https://www.casino.org/vitalvegas/irs-finally-confirms-jackpot-reporting-threshold-will-increase-to-2000/

Refresh my memory...

Why did Congress choose to raise it a measly $800?

https://wizardofvegas.com/common/trans.gif

Quote: 100xOdds$2k:

https://www.casino.org/vitalvegas/irs-finally-confirms-jackpot-reporting-threshold-will-increase-to-2000/

Refresh my memory...

Why did Congress choose to raise it a measly $800?

https://wizardofvegas.com/common/trans.gif

link to original post

Because congressmen like playing $2 DDB?

They really should have made it $2001.

Quote: AutomaticMonkeyQuote: 100xOdds$2k:

https://www.casino.org/vitalvegas/irs-finally-confirms-jackpot-reporting-threshold-will-increase-to-2000/

Refresh my memory...

Why did Congress choose to raise it a measly $800?

https://wizardofvegas.com/common/trans.gif

link to original post

Because congressmen like playing $2 DDB?

They really should have made it $2001.

link to original post

i agree $2001 threshold makes playing vp more convenient.

but At least now playing $2 db/ddb/tdb, getting plain quad aces ($1600) no longer gets a tax form.

You can also now bet bigger on e-Games like e-Craps and e-Bacc without fear of a w2-g.

On the other hand, my casino runs a special once a year where on that night (6pm-11:59pm), if you get a handpay, you get an extra $500 freeplay.

e-Machines excluded

Quote: ChumpChangeTold you the IRS wasn't clear. Now they are? Hahahaha.

link to original post

I am shocked they clarified it NOW instead of 1st quarter 2026 with how dysfunctional the IRS currently is.

I'll update my strategies for VBJ at $2,000 just in case. I have a current maximum bet of $145 that pays out $1,160 for a single split and two double downs plus the bets back. I could tack on $100 to that bet and make it $245 that pays out $1,960 for the same.

Bubble craps could raise their box number bets to $650 minus the vig for the 4 & 10 from the current $400. The Pass Line with double odds could be raised from $195 + $390 (which would be a hand pay of $1,560 on a 4 or 10), to $245 + $490 which would pay $1,960 on a 4 or 10. All the other bet limits could be raised substantially too. I doubt the slot techs know how to set the limits, they would need some help.

Also note that this is a draft document. Unless the casinos get "the real thing," they will probably keep the reporting value at $1200.

Finally, the Code of Federal Regulations still says $1200.

And the $5 JoB machines that pay 239 coins for a SF.Quote: rxwineRemember the $1199 VP machines? That's how they addressed the 1200 limit.

link to original post

Quote: ThatDonGuyLVRJ reported today (on the front page, no less) that the IRS has confirmed that the $2000 reporting threshhold is correct, starting January 1

link to original post

Now the question is why did Congress decide to raise it at all?

Quote: 100xOddsQuote: ThatDonGuyLVRJ reported today (on the front page, no less) that the IRS has confirmed that the $2000 reporting threshhold is correct, starting January 1

link to original post

Now the question is why did Congress decide to raise it at all?

link to original post

Congress didn't - well, not directly. Apparently, it is being done in conjunction with the requirement in the One Big Beautiful Bill that the threshhold for reporting any "payment in the course of such trade or business to another person, of rent, salaries, wages, premiums, annuities, compensations, remunerations, emoluments, or other fixed or determinable gains, profits, and income" be increased from $600 to $2000 and be increased annually for inflation.

Quote: ThatDonGuyQuote: 100xOddsQuote: ThatDonGuyLVRJ reported today (on the front page, no less) that the IRS has confirmed that the $2000 reporting threshhold is correct, starting January 1

link to original post

Now the question is why did Congress decide to raise it at all?

link to original post

and be increased annually for inflation.

link to original post

so in 2027, probably at least $2001 so getting aces with kicker at $1 ddb will be safe?

Quote: 100xOddsQuote: ThatDonGuyQuote: 100xOddsQuote: ThatDonGuyLVRJ reported today (on the front page, no less) that the IRS has confirmed that the $2000 reporting threshhold is correct, starting January 1

link to original post

Now the question is why did Congress decide to raise it at all?

link to original post

and be increased annually for inflation.

link to original post

so in 2027, probably at least $2001 so getting aces with kicker at $1 ddb will be safe?

link to original post

I would not expect the lockup or reporting threshold to be adjusted for changes less than $100.

