But I hit a couple hand pays last year, and it ticked me off that I didnít have my losses tracked to help with the taxes. So this year I want to track my play, and I want to use my phone to help. It would be simple to just open up a note page, but Iím curious if there is an android app that people use.

Thanks.

No, I do not write down the machine ID # nor the amount won or lost from each machine: too much of a :PITA, actually.

Instead I write down the amount I start each session at a casino with, and then when I am done I write down how much I walk out with; I do the math and write down the amount I won or lost for that session; I also do it for craps play, and have totals for both slots and craps.

I do it for every session.

I usually play at two casinos and I do it for each.

At the end of the trip I tally everything up and write down the daily win or loss amount for each casino.

Been doing if for a couple decades; down $66K life time, which is not what I'd prefer but it's the price I pay for entertainment.

Quote: MrVI keep a record but it isn't as detailed as the IRS would like for machine play.

No, I do not write down the machine ID # nor the amount won or lost from each machinelink to original post

This is the first time I hear this level of detail is required.

My understanding was that tracking the total for the location (casino) and type of game (slots or craps) per day is sufficient - essentially what you are doing.

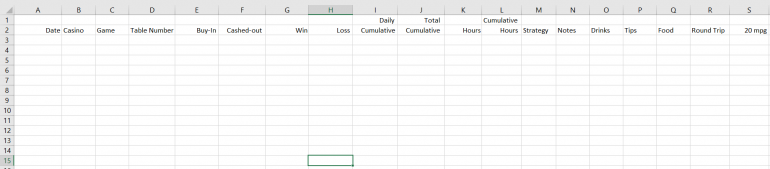

I'm essentially doing the same thing - and tracking it in a simple excel spread sheet. You can even open the spreadsheet on your phone, so it's not really hard to update.

The fun thing is - if you track this in Excel, you can even do additional stuff with pivot tables - maybe you want to know if you do better on certain week days. Or if you also track the number of hour per session you can even calculate your hourly win/loss. And it's easy to see results of time per month for instance.

Quote: MukkeQuote: MrVI keep a record but it isn't as detailed as the IRS would like for machine play.

No, I do not write down the machine ID # nor the amount won or lost from each machinelink to original post

This is the first time I hear this level of detail is required.

My understanding was that tracking the total for the location (casino) and type of game (slots or craps) per day is sufficient - essentially what you are doing.

I'm essentially doing the same thing - and tracking it in a simple excel spread sheet. You can even open the spreadsheet on your phone, so it's not really hard to update.

The fun thing is - if you track this in Excel, you can even do additional stuff with pivot tables - maybe you want to know if you do better on certain week days. Or if you also track the number of hour per session you can even calculate your hourly win/loss. And it's easy to see results of time per month for instance.

link to original post

Thatís what I was thinking of doing if there was no app (the app would probably use an Excel shell anyhow), I have Office for Android but only used it for documents, I never needed to learn how to set up spreadsheets. They canít be that hard though.

https://gmail.googleblog.com/2008/03/2-hidden-ways-to-get-more-from-your.html

There's Grambling Tracker as well but it has less features.

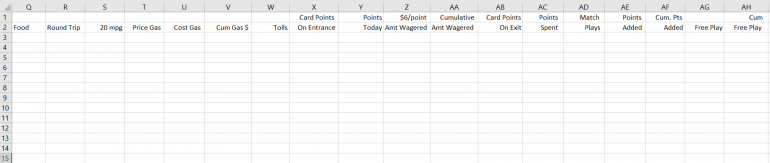

Keeping totals for each column can keep totals by game and adding those gives the grand total, so far, for the year.

Sometimes one needs to cater for foreign holidays, so I would use something like =100/1.311 to show $100 and convert it to £s.

