JMG ENTERPRISES

63.7K subscribers

Mesa couple sues Chase Bank for failing to return over $48k - Arizona News - Dec 14, 2022

The money was returned to the couple by Chase 5 days before the court date with no explanation whatsoever.

Chase customers ask "where are my deposits?" KFOR 4 News Oklahoma - Jan 22, 2024

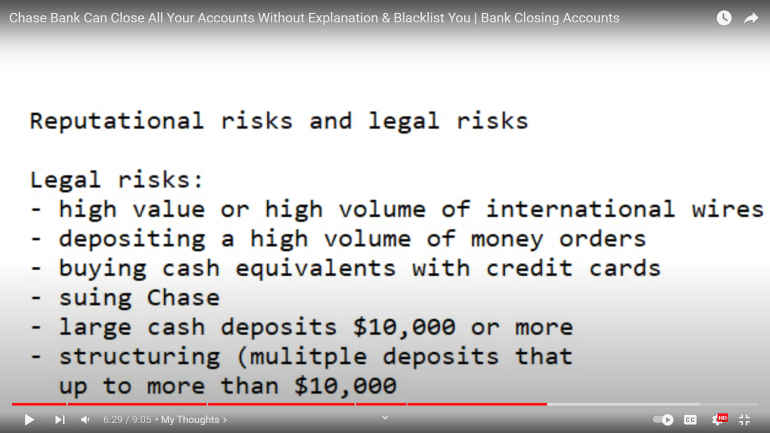

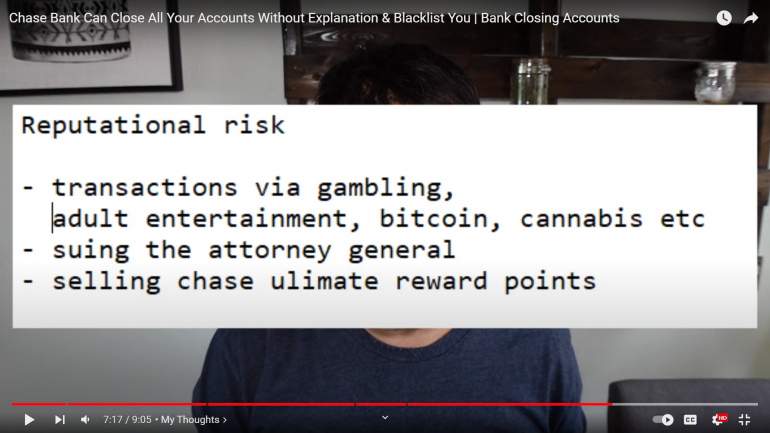

I have an Amazon Chase credit card which is ubiquitous among Amazon online shoppers, and all those cards are at risk of being turned off by this bank as mentioned in the first video. Chase bank can shut you down over a SAR, so suddenly they get squeamish about cash or even depositing casino cashiers checks from what I'm reading here in the video screenshot. But in the comment sections of these videos there are legions of people saying they've had their accounts shut down and the money withheld with no explanation and they can't pay their bills. Others would say all the biggest banks are like this and to find a smaller regional bank or credit union. I'm wondering if anybody who pays money to an OnlyFans account will get their account shutdown too.

When I was volunteering with people to try and get their financial affairs in order, I must have looked into a few dozen cases of supposed bank error or an account being closed with no warning and no reason. The banks were usually right but people left bad social media content.

I have a good relationship with Wells Fargo but I'm in a high tier. I opened an account with two local banks in Bisbee but didn't find them any better than Wells. I'm slowly transitioning to Ally Bank, which is internet-only.

It seemed like finding an in-network cash deposit ATM was nigh impossible.

- Jan 19, 2021

Your Host J

7.3K subscribers

UPDATE - CHASE BANK BANS ME FOR LIFE! THEY CLOSE MY ACCOUNT AND WITHHOLDING MY MONEY! PART 2

- Jan 21, 2021

Quote: darkozI have been saying for years I don't trust banks and refuse to keep a bank account

link to original post

Where do you live?