What casinos are confirming the new $2k w2-g threshold?

Quote: 100xOddsWell, 2 more days till Jan 1.

What casinos are confirming the new $2k w2-g threshold?

link to original post

Personally, I expect to play bar slots in Montana, and just not worry about it. ;)

If they wanted to change the maximum bets on Bubble Craps, the people they lease the machine from or have service the machine would have to run code through it. The casino's local slot techs cannot do that. They'll be getting rid of the machine in a couple weeks anyway because of poor and difficult maintenance (after 4 years). New individual Bubble Craps will take the place of the community Bubble Craps. So maybe those will have higher bet limits for $2K.

I had to get a cash refund for the amount I had on the machine when the dice camera broke and stopped the machine. There was still a bet on the pass line. I got all my money back, but the slot attendant said I should check back at the cage and see if I can claim a win for the pass line bet if they ever got the machine running again and the bet won. I kept telling her I was cashed out and wasn't playing that bet anymore, but she said they would open an account at the cage for me for those few dollars if it won. Just check back within 180 days.

The casino has been moving slot machines around a lot in the past year, probably due to new ownership of the casino. It wouldn't surprise me if banks of machines were taken off the floor and readjusted by their servicer and brought back later.

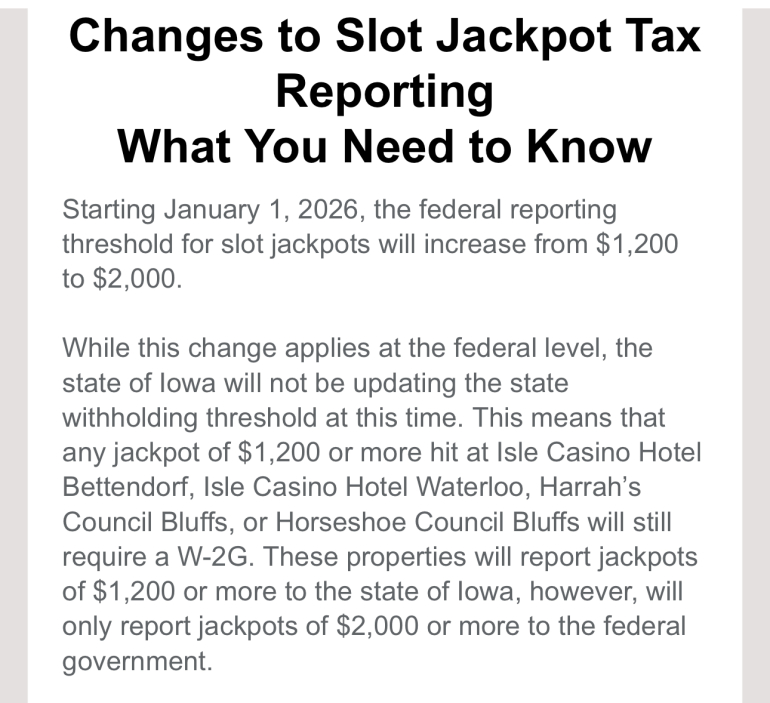

Quote: HunterhillCasinos in Ohio have mailed out letters saying that the state jackpot amount of 1200+ will not change but that the federal will be 2k.

link to original post

That sounds like it's going to gum things up

So win $1800, get a tax form for state taxes but not a W2G because you didn't go over $2000?

Quote: darkozQuote: HunterhillCasinos in Ohio have mailed out letters saying that the state jackpot amount of 1200+ will not change but that the federal will be 2k.

link to original post

That sounds like it's going to gum things up

So win $1800, get a tax form for state taxes but not a W2G because you didn't go over $2000?

link to original post

It will be interesting to see how they deal with it and if other states follow suit

After a few weeks of work, most of the slot machines will be changed to lock up at $2,000. There are some old ones that are hard-coded, so they will still get the handpays of $1,200 to $1,999.99 indefinitely.

If someone wins a jackpot less than $2,000 shortly before midnight and they don't want a W-2G, I'll just let it sit in the queue until 12:01 AM when it magically becomes not reportable income.

This is in Black Hawk, Colorado.