FYI not everyone is proficient at spreadsheets, some people want it to be it to be all set up and in a cookie cutter Format. That's where an app comes in... That's why apps are wildly successful.Quote: charliepatrickI used to keep a spreadsheet with a row for each daily visit to each place. Across the top I listed the games (or types of games if novelty, e.g. "BJ variant") and added notes to anything interesting, so the columns might be BJ, Craps, etc.

Keeping totals for each column can keep totals by game and adding those gives the grand total, so far, for the year.

Sometimes one needs to cater for foreign holidays, so I would use something like =100/1.311 to show $100 and convert it to £s.

link to original post

I would have separate entries for different games. Like MS Stud gets a line across, BJ gets another, Baccarat gets another. Slots are so TITO dependent, I would just add up the total buy-ins, and figure out my win/loss when I took it to the cashier. I may not bother with machine or table numbers on metal plates unless it's easy to do.

If I visit multiple casinos in one day, they each get a line with a list of games played on the same line & on the lines below.

The spacing of the columns in the photos above are not accurate. I just set them to minimum column width for the photos.

It hasn't even crossed my mind that I would get W-2G forms, so I should have a couple columns for those, one would be a cumulative total. I'm gonna put them right after the Total Cumulative $ column. If I was a player on a high limit slot getting hand pays every so often, I'd have a separate excel sheet for those.

tuttigym

Quote: tuttigymWhen I was in sales, I would keep a log of all my sales and write the mileage down for tax purposes. The "log" was single spaced, handwritten, and covered about 15 pages. One year I was audited and brought the "log" with me for the IRS agent to review. She opened the "log," took a very quick glance, noted dates, names, mileage, closed the book, handed it back to me, and basically said "your good." She then accepted my tally on my Sched. D and completed the audit with no further questions. I was never audited again. So basically, what I am saying is that an auditor is NOT going to review each entry and calculate all the entries. It is too time consuming. They are very "busy" people.

tuttigym

link to original post

The only thing you canít say is, ďI donít have one.Ē

Quote: DRichI also just used the notepad on my phone by day and casino. Just entered the win/loss for each casino each day. I would then email it to myself so no one could claim it was made up while doing my taxes.

link to original post

Quote: AxelWolfEasy Bankroll would be more than sufficient for you based on what you said.

There's Grambling Tracker as well but it has less features.

link to original post

I think Iíll do one of these options. We donít play often enough to learn new stuff, this is just in case I generate a 1099g so I donít have to suck it up and pay.

Edit: Axel, Easy Bankroll is exactly what I was looking for, thanks for the guidance!

Thanks.

I went through a TCMP audit and a two-day business and personal audit with two auditors at my accountant's office with all business and personal records. That year I had $2.9-million in W2Gs and the auditors ignored everything related to gambling.

Everything.

why did they ignore everything gambling related?!Quote: AlanMendelsonHas anyone here ever had their gambling audited by the IRS?

I went through a TCMP audit and a two-day business and personal audit with two auditors at my accountant's office with all business and personal records. That year I had $2.9-million in W2Gs and the auditors ignored everything related to gambling.

Everything.

link to original post

Quote: 100xOddswhy did they ignore everything gambling related?!Quote: AlanMendelsonHas anyone here ever had their gambling audited by the IRS?

I went through a TCMP audit and a two-day business and personal audit with two auditors at my accountant's office with all business and personal records. That year I had $2.9-million in W2Gs and the auditors ignored everything related to gambling.

Everything.

link to original post

link to original post

I have no idea. But when I mentioned this to a high ranking IRS official during a news interview I was told that unless someone wins a mega jackpot such as a lottery they believe everyone is a net loser.

