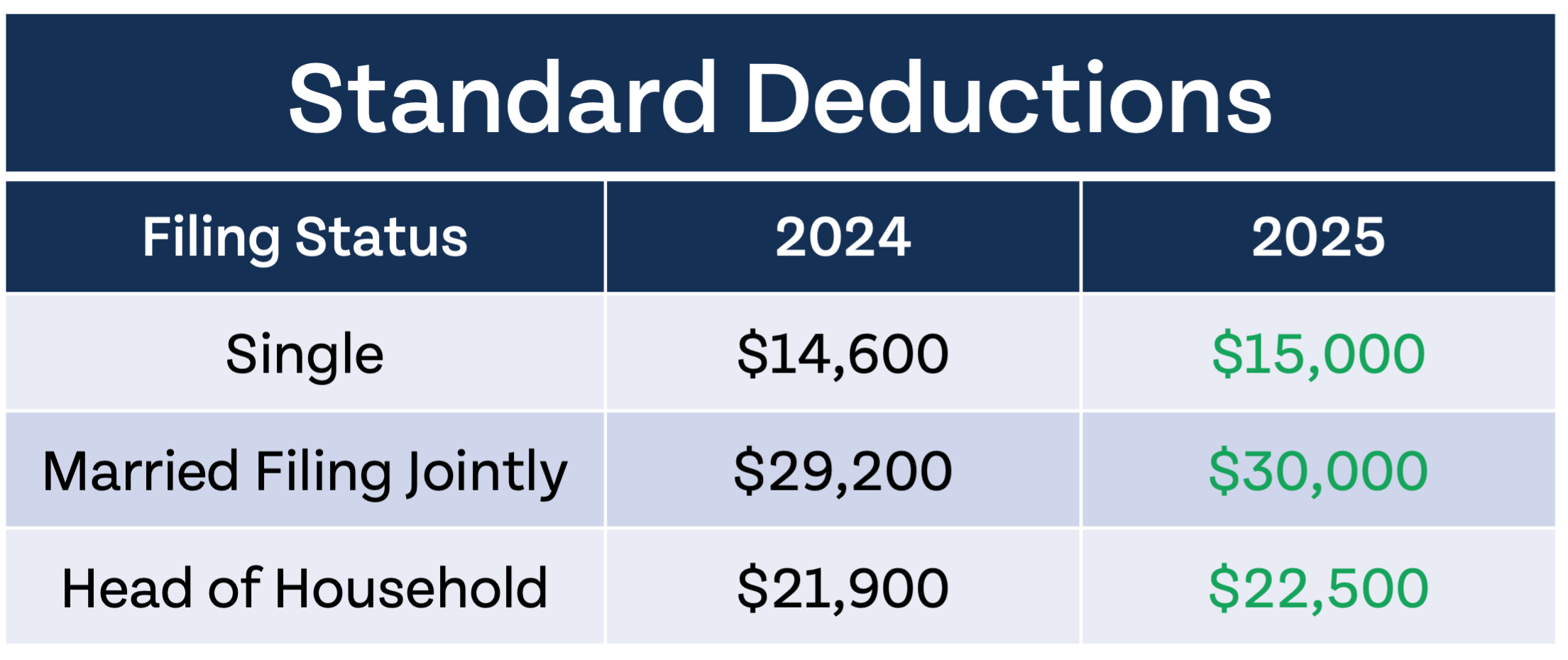

Edit - my OP was incorrect because it did not include the Standard Deduction - what follows should be correct

"Estimated 2025 federal income tax liability for a single filer with $75,000 income

If you're a single filer with an annual income of $75,000 -

Breakdown of calculations

Standard Deduction: The first step is to subtract the standard deduction from your gross income to determine your taxable income. For a single filer in 2025, the standard deduction is $15,750.

$75,000 (Gross Income) - $15,750 (Standard Deduction) = $59,250 (Taxable Income).

Tax Brackets: The U.S. has a progressive tax system, meaning different portions of your income are taxed at different rates based on your income bracket. Here's how your $59,250 taxable income would be taxed using the 2025 federal tax brackets for single filers:

10% Bracket: The first $11,925 of your taxable income is taxed at 10%.