# to your safe? :)

(Too soon?)

i couldnt find a way to deposit cash to my online banks.Quote: DieterIs there a fairly convenient way to do cash transactions with Ally (or similar online banks)?

It seemed like finding an in-network cash deposit ATM was nigh impossible.

link to original post

best was buy a money order and use app to e-Deposit the check.

so i have a brick and mortar bank to deposit cash

Quote: DieterIs there a fairly convenient way to do cash transactions with Ally (or similar online banks)?

It seemed like finding an in-network cash deposit ATM was nigh impossible.

link to original post

I deposit cash into Wells Fargo and either transfer it, which takes up to three days, or I write a check on my WF account and deposit it via my phone. If it is under a certain amount, it's usually available the next day. I don't deal with much cash so I have not looked into better ways.

Thanks.

Quote: DieterThat's kind of what I thought. You need another bank for cash, and then there are many ways to finagle the money into the online account.

Thanks.

link to original post

I got a 1% bonus for depositing into my first Ally account, and they offer very competitive CD rates, including a no-penalty CD. I just finished my first year with them and they gave me a one-time booster rate on the next CD I open. with them. It may not be the best choice as a main bank but it's a good place to park extra funds. They also offer stocks.

Quote: billryanQuote: DieterThat's kind of what I thought. You need another bank for cash, and then there are many ways to finagle the money into the online account.

Thanks.

link to original post

I got a 1% bonus for depositing into my first Ally account, and they offer very competitive CD rates, including a no-penalty CD. I just finished my first year with them and they gave me a one-time booster rate on the next CD I open. with them. It may not be the best choice as a main bank but it's a good place to park extra funds. They also offer stocks.

link to original post

I think the online bank I'm using is about half a percent higher on CD's right now, and has been consistently on savings interest every time I've bothered to check.

They also made it trivially convenient to set up ACH to and from my regular credit union.

edit: consistently higher. Curse my metal body.

Quote: 100xOddsQuote: darkozI have been saying for years I don't trust banks and refuse to keep a bank account

link to original post

Where do you live?

# to your safe? :)

(Too soon?)

link to original post

Not too soon.

I actually called it my "unsafe"

I used to do the same.

But after discovering money market accounts at brokers (In my case, Fidelity, FZFXX), I just keep most of my liquid funds in my brokerage instead of bank chasing every 6-12 month, Currently it's earning 4.97% (can change daily), and it's as liquid as a checking account.

Quote: MukkeI'm surprised how many people "shop" around or otherwise discuss how great the CD or checking interest rate is at bank or credit union x.

I used to do the same.

But after discovering money market accounts at brokers (In my case, Fidelity, FZFXX), I just keep most of my liquid funds in my brokerage instead of bank chasing every 6-12 month, Currently it's earning 4.97% (can change daily), and it's as liquid as a checking account.

link to original post

The gap between banks is huge, and seems to be growing. Wells Fargo is offering CDs in the 1% range while Ally is over 5%, plus sign-on bonuses and re-upping bonuses. Too many people I know have money in brick banks paying next to nothing.

I, for one, think this should be discussed more. I found out about Ally when someone on a comic book forum mentioned the 1% sign-up bonus. Much better rates and a couple hundred dollars in cash are something I'd rather discuss than yet another roulette system.

Quote: billryan

The gap between banks is huge, and seems to be growing. Wells Fargo is offering CDs in the 1% range while Ally is over 5%, plus sign-on bonuses and re-upping bonuses. Too many people I know have money in brick banks paying next to nothing.

I, for one, think this should be discussed more. I found out about Ally when someone on a comic book forum mentioned the 1% sign-up bonus. Much better rates and a couple hundred dollars in cash are something I'd rather discuss than yet another roulette system.

link to original post

This is true, but after you discover Ally, you may also discover brokerage accounts, where the rate follows the market, which gives you 2 advantages:

* You no longer have to chase (excuse my pun) to have the best rate (Ally does not have the best right now, but they will probably temporarily again at some point in the future when they decide they want to raise more capital again).

