May 11th, 2013 at 11:39:38 AM

permalink

Testing the 4% hypothesis

I recently discovered you can put a negative number into the compound interest calculator I like to fool around with. It means you can postulate certain figures per month to withdraw from assets and pose it against growth of assets.

That you can take 4% per year out of your assets, allow that to increase with inflation, and still have the assets [at moderate risk] last for decades, seems to be something the financial advisors have kicked around for some time. A million dollars allows $40,000 per year in withdrawals initially [to go up]. So, I put this to the test.

Frequently long term inflation is figured at 3%. Although capable of wild fluctuation, the link at Inflation/DecadeInflation does show this has been historical over the years [actually 3.22%]. You have to use something, so I used two scenarios, 3% and 3.5%

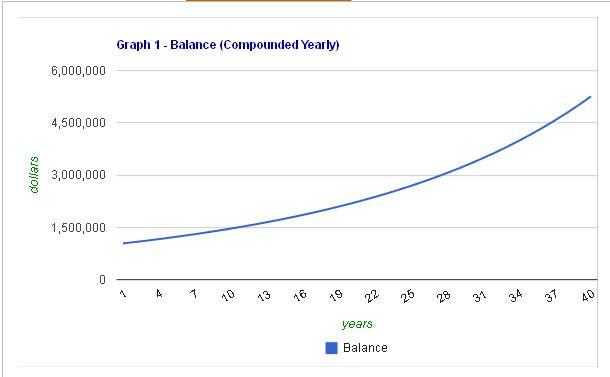

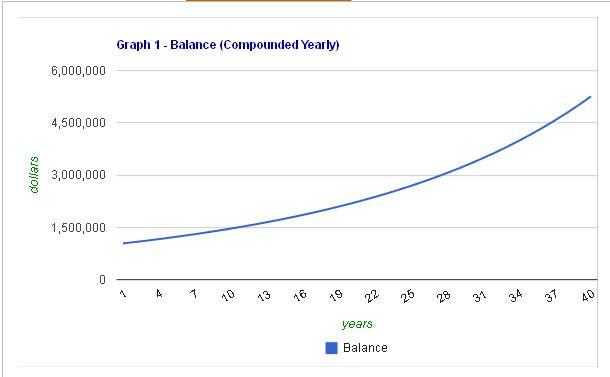

First graph shows 8 percent yield on assets and inflation adjusted initial 4% withdrawals subject to 3% inflation. This reminds me of looking at possible outcomes at 20x free odds in craps. Yep, it is possible a guy could get so lucky, but somehow we know this ain't gonna happen.

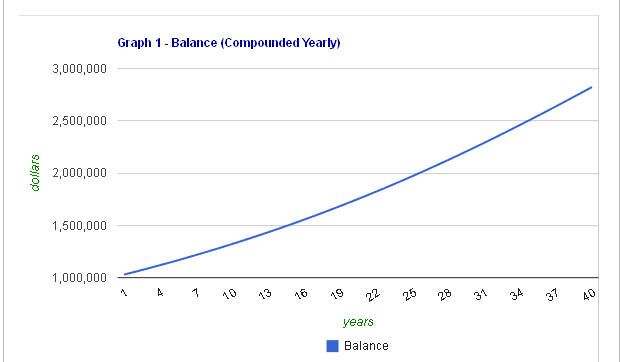

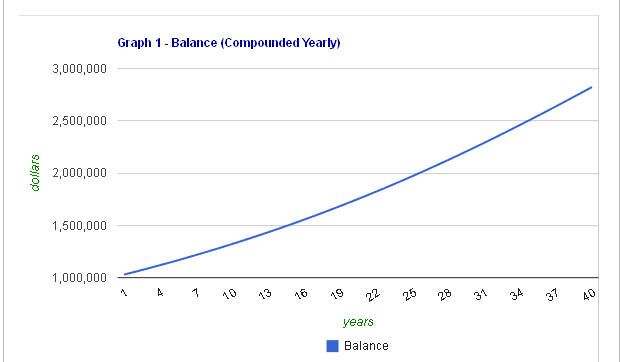

Below is 7% and inflation adjusted initial 4% withdrawals subject to 3% inflation