So... has anyone been audited for gambling?

whoa.. what?!Quote: DRichI also just used the notepad on my phone by day and casino. Just entered the win/loss for each casino each day. I would then email it to myself so no one could claim it was made up while doing my taxes.

link to original post

i've been doing in excel spreadsheet on my phone:

date-casino-the machine and ID # - amount started with - amount ended with

you mean all i need for IRS audits is:

date - casino - amount started - amount ended?

yeah, emailing the spreadsheet to myself sounds like something you should do so that the IRS cant accuse you of making stuff up

Quote: 100xOddswhoa.. what?!Quote: DRichI also just used the notepad on my phone by day and casino. Just entered the win/loss for each casino each day. I would then email it to myself so no one could claim it was made up while doing my taxes.

link to original post

i've been doing in excel spreadsheet on my phone:

date-casino-the machine and ID # - amount started with - amount ended with

you mean all i need for IRS audits is:

date - casino - amount started - amount ended?

yeah, emailing the spreadsheet to myself sounds like something you should do so that the IRS cant accuse you of making stuff up

link to original post

I sure can't tell you what you need to do, but that was all I did. In my mind that would be sufficient but if you want to be meticulous account for every machine and table you play.

Quote: ChumpChangeI guess professional gamblers have to make estimated tax payments quarterly. But maybe you can get the casino to withhold a certain percentage for taxes, idk. You'd have to estimate how much you want the casino to withhold and maybe only have them withhold taxes on every 3rd JP over $10K or something, lol.

link to original post

Dont our professional friends including card counters fly under the radar? I dont think they'd want the casinos knowing their names.

But I recall a VP player hitting a handpay and asking the slot attendant to withhold the taxes on a $1250 hand. And the slot attendant saying "we don't like to do that." Then a manager came to ask the player to take the full payment.

I dont think casinos want to be sending payments to the IRS on behalf of players.

Quote: AlanMendelsonBut I recall a VP player hitting a handpay and asking the slot attendant to withhold the taxes on a $1250 hand. And the slot attendant saying "we don't like to do that." Then a manager came to ask the player to take the full payment.

I dont think casinos want to be sending payments to the IRS on behalf of players.

link to original post

I think it depends on the casino and the amount. There is likely a threshold which varies from house to house. I know on W2G's under $2000, I was usually just handed cash; over $2000 or so they'd ask if I wanted withholding, preferred to be paid by check, cash, or a check/cash split. Any W2G over the CTR threshold, I sort of expect it.

I would expect that a vaguely modern computer accounting system would make it as easy as a checkbox or two to do the withholding.

As to why... I think the casinos have figured out that it's easier for their best players to grind back the money if it's cash in their pocket instead of a check already mailed to the IRS.

Quote: AlanMendelsonQuote: 100xOddswhy did they ignore everything gambling related?!Quote: AlanMendelsonHas anyone here ever had their gambling audited by the IRS?

I went through a TCMP audit and a two-day business and personal audit with two auditors at my accountant's office with all business and personal records. That year I had $2.9-million in W2Gs and the auditors ignored everything related to gambling.

Everything.

link to original post

link to original post

I have no idea. But when I mentioned this to a high ranking IRS official during a news interview I was told that unless someone wins a mega jackpot such as a lottery they believe everyone is a net loser.

So... has anyone been audited for gambling?

link to original post

You asked an IRS official why they didnít look into YOUR gambling income? Ok then.

Quote: mcallister3200Quote: AlanMendelsonQuote: 100xOddswhy did they ignore everything gambling related?!Quote: AlanMendelsonHas anyone here ever had their gambling audited by the IRS?

I went through a TCMP audit and a two-day business and personal audit with two auditors at my accountant's office with all business and personal records. That year I had $2.9-million in W2Gs and the auditors ignored everything related to gambling.

Everything.

link to original post

link to original post

I have no idea. But when I mentioned this to a high ranking IRS official during a news interview I was told that unless someone wins a mega jackpot such as a lottery they believe everyone is a net loser.

So... has anyone been audited for gambling?

link to original post

You asked an IRS official why they didnít look into YOUR gambling income? Ok then.

link to original post

You maybe didnt know that for 30+ years I was a TV business and consumer news reporter. Tax tips were something I did every year on TV. And of course I'd do stories on audits and all kinds of tax issues.