Quote: darkozQuote: HunterhillCasinos in Ohio have mailed out letters saying that the state jackpot amount of 1200+ will not change but that the federal will be 2k.

link to original post

That sounds like it's going to gum things up

So win $1800, get a tax form for state taxes but not a W2G because you didn't go over $2000?

link to original post

Sounds like Ohio doesnít trust you to be honest and report that $1800 win while the Federal government does trust you.

Agree that it is idiotic that State tax rules just donít mimic Federal rules.

I just see slot machines vanishing from casinos over the next two to three years, and table games will have to pick up the slack or the casinos will close.

Then some other proposal comes out that says casinos need bank statements for buy-ins of $500 or more.

Quote: SOOPOOQuote: darkozQuote: HunterhillCasinos in Ohio have mailed out letters saying that the state jackpot amount of 1200+ will not change but that the federal will be 2k.

link to original post

That sounds like it's going to gum things up

So win $1800, get a tax form for state taxes but not a W2G because you didn't go over $2000?

link to original post

Sounds like Ohio doesnít trust you to be honest and report that $1800 win while the Federal government does trust you.

Agree that it is idiotic that State tax rules just donít mimic Federal rules.

link to original post

Some states including Ohio automatically withhold state and/ or city taxes.

I stand corrected.

Google AI wrote:

The federal tax reporting threshold for certain types of gambling winnings is increasing, but this change does not affect most lottery winnings, which are typically reported at a higher or different threshold determined by state law. The current $600 threshold you mention is the general minimum for certain miscellaneous income reporting (Form 1099-MISC).

Key Changes to Gambling Tax Thresholds (Effective 2026 Tax Year)

A new federal law, the "One Big Beautiful Bill Act," is raising certain reporting thresholds to $2,000, effective for payments made after December 31, 2025 (for the 2026 tax year).

General Reporting Threshold: The general threshold for miscellaneous income reported on Form 1099-MISC (which previously included some types of gambling wins when the payout was 300 times the wager) is increasing from $600 to $2,000.

Slot Machines: The reporting threshold for slot machine jackpots is increasing from $1,200 to $2,000. This amount has not been updated since 1977.

Other Games: The thresholds for bingo and keno are also consolidating to a $2,000 threshold.

Lottery Winnings Are Different

The reporting and withholding requirements for lottery prizes are generally separate from these changes and are determined by both federal and state laws:

Federal Requirements: The federal threshold for issuing a Form W-2G for lottery winnings is currently more than $5,000, with federal tax withholding generally required at that point.

State Requirements: Individual states set their own reporting and withholding thresholds. For example:

New York requires reporting and withholding on single payments of $1,000 or more.

Florida requires prizes of $600 or more to be claimed at a district office, with varying tax rules.

Important Note: Regardless of whether you receive a tax form (W-2G or 1099), all gambling winnings are considered taxable income and must be reported on your federal income tax return.

******************************

See, if they raised this to $6,500, I could put $5 down on the fire bet with no worries. But at least I can put down $1 now.

Maybe I can catch some secondary table jackpots on other games from the $1 antes for under $2K too.

If they raised it to $6,500 and there was 3.1% inflation in 2026, the threshold would go up by $200 to $6,700 for 2027.

Quote: DieterQuote: 100xOddsWell, 2 more days till Jan 1.

What casinos are confirming the new $2k w2-g threshold?

link to original post

Personally, I expect to play bar slots in Montana, and just not worry about it. ;)

link to original post

Does Montana still have the $800 cap on jackpots?

Quote: DRichQuote: DieterQuote: 100xOddsWell, 2 more days till Jan 1.

What casinos are confirming the new $2k w2-g threshold?

link to original post

Personally, I expect to play bar slots in Montana, and just not worry about it. ;)

link to original post

Does Montana still have the $800 cap on jackpots?

link to original post

All the machines I just played stated a $2 / $800 maximum.

My understanding is that tribal properties have different limitations than the alcohol licensed gaming.

My local casino has on the slot screen saying new w2-g is $2k.

and Caesars sent email saying $2k.

So it looks like the move to $2k is happening

Iowa not missing out on mandatory 3.8% state tax withholding. This is from local Caesars joint.

Right now, the Iowa state income tax rate applied to sports betting winnings is 6.75%. But in 2025, the state income tax rate had it reduced to 3.8%.