* Your money is not tied up for 12 months (or other arbitrary period).

Finally, once you become comfortable with brokers you might discover brokered CDs. These are essentially like all your other CDs from individual banks, except they tend to pay slightly more than the bank offers you. Isn't it ironic that you can get a CD from Chase if you're a customer with them. But if instead you buy Chase's CDs through Fidenlity, you get a better rate? (CAse in point, I currently have a 5.7% 12-month CD from Chase right now)

https://www.investopedia.com/terms/b/brokered-cd.asp

https://www.fidelity.com/mutual-funds/mutual-fund-spotlights/money-market-funds

Quote: darkozQuote: 100xOddsQuote: darkozI have been saying for years I don't trust banks and refuse to keep a bank account

link to original post

Where do you live?

# to your safe? :)

(Too soon?)

link to original post

Not too soon.

I actually called it my "unsafe"

link to original post

I remember that! Wow, your Daughter's ex boyfriend was really a piece of work, stealing from you! :O

Quote: billryanQuote: DieterThat's kind of what I thought. You need another bank for cash, and then there are many ways to finagle the money into the online account.

Thanks.

link to original post

I got a 1% bonus for depositing into my first Ally account, and they offer very competitive CD rates, including a no-penalty CD. I just finished my first year with them and they gave me a one-time booster rate on the next CD I open. with them. It may not be the best choice as a main bank but it's a good place to park extra funds. They also offer stocks.

link to original post

I have quit buying CD's as many savings accounts now pay just as much or more with no minimums and no early withdrawll penalties.

Quote: DRichQuote: billryanQuote: DieterThat's kind of what I thought. You need another bank for cash, and then there are many ways to finagle the money into the online account.

Thanks.

link to original post

I got a 1% bonus for depositing into my first Ally account, and they offer very competitive CD rates, including a no-penalty CD. I just finished my first year with them and they gave me a one-time booster rate on the next CD I open. with them. It may not be the best choice as a main bank but it's a good place to park extra funds. They also offer stocks.

link to original post

I have quit buying CD's as many savings accounts now pay just as much or more with no minimums and no early withdrawll penalties.

link to original post

Ally has no penalty CDs after the first week, but their MMA pays just about the same. I'm not promoting Ally as the best of choices, just that it is better than most brick banks.

Quote: billryan

Ally has no penalty CDs after the first week, but their MMA pays just about the same. I'm not promoting Ally as the best of choices, just that it is better than most brick banks.

link to original post

I am using an online bank also. I use Bask bank and am getting 5.1% on my savings accounts.

Quote: DRichQuote: billryan

Ally has no penalty CDs after the first week, but their MMA pays just about the same. I'm not promoting Ally as the best of choices, just that it is better than most brick banks.

link to original post

I am using an online bank also. I use Bask bank and am getting 5.1% on my savings accounts.

link to original post

That's great, but it can go down at any time. I don't keep enough in savings that a couple of tenths of a point makes a big difference.

I've been parking cash in JP Morgan equity funds that pay 1% dividends per month.

I grew up in an era where banks routinely paid 5% for savings, and my bank seemed to pay an extra dividend each year. By the time I was making money, six-month CDs were paying 12%. Not knowing any better, I thought those rates would last forever. I had no idea that was a once-in-a-lifetime opportunity. My Aunt bought twenty-year bonds at almost 15%. I bought six-month T-bills.

Quote: billryanQuote: DRichQuote: billryan

Ally has no penalty CDs after the first week, but their MMA pays just about the same. I'm not promoting Ally as the best of choices, just that it is better than most brick banks.

link to original post

I am using an online bank also. I use Bask bank and am getting 5.1% on my savings accounts.

link to original post

That's great, but it can go down at any time. I don't keep enough in savings that a couple of tenths of a point makes a big difference.

I've been parking cash in JP Morgan equity funds that pay 1% dividends per month.