Quote: AlanMendelsonQuote: ChumpChangeI guess professional gamblers have to make estimated tax payments quarterly. But maybe you can get the casino to withhold a certain percentage for taxes, idk. You'd have to estimate how much you want the casino to withhold and maybe only have them withhold taxes on every 3rd JP over $10K or something, lol.

link to original post

Dont our professional friends including card counters fly under the radar? I dont think they'd want the casinos knowing their names.

But I recall a VP player hitting a handpay and asking the slot attendant to withhold the taxes on a $1250 hand. And the slot attendant saying "we don't like to do that." Then a manager came to ask the player to take the full payment.

I dont think casinos want to be sending payments to the IRS on behalf of players.

link to original post

The casino wants you to take the full amount so that they have a chance to win it back. If it is withheld for the IRS they can't win it back.

About 25 years ago I donated a large amount of sports memorabilia to a local church to give away at the picnics, bazaars, auctions, etc; it was what they call "junk wax", things that have no real value. Pro Set hockey cards, etc. I claimed it on my taxes and got audited, I had a 2" thick file of everything and its retail value. The guy didn't look at it, he just needed to know it existed.

Tax audits are no fun. Heck, no audit is fun. At work I used to get a PA banking division audit, and a DMV audit, randomly. Even though I knew my records were clean, it was never a good day.

$2.9M worth of w2-g's?Quote: AlanMendelsonHas anyone here ever had their gambling audited by the IRS?

I went through a TCMP audit and a two-day business and personal audit with two auditors at my accountant's office with all business and personal records. That year I had $2.9-million in W2Gs and the auditors ignored everything related to gambling.

Everything.

link to original post

How much did you claim as profit?

Quote: AlanMendelsonHas anyone here ever had their gambling audited by the IRS?

I went through a TCMP audit and a two-day business and personal audit with two auditors at my accountant's office with all business and personal records. That year I had $2.9-million in W2Gs and the auditors ignored everything related to gambling.

Everything.

link to original post

I wasnít audited but twice Iíve had a letter and had to provide extra documentation. One time I had to call and speak with an agent. The agent didnít know what he was talking about and I told him I needed to speak with his supervisor. After some explanation the case was closed.

Quote: 100xOdds$2.9M worth of w2-g's?Quote: AlanMendelsonHas anyone here ever had their gambling audited by the IRS?

I went through a TCMP audit and a two-day business and personal audit with two auditors at my accountant's office with all business and personal records. That year I had $2.9-million in W2Gs and the auditors ignored everything related to gambling.

Everything.

link to original post

How much did you claim as profit?

link to original post

I had a loss.

and you didn't get audited by the IRS for putting down $2.9M in gambling losses to offset the w2-g's?Quote: AlanMendelsonQuote: 100xOdds$2.9M worth of w2-g's?Quote: AlanMendelsonHas anyone here ever had their gambling audited by the IRS?

I went through a TCMP audit and a two-day business and personal audit with two auditors at my accountant's office with all business and personal records. That year I had $2.9-million in W2Gs and the auditors ignored everything related to gambling.

Everything.

link to original post

How much did you claim as profit?

link to original post

I had a loss.

link to original post

Quote: 100xOddsand you didn't get audited by the IRS for putting down $2.9M in gambling losses to offset the w2-g's?Quote: AlanMendelsonQuote: 100xOdds$2.9M worth of w2-g's?Quote: AlanMendelsonHas anyone here ever had their gambling audited by the IRS?

I went through a TCMP audit and a two-day business and personal audit with two auditors at my accountant's office with all business and personal records. That year I had $2.9-million in W2Gs and the auditors ignored everything related to gambling.

Everything.

link to original post

How much did you claim as profit?

link to original post

I had a loss.

link to original post

link to original post

As my accountant told me... they didnt even look.

Many years ago I was an active options trader. I was hit with a TCMP audit. I had hundreds of option trades.