And, starting in 2026, there are changes to the way taxes are withheld from winnings. For winnings which are more than $5,000, and are at least 300 times larger than the wager, income tax will be withheld in circumstances when federal income tax is withheld from those winnings. Winnings are taxed federally at a rate of 24%.

https://www.ktiv.com/2025/12/30/new-iowa-legislation-will-change-tax-rates-money-won-sports-gambling/

This seems to apply to sports betting. It's similar to Class II slots though, maybe it will apply to them too.

*****************************

In New York State we get Form IT-2102-G for use on our annual tax Form IT-201. Maybe other states have different numbers for their forms. It's too soon for any information about what states are doing for the next tax year as they are gearing up for collecting the information about 2025 tax returns. We may not know unless there is a blow up in the media about what is happening at the state level or letters like in the post above surface.

I'm looking at the New York Gambling & Betting Winnings Tax Calculator . Not sure if I got it right, but if I win $125,000 gambling, that win should be included in the Total Annual Taxable Income side of the calculator too. So if I had no other income but a $125K win, I'd be taxed @ 6.33% on $125,000, not $250,000 even though I included $125,000 in the first box as well as the 2nd box. And it doesn't seem to be graduated like the Federal Tax. They just zeroed in on my Total Annual Taxable Income and threw a blanket rate on it, and applied it to my gambling winnings to figure out how much I'd be taxed on my winning income.

https://www.nysafebets.com/betting-calculators/tax-calculator#:~:text=Gambling%20winnings%20have%20a%2024%25,higher%20your%20state%20tax%20banding.

This site also mentions:

The payor (i.e. the sportsbook, casino, lottery operator etc.) is required to complete a specific form. This W-2 G form outlines the amount won and the tax value, if any, that was taken.

The bettor will also receive a W-2 G form when payouts during the previous calendar year exceed certain thresholds as applied by the IRS. These are:

$5,000 or more from playing poker (but reduced by the buy-in amount).

$1,200 or more from slots or bingo (not reduced by wager amounts).

$600 or more, or a win of 300x the wager amount, from sports betting or any pari-mutuel event such as horse racing.

$600 or more from any daily fantasy sports competitions.

Remember that those levels are cumulative ones per year. So, if you win six bets of $100, you reach the threshold. You'll also need to report non-cash prizes such as a television, a car, or a vacation.

**********************************

I'm going to have to cross off horse racing as a betting pastime until those thresholds increase dramatically. I won on one ticket but it was only for a few dollars, nothing to worry about.

**********************************

So next year if I have 25 session wins totaling $1,750, and 35 session losses totaling $2,000; I can count $1,800 in losses and that covers my $1,750 in wins and I'll owe tax on $0. I landed outside of the 10% phantom income zone.

**********************************

Google AI wrote:

Reporting Threshold Details

The new $2,000 threshold applies to various types of winnings that require a Form W-2G:

Slot machines

Sports wagering (subject to an additional 300-to-1 odds rule for certain wins)

Lotteries, horse races, and other casino games

Starting in 2027, this $2,000 threshold will be adjusted annually for inflation without needing new congressional action.

Impact and Current Status

The changes have faced criticism from the gaming industry and some lawmakers, with the American Gaming Association calling the loss deduction cap "uniquely penalizing". A bill known as the "FAIR BET Act" has been introduced in the House to restore the 100% loss deductibility, but its future is uncertain.

For your personal tax strategy in 2026, it is vital to:

Keep excellent, detailed records of all wins and losses, including dates, locations, types of games, and wager amounts.

Consult a qualified tax professional for personalized advice on how these changes and your state's specific laws affect your situation.

************************************************

Gambling Industry Already Feeling Squeeze of Impending Tax Deduction Change

https://finance.yahoo.com/news/gambling-industry-already-feeling-squeeze-215100117.html

Erik Seidel, member of the Poker Hall of Fame, has won 10 WSOP bracelets and cashed in 151 WSOP events over his decades-long tenure, including seven this year. Seidel told the Nevada Independent, ďNext year, I am kind of forced into retirement. Everyone who Iíve spoken to

plans on either cutting back or stopping. If you look at the top performers, most of them are from the U.S., and thatís just going to go away.Ē

Quote: billryanI wonder how this will affect people's jobs in the casino?

link to original post

This is a VERY good question and I'm surprised no one has responded to your VERY good question. 🤔 I guess that Casino Workers will be making a lot less money as there won't be nearly as many jackpots to be getting tipped from now that the jackpot threshold has been raised. 💡🤔 Casino Workers most likely will be getting much more annoyed by the new upped jackpot limit, similarly if all Casinos decide to go to self pay jackpot where all guests get paid right to their Player's Club card instantly without having to wait for Casino Staff to have them sign paperwork and give them the cash hand to hand or have Casino Staff make them a check.