$11,925 * 0.10 = $1,192.50

12% Bracket: The next portion, from $11,926 to $48,475, is taxed at 12%.

$48,475 - $11,925 = $36,550

$36,550 * 0.12 = $4,386

22% Bracket: The remaining portion, from $48,476 to $59,250, is taxed at 22%.

$59,250 - $48,475 = $10,775

$10,775 * 0.22 = $2,370.50

Total Federal Income Tax: Adding up the taxes from each bracket:

$1,192.50 + $4,386 + $2,370.50 = $7,949

this amounts to a tax of about 10.6% of an income of $75K for a single filer

.

Capital gains tax rates are determined by how long you've held the asset (short-term vs. long-term) and your overall taxable income.

1. Short-Term Capital Gains Tax:

Applies to assets held for one year or less.

Taxed as ordinary income at your regular income tax rates (10% to 37%).

2. Long-Term Capital Gains Tax:

Applies to assets held for more than one year.

Generally taxed at lower rates (0%, 15%, or 20%).

For the 2025 tax year, the income thresholds for these rates vary based on filing status. You can find the specific thresholds for single filers, married filing jointly, and head of household in the referenced documents.

Important Notes:

High-income earners may also be subject to a 3.8% Net Investment Income Tax.

Certain assets, like collectibles or qualified small business stock, may have different rates.

State capital gains tax rates may also apply.

In summary, the capital gains tax rate depends on the holding period of the asset and your income level, with long-term gains generally taxed at lower rates than short-term gains. "

I reuploaded with a format change in the last two columns and an error fix on the bottom line of Cum Tax which was a couple quarters.

6 and half hours later:

My new chart for April 2026.

Quote: ChumpChangeThese are the last year numbers I put into a chart. I'm building a new chart based on the numbers in the above post, but it's incomplete.

link to original post

The 2024 tax brackets are listed here, on page 109 of this document

my post was based on 2025 tax brackets - there have been some changes - see link

"2025 adjustments to 2024 tax brackets

The seven federal tax rates remain the same for 2025: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. The qualifying income for each 2025 tax bracket moves slightly higher compared to 2024."

the Standard Deduction for 2025 has increased by $400 for single filers and $800 for joint filers

the image shows the differences between 2024 and 2025

https://www.usbank.com/wealth-management/financial-perspectives/financial-planning/tax-brackets.html#:~:text=Some%20of%202025's%20tax%20changes,at%20the%20end%20of%202025.

.

.

If youíre a loser the new law doesnít really do much

If you have -100k in losses and 90k in wins, you can write off 90k and thus not owe any taxes, identical to the old law. If it was 90% of wins youíd end up owing $9k in taxes for losing $10k which would be preposterous.

Based on recent information, the standard deduction amounts for the 2025 tax year (when filing in early 2026) have been updated.

The revised 2025 standard deduction amounts are:

Single or Married Filing Separately: $15,750

Married Filing Jointly or Qualifying Widow(er): $31,500

Head of Household: $23,625

Additional Standard Deduction and Other Considerations:

Taxpayers who are 65 or older and/or blind may qualify for an additional standard deduction. For 2025, this is $2,000 for single filers or heads of household, and $1,600 per qualifying individual if married filing jointly or separately.

There is also a temporary $6,000 bonus deduction for qualifying adults aged 65 and older, which may be subject to phase-out based on income.

For individuals claimed as dependents, the standard deduction is limited to the greater of $1,350 or their earned income plus $450 (up to the basic standard deduction for their filing status).

It is recommended to consult official IRS resources or a tax professional for specific advice.

*****************************************

So I'll be counting $15,750 as the Standard Deduction on my chart for 2025. Next year I'll have to see about adding $2,000 and $6,000 of deductions onto my specific chart for being over 65 for part of the year. That could put me around $25K for a standard deduction.

https://www.filelater.com/resources/tax-strategies-for-professional-gamblers-2025-irs-rules/

https://www.irs.gov/publications/p505

Who Must Pay Estimated Tax

If you owed additional tax for 2024, you may have to pay estimated tax for 2025.