The TCMP audit is the most comprehensive type of audit. Everything is examined.

When it came time to go to the section about my options trading the auditor simply put a check mark next to THREE trades. Out of hundreds of trades ONLY THREE.

I showed him the buy and sell confirmations for those three trades and that was the end of it.

Again I will ask WHO HERE HAS BEEN AUDITED FOR GAMBLING? So far crickets.

a co-worker who doesnt gamble much got a w-2g a few years ago.Quote: AlanMendelsonAgain I will ask WHO HERE HAS BEEN AUDITED FOR GAMBLING? So far crickets.

link to original post

he forgot about it and didnt put it down on his 1040.

the irs sent him a letter saying he owes $. no idea how it ended up. I havent seen him in a few years.

That's the closest i know about irs coming after you because of gambling.

Quote: 100xOddsa co-worker who doesnt gamble much got a w-2g a few years ago.Quote: AlanMendelsonAgain I will ask WHO HERE HAS BEEN AUDITED FOR GAMBLING? So far crickets.

link to original post

he forgot about it and didnt put it down on his 1040.

the irs sent him a letter saying he owes $. no idea how it ended up. I havent seen him in a few years.

That's the closest i know about irs coming after you because of gambling.

link to original post

That's not an audit.

When I was married to wife #3 she frequently forgot to give me her W2Gs. It was no big deal. You write a letter acknowledging the error. In our case we had a losing year and simply said our losses offset the win.

I wrote the letter by hand on a page from a yellow Legal pad. As informal as you can get.

That was the end of it.

like i said, closest i know about irs coming after you because of gambling.Quote: AlanMendelsonThat's not an audit.Quote: 100xOddsa co-worker who doesnt gamble much got a w-2g a few years ago.Quote: AlanMendelsonAgain I will ask WHO HERE HAS BEEN AUDITED FOR GAMBLING? So far crickets.

link to original post

he forgot about it and didnt put it down on his 1040.

the irs sent him a letter saying he owes $. no idea how it ended up. I havent seen him in a few years.

That's the closest i know about irs coming after you because of gambling.

link to original post

link to original post

Quote: 100xOddsa co-worker who doesnt gamble much got a w-2g a few years ago.Quote: AlanMendelsonAgain I will ask WHO HERE HAS BEEN AUDITED FOR GAMBLING? So far crickets.

link to original post

he forgot about it and didnt put it down on his 1040.

the irs sent him a letter saying he owes $. no idea how it ended up. I havent seen him in a few years.

That's the closest i know about irs coming after you because of gambling.

link to original post

I had that same situation. I forgot to claim about 20 W2-G's out of probably 500. They sent me a letter saying they had $XXXXX amount of unclaimed income and I owed an additional $XXXX. I admitted my mistake, argued that I didn't owe $XXXX because I had higher losses than originally claimed, argued for a few months, and finally settled when they lowered it to $XXX owed, and then I amended my return,

Sales tax is different as you are actually collecting other people's money for the state. I personally think the state should pay me a fee for collecting and forwarding their money but it doesn't work like that.

Quote: billryanI've been audited for sales taxes twice, and those folks are bloodhounds. The first time they said my shortfall was over $8,000 and we settled for about $80, and the second time they wanted $5,000 and settled for under $200.

Sales tax is different as you are actually collecting other people's money for the state. I personally think the state should pay me a fee for collecting and forwarding their money but it doesn't work like that.

link to original post

A few years ago California had a ballot proposition to extend the sales tax to advertising. If that had passed I would have closed my business. What a headache!

Quote: AlanMendelson

A few years ago California had a ballot proposition to extend the sales tax to advertising. If that had passed I would have closed my business. What a headache!

link to original post

I actually love that idea.

I'm all for taxes on "nuisances". If people want to spam me with ads, have them pay taxes on it. It might reduce the number of ads, or in worst case scenario, increase the tax revenue to possibly offset some future tax hikes on me.