A Woman hit $80,000 on a Wheel Of Fortune machine and a crowd came rushing to her to see her big win, even knocking a nearby Player out of his seat who was just innocently playing and minding his own business. She thought,"He just got knocked out of his seat and he was just merely playing near me, what would this crowd do to ME, the actual WINNER? 😱😳 She asked Casino Staff Members to escort her to the back office and pay her with a check in private and they did.

So, Casino Staff will definitely be losing money with all self pay jackpots and the threshold jackpot limit being raised.

If a casino sees slot attendants as yet another expense to be minimized, this could result in longer waits for service.

I think that with the threshold increasing, the usual toke size may also increase.

Top prize is $1999 but it hits quite often, the music should be obvious, and just a general late 20th century theme.

Google AI wrote:

Did Prince sing in A Love Bizarre?

While Prince was heavily involved in the album, this is is the only track to be credited as "produced, written and arranged by Sheila E. and Prince" - in fact, while Sheila E. sings on the track and plays percussion, all other vocals and instruments (other than saxophone by Eddie M.) are played by Prince.

If you want any part of Prince, I suppose you'll have to go through his estate.

Quote: AutomaticMonkeyThis could be an opportunity to get creative. How about a 1999 themed slot machine, featuring Prince? Call it a fruit machine!

Top prize is $1999 but it hits quite often, the music should be obvious, and just a general late 20th century theme.

link to original post

In the early 2000's I was contracted by a group to create slot machines to celebrate famous black musicians and groups. We ended up doing two or three. There was a big event to unveil the machines and celebrate the contributions of black musicians. The Little Richard machine we did was pretty good because his music seemed very appropriate for slot machine customers. The company that contracted me didn't get the funding they were expecting and the project was shelved.

Quote: DRichQuote: AutomaticMonkeyThis could be an opportunity to get creative. How about a 1999 themed slot machine, featuring Prince? Call it a fruit machine!

Top prize is $1999 but it hits quite often, the music should be obvious, and just a general late 20th century theme.

link to original post

In the early 2000's I was contracted by a group to create slot machines to celebrate famous black musicians and groups. We ended up doing two or three. There was a big event to unveil the machines and celebrate the contributions of black musicians. The Little Richard machine we did was pretty good because his music seemed very appropriate for slot machine customers. The company that contracted me didn't get the funding they were expecting and the project was shelved.

link to original post

What, no Sammy? What could be more Vegas! I'd call the game "E-O-Eleven" and that would be the music, and it would have a craps and Ocean's 11 theme.

Or they could do a bad taste Jimi Hendrix machine! When the number of symbols adds up to 27, you get a bonus game- the belt goes around his arm, the needle goes in, and you watch how "high" the winnings go before Jimi collapses and stops breathing, all the while playing "Purple Haze."

I think slot and other game designers have been missing out on making some games that are really socially transgressive, because young people love bad taste humor, as an escape from the sanctimony that gets put upon them (more so in the present generation than ever). If you want to keep a bunch of 20s bros entertained for hours, give them something rude and offensive to play with! It's an adults-only environment in a casino so there are a lot of places you can go, and I am surprised there aren't already slots with cursing, sensitive topics, and outright porn, in parts of casinos not visible from any place a minor can legally be.

Quote: AutomaticMonkey

Or they could do a bad taste Jimi Hendrix machine! When the number of symbols adds up to 27, you get a bonus game- the belt goes around his arm, the needle goes in, and you watch how "high" the winnings go before Jimi collapses and stops breathing, all the while playing "Purple Haze."

link to original post

From what I've heard, I think Experience Hendrix LLC would not approve such an offering.

Quote: DieterQuote: AutomaticMonkey

Or they could do a bad taste Jimi Hendrix machine! When the number of symbols adds up to 27, you get a bonus game- the belt goes around his arm, the needle goes in, and you watch how "high" the winnings go before Jimi collapses and stops breathing, all the while playing "Purple Haze."

link to original post

From what I've heard, I think Experience Hendrix LLC would not approve such an offering.

link to original post

But if 6 was 9, would they mind? (I don't know, Gary Glitter might!)