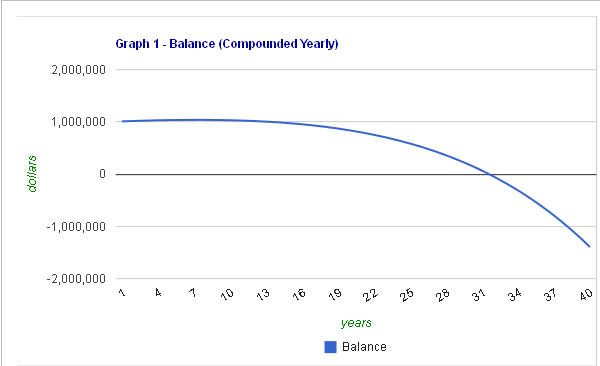

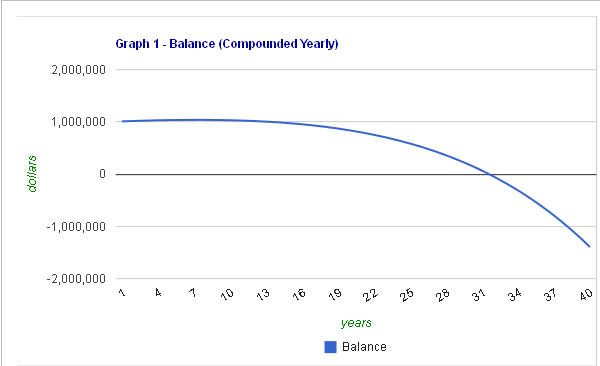

An obviously bad scenario, 5% and inflation adjusted initial 4% withdrawals subject to 3.5 % inflation. Still, a 60 year old man lives to around 90 [edit] before going broke.

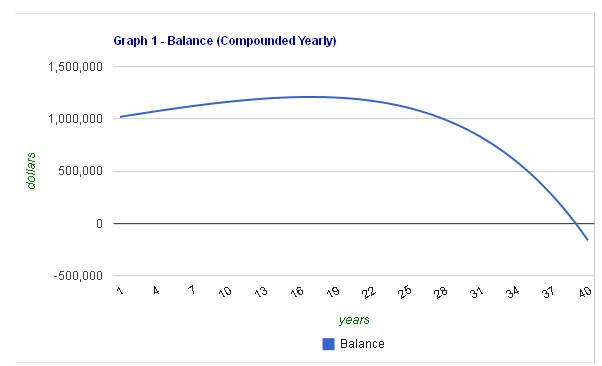

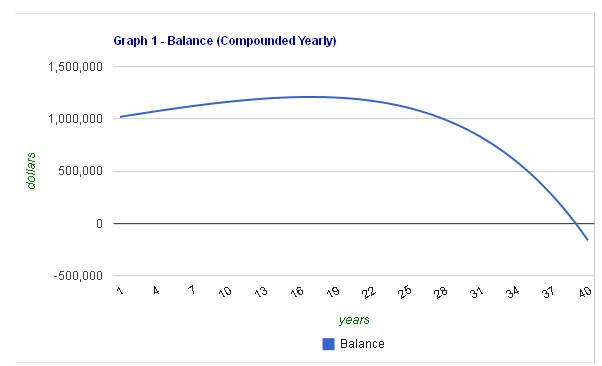

Perhaps realistic 6% and inflation adjusted initial 4% withdrawals subject to 3% inflation

Try your own scenarios:

http://www.thecalculatorsite.com/finance/calculators/compoundinterestcalculator.php

I recently discovered you can put a negative number into the compound interest calculator I like to fool around with. It means you can postulate certain figures per month to withdraw from assets and pose it against growth of assets.

That you can take 4% per year out of your assets, allow that to increase with inflation, and still have the assets [at moderate risk] last for decades, seems to be something the financial advisors have kicked around for some time. A million dollars allows $40,000 per year in withdrawals initially [to go up]. So, I put this to the test.

Frequently long term inflation is figured at 3%. Although capable of wild fluctuation, the link at Inflation/DecadeInflation does show this has been historical over the years [actually 3.22%]. You have to use something, so I used two scenarios, 3% and 3.5%

First graph shows 8 percent yield on assets and inflation adjusted initial 4% withdrawals subject to 3% inflation. This reminds me of looking at possible outcomes at 20x free odds in craps. Yep, it is possible a guy could get so lucky, but somehow we know this ain't gonna happen.

Below is 7% and inflation adjusted initial 4% withdrawals subject to 3% inflation

An obviously bad scenario, 5% and inflation adjusted initial 4% withdrawals subject to 3.5 % inflation. Still, a 60 year old man lives to around 90 [edit] before going broke.

Perhaps realistic 6% and inflation adjusted initial 4% withdrawals subject to 3% inflation

Try your own scenarios:

http://www.thecalculatorsite.com/finance/calculators/compoundinterestcalculator.php

the next time Dame Fortune toys with your heart, your soul and your wallet, raise your glass and praise her thus: “Thanks for nothing, you cold-hearted, evil, damnable, nefarious, low-life, malicious monster from Hell!” She is, after all, stone deaf. ... Arnold Snyder