Similarly, I wish there was a tax (200%) on political campaign contributions. If people want to buy influence, at least have them donate to the common coffers at the same time.

Quote: billryanI've been audited for sales taxes twice, and those folks are bloodhounds. The first time they said my shortfall was over $8,000 and we settled for about $80, and the second time they wanted $5,000 and settled for under $200.

Sales tax is different as you are actually collecting other people's money for the state. I personally think the state should pay me a fee for collecting and forwarding their money but it doesn't work like that.

link to original post

In Nevada, there is a collection allowance for collecting sales tax for the state. Nothing to write home about at 0.25% of the tax base. Plus you keep all of the fractions of pennies that your customers ďoverpayĒ in order to pay in whole cents. Yippee!

Quote: AlanMendelsonHas anyone here ever had their gambling audited by the IRS?

I went through a TCMP audit and a two-day business and personal audit with two auditors at my accountant's office with all business and personal records. That year I had $2.9-million in W2Gs and the auditors ignored everything related to gambling.

Everything.

link to original post

I, too, was hoping to see some responses to your question about being audited. I was sure there was at least one member who had mentioned something in a prior thread on this topic; however, when I did a search, all I found were posts from inactive (banned) membersÖ (heavy sigh)

Quote: AlanMendelsonQuote: 100xOddsand you didn't get audited by the IRS for putting down $2.9M in gambling losses to offset the w2-g's?Quote: AlanMendelsonQuote: 100xOdds$2.9M worth of w2-g's?Quote: AlanMendelsonHas anyone here ever had their gambling audited by the IRS?

I went through a TCMP audit and a two-day business and personal audit with two auditors at my accountant's office with all business and personal records. That year I had $2.9-million in W2Gs and the auditors ignored everything related to gambling.

Everything.

link to original post

How much did you claim as profit?

link to original post

I had a loss.

link to original post

link to original post

As my accountant told me... they didnt even look.

Many years ago I was an active options trader. I was hit with a TCMP audit. I had hundreds of option trades.

The TCMP audit is the most comprehensive type of audit. Everything is examined.

When it came time to go to the section about my options trading the auditor simply put a check mark next to THREE trades. Out of hundreds of trades ONLY THREE.

I showed him the buy and sell confirmations for those three trades and that was the end of it.

Again I will ask WHO HERE HAS BEEN AUDITED FOR GAMBLING? So far crickets.

link to original post

What is it you are trying to find out. So maybe no one here has been audited for gambling. I have been filing as s gambler for over 20 years and as of now have never had a full blown audit

The old gambler man walks into the meeting with his lawyer. The IRS agent tells him he can't make all these write offs for gambling loses unless he can prove he is a professional gambler.

The old man says "alright, how about I bet you $10,000 I can bite my eye".

The agent thinks 'there is no way he can do that' and shook. The old man pops out his glass eye, sticks it in his mouth, and bites it. The agent shakes his head, but says "that still doesn't prove you're a professional gambler".

"Alright", says the old man, "I'll give you a chance to win your money back. Double or nothing, I'll bite my other eye".

'He isn't blind, so there is no way he has a second glass eye' thinks the agent. He accepts the bet and they shake on it. The old man pops out his fake teeth, puts them to his head, and clamps them down around his other eye.

"Well that still doesn't prove you're a professional gambler" says the IRS agent, while shaking his head.

"Alright, I'll give you one last chance to win your money. See that trash can over in the corner of your office? Double or nothing, I can stand here and piss in that trash can without missing a drop".

The agent thinks 'that man is like 85, and that can is 12 feet away. There is absolutely no way he can make it in'. He agrees to the bet and they shake on it.

The man stands up, unzips his pants, and whips it out. He takes aim, and let's out a stream all over the office. He pees on the desk, the floor, the walls, and even the IRS agent, all while the agent is cheering that he keeps his money.

The old man's lawyer is sitting there, shaking his head in defeat. "What's wrong with you?" asks the agent.