Weren't there topless dealers at some time in the US? It just seems to me the adults-only character of casinos is being underexploited. Is there any rule against a casino also being a consumption lounge? God help Vegas if I ever buy a casino. It'll look like Animal House mixed with The Purge, and with great blackjack rules.

Quote: AutomaticMonkeyQuote: DieterQuote: AutomaticMonkey

Or they could do a bad taste Jimi Hendrix machine! When the number of symbols adds up to 27, you get a bonus game- the belt goes around his arm, the needle goes in, and you watch how "high" the winnings go before Jimi collapses and stops breathing, all the while playing "Purple Haze."

link to original post

From what I've heard, I think Experience Hendrix LLC would not approve such an offering.

link to original post

But if 6 was 9, would they mind? (I don't know, Gary Glitter might!)

Weren't there topless dealers at some time in the US? It just seems to me the adults-only character of casinos is being underexploited. Is there any rule against a casino also being a consumption lounge? God help Vegas if I ever buy a casino. It'll look like Animal House mixed with The Purge, and with great blackjack rules.

link to original post

The rules on marijuana, alcohol, and gambling vary by jurisdiction, but many gambling venues only allow alcohol. Out here in the sticks, "No Smoking, No vapes, No Pot" signs on the doors to the casino are surprisingly common.

From an operations standpoint, I would worry about partakers getting lost in the experience and slowing down the game.

Quote: AutomaticMonkeyQuote: DRichQuote: AutomaticMonkeyThis could be an opportunity to get creative. How about a 1999 themed slot machine, featuring Prince? Call it a fruit machine!

Top prize is $1999 but it hits quite often, the music should be obvious, and just a general late 20th century theme.

link to original post

In the early 2000's I was contracted by a group to create slot machines to celebrate famous black musicians and groups. We ended up doing two or three. There was a big event to unveil the machines and celebrate the contributions of black musicians. The Little Richard machine we did was pretty good because his music seemed very appropriate for slot machine customers. The company that contracted me didn't get the funding they were expecting and the project was shelved.

link to original post

What, no Sammy? What could be more Vegas! I'd call the game "E-O-Eleven" and that would be the music, and it would have a craps and Ocean's 11 theme.

Or they could do a bad taste Jimi Hendrix machine! When the number of symbols adds up to 27, you get a bonus game- the belt goes around his arm, the needle goes in, and you watch how "high" the winnings go before Jimi collapses and stops breathing, all the while playing "Purple Haze." <snip>

link to original post

How about a James Brown Slot Machine? They could use the opening one second of I Feel Good*, where he sings "Ow!", and play it every time a spin loses 😆

Dog Hand

*The song title is in fact I Got You (I Feel Good).

Quote: DogHandQuote: AutomaticMonkeyQuote: DRichQuote: AutomaticMonkeyThis could be an opportunity to get creative. How about a 1999 themed slot machine, featuring Prince? Call it a fruit machine!

Top prize is $1999 but it hits quite often, the music should be obvious, and just a general late 20th century theme.

link to original post

In the early 2000's I was contracted by a group to create slot machines to celebrate famous black musicians and groups. We ended up doing two or three. There was a big event to unveil the machines and celebrate the contributions of black musicians. The Little Richard machine we did was pretty good because his music seemed very appropriate for slot machine customers. The company that contracted me didn't get the funding they were expecting and the project was shelved.

link to original post

What, no Sammy? What could be more Vegas! I'd call the game "E-O-Eleven" and that would be the music, and it would have a craps and Ocean's 11 theme.

Or they could do a bad taste Jimi Hendrix machine! When the number of symbols adds up to 27, you get a bonus game- the belt goes around his arm, the needle goes in, and you watch how "high" the winnings go before Jimi collapses and stops breathing, all the while playing "Purple Haze." <snip>

link to original post

How about a James Brown Slot Machine? They could use the opening one second of I Feel Good*, where he sings "Ow!", and play it every time a spin loses 😆

Dog Hand

*The song title is in fact I Got You (I Feel Good).

link to original post

James singing,"Ow!" Everytime a losing spin appears is a REALLY good idea! 😀💡 Willy Wonka slot had a feature where Willy Wonka yells,"You get nothing! You lose! Good day!" When a bonus gave literally nothing! 🤣🤭