You can use the following general rule as a guide during the year to see if you will have enough withholding, or should increase your withholding or make estimated tax payments.

General Rule

In most cases, you must pay estimated tax for 2025 if both of the following apply.

You expect to owe at least $1,000 in tax for 2025 after subtracting your withholding and tax credits.

You expect your withholding and tax credits to be less than the smaller of:

90% of the tax to be shown on your 2025 tax return, or

100% of the tax shown on your 2024 tax return. Your 2024 tax return must cover all 12 months.

Note. The percentages in (2a) or (2b) just listed may be different if you have income from farming or fishing or are a higher income taxpayer. See Special Rules, later.

.The result from using the general rule above suggests that you wonít have enough withholding, complete the 2025 Estimated Tax Worksheet for a more accurate calculation.

.

Figure 2-A takes you through the general rule. You may find this helpful in determining if you must pay estimated tax.

All your income will be subject to income tax withholding, you probably donít need to pay estimated tax.

*********************************************

So once I hit $25,750 I'll have $10K over the standard deduction and owe $1,000 in taxes on it.

I'll see what I can do about winning a table max prize of $75K and pay $8K tax on that.

.

It seems that no-one knows who drafted that part of the bill, or who requested or sponsored it.

24% Federal plus 15% self employment plus 8% state = 48%Quote: tuttigymQuote: SandybestdogWow if thatís the case itís really bad. So someone who legitimately wins and claims their net profit is being hit extra now. What business literally makes you claim more profit than you actually had? A pro gambler (small business owner) making $75k a year is already taxed at like 40%. Meanwhile billionaires pay 20% capital gains rate.

link to original post

So much misinformation here. $75k taxable income at its highest level is 12%, I believe, and the capital gains rate is at ordinary income rates up to 39%, I believe.

tuttigym

link to original post

Capital gains rates are 20%. No state taxes(theyíre rich and established residency elsewhere) I mean this isnít exactly disputed. Why are workers paying double the tax rate of billionaires? I donít have a problem with billionaires, but I shouldnít have to pay double the tax rate.

When I put my info into the tax software I put all my w2gís first. It was a significant amount. It said I owed X. When I started putting in my miles and airfare and losses etc each dollar in expense reduced the tax by 45 cents. This was just federal. Why do we tax income so much but let investments slide?

Gamblers caught in the politics it looks like.

https://apnews.com/article/gambling-tax-trump-bill-republicans-6de8c89b9c1c775a38ea819facbcc0e8

Quote: camaplQuote: ThatDonGuyQuote: TomGDina Titus, legislator from Las Vegas, is trying to undo the new laws on gambling taxes in the obbb or whatever itís called. I think she should be able to get it done just because of how insane it is, but having this in the law just singed proves that sanity is not always a reason to make changes in our laws.

link to original post

The bill is co-sponsored by Ro Khanna of California. I posted a link to the bill a few posts above. Whether or not it gets anywhere before next April 15 is anybody's guess.

link to original post

Is it possible for a new bill to affect a tax year that is already half over? I had assumed that the earliest tax year that this could affect would be TY 2026Ö

link to original post

Under the new tax law, starting in 2026, individuals can only deduct 90% of their gambling losses up to the amount of their winnings. Thatís a change from the previous rule, which allowed gamblers to deduct 100% of their losses, up to the amount they won.

Quote: TheguyoverthereThis isnít nearly as bad as I thought at first. It just really requires you to have all your losses documented, otherwise anyone can just input (gambling wins / 0.9) in the gambling loss box and bingo youíre good to go. And most recreational gamblers will have at least this 10% disparity in wins and losses as 10% is a pretty typical hold % for slot machines. And at the end of the year if you find yourself not losing enough you have a fun freeroll to go to Vegas and gamble, knowing if you lose, well, you were gonna give 30% of that to taxes anyway! ;)

link to original post

I am guessing that most "recreational" gamblers like myself, do NOT even report their wins to the feds since casinos do not provide W2G's on table game wins.

tuttigym