"Today my client came into my office and bet me $75,000 he could piss all over you during the audit and you'd be happy about it".

I think I first read it in Amarillo Slims book

Quote: Hunterhill

What is it you are trying to find out. So maybe no one here has been audited for gambling. I have been filing as s gambler for over 20 years and as of now have never had a full blown audit

Canít speak for anyone else, but Iím curious to know of othersí experiences in an audit with respect to gambling in order to see if there is any contradiction to what Iíve read here. So far, it seems the consensus is as long as you have a log theyíre satisfied; if audited for other reasons, they donít pay much attention to gambling specifically (as long as nothing stands out?); and filing as a professional gambler should be a last resort.

It sounds like your experience may contradict that last point. Are you saying that you list Gambler as a profession and file the appropriate schedule like a sole proprietor? 20 years and no audit? Sounds good to me!

Iím starting to think some of the posts in prior threads were crying wolf as it wereÖ

Quote: camaplQuote: Hunterhill

What is it you are trying to find out. So maybe no one here has been audited for gambling. I have been filing as s gambler for over 20 years and as of now have never had a full blown audit

Canít speak for anyone else, but Iím curious to know of othersí experiences in an audit with respect to gambling in order to see if there is any contradiction to what Iíve read here. So far, it seems the consensus is as long as you have a log theyíre satisfied; if audited for other reasons, they donít pay much attention to gambling specifically (as long as nothing stands out?); and filing as a professional gambler should be a last resort.

It sounds like your experience may contradict that last point. Are you saying that you list Gambler as a profession and file the appropriate schedule like a sole proprietor? 20 years and no audit? Sounds good to me!

Iím starting to think some of the posts in prior threads were crying wolf as it wereÖ

link to original post

I do file as a professional gambler, but that is my sole source of income other than investments.

From what I understand you attract more attention and likely audit if you file as a professional and you also have another occupation.

Quote: 100xOddsa co-worker who doesnt gamble much got a w-2g a few years ago.Quote: AlanMendelsonAgain I will ask WHO HERE HAS BEEN AUDITED FOR GAMBLING? So far crickets.

link to original post

he forgot about it and didnt put it down on his 1040.

the irs sent him a letter saying he owes $. no idea how it ended up. I havent seen him in a few years.

That's the closest i know about irs coming after you because of gambling.

link to original post

I had the same scenario. I had some slot hand pay (barely over the W-2g amount, probably less than 2k, closer to 1.2k I think) so I got a letter some months after tax season saying that they received an undeclared W-2 and I owed for it, it was pretty small. I had a similar thing happen one year for a random small 1099 that I also totally forgot about for a short contracting gig. Its just a letter saying, "hey you owe us 200 more dollars than you paid", you just send them a check (or do it online) and move on.

This (neither scenario) is not an audit, its just when they receive statements that do not match with what you declared and send you a letter saying you actually owe a bit more. My guess is neither of these is audit worthy, especially for such low amounts of money, the IRS knows things slip through the cracks when you have multiple W-2s and 1099s and if you pay its all good.

The gambling one, I was pretty young (probably did not even fully understand what a hand pay meant), and I certainly outweighed it in losses that year (so I could have deducted it, if I had filed properly and kept a log), but I figured its not worth resubmitting and amendment, and easier to just pay (going through the time and money of submitting an amended tax return through a tax firm would probably cost more than whatever the taxes owed on a 1200ish dollar win were, I don't recall what it was, but not much).

Though I never made those mistakes again though (1099 and W-2G), once you get a letter from the IRS it scares you into keeping track of that category.

This year I actually got a similar letter, and I was annoyed/confused at first (because I am very careful now), but it turns out I overpaid, by 1.00 USD exactly when sending payment with my Tax Return, so I received one of those nice U.S. Treasury checks for a whole dollar, it was a nice surprise (still not sure how I overpaid by exactly one dollar, but its better than owing a dollar).