I grew up in an era where banks routinely paid 5% for savings, and my bank seemed to pay an extra dividend each year. By the time I was making money, six-month CDs were paying 12%. Not knowing any better, I thought those rates would last forever. I had no idea that was a once-in-a-lifetime opportunity. My Aunt bought twenty-year bonds at almost 15%. I bought six-month T-bills.

link to original post

JPMorgan pays 12% per year???

link to that acct?

interesting.. Bask also offers the ability to have the bank interest as American Airlines miles instead.Quote: DRichQuote: billryan

Ally has no penalty CDs after the first week, but their MMA pays just about the same. I'm not promoting Ally as the best of choices, just that it is better than most brick banks.

link to original post

I am using an online bank also. I use Bask bank and am getting 5.1% on my savings accounts.

link to original post

if taking business class, those miles are worth 1.8 cents.

so like 9.18% interest. :o

Great if you're a AA frequent flyer.

Unfortunately, my nearest hub is United.

Any bank that gives rewards in United miles?

Quote: 100xOddsQuote: billryanQuote: DRichQuote: billryan

Ally has no penalty CDs after the first week, but their MMA pays just about the same. I'm not promoting Ally as the best of choices, just that it is better than most brick banks.

link to original post

I am using an online bank also. I use Bask bank and am getting 5.1% on my savings accounts.

link to original post

That's great, but it can go down at any time. I don't keep enough in savings that a couple of tenths of a point makes a big difference.

I've been parking cash in JP Morgan equity funds that pay 1% dividends per month.

I grew up in an era where banks routinely paid 5% for savings, and my bank seemed to pay an extra dividend each year. By the time I was making money, six-month CDs were paying 12%. Not knowing any better, I thought those rates would last forever. I had no idea that was a once-in-a-lifetime opportunity. My Aunt bought twenty-year bonds at almost 15%. I bought six-month T-bills.

link to original post

JPMorgan pays 12% per year???

link to that acct?

link to original post

JEPI ( 11%)and /or JEPQ(12.8). The price is up slightly so the yield is down slightly.

A couple years ago I had an opportunity where I quickly needed to use all of my credit for an opportunity. My 2 Amex cards had been open for more than a dozen years and they were used to sporadic action from me. Understandably using up all of the credit line over a 3 month period gave them a little concern and they froze them pending a financial review. I have since come to find out that this is usually a death sentence but the lady called me twice and was professional and unfroze them and only reduced the credit limit on one by a minuscule amount. I paid them off a few months later.

These experiences taught me that you canít rely on one particular company as they can shut you down at any time. People talk how they have 3-4 Amex or Chase cards. No you have one. If they donít like you they can just shut you down. Itís like they say how can I get credit if you wonít give me any. Well itís also what the point of you giving me a credit line if you freak out if I want to use it all? The 2008 financial crisis was really awful for consumers as it saw so many companies merge and create less competition for the consumer.

Quote: SandybestdogI was buying gift cards with the Capital One Spark card (2% back) a couple years ago. I of course had perfect payment history with it and all that. I believe they didnít like those purchases and sent me a letter closing it. Except they werenít satisfied with closing just that. They also closed the other Capital One card that I had open since I was 18. I barely used this card and it sat mostly idle. But they werenít satisfied with just this either. They also closed my checking account that I had had open since I was about 13. They didnít want me as a customer at all.

A couple years ago I had an opportunity where I quickly needed to use all of my credit for an opportunity. My 2 Amex cards had been open for more than a dozen years and they were used to sporadic action from me. Understandably using up all of the credit line over a 3 month period gave them a little concern and they froze them pending a financial review. I have since come to find out that this is usually a death sentence but the lady called me twice and was professional and unfroze them and only reduced the credit limit on one by a minuscule amount. I paid them off a few months later.

These experiences taught me that you canít rely on one particular company as they can shut you down at any time. People talk how they have 3-4 Amex or Chase cards. No you have one. If they donít like you they can just shut you down. Itís like they say how can I get credit if you wonít give me any. Well itís also what the point of you giving me a credit line if you freak out if I want to use it all? The 2008 financial crisis was really awful for consumers as it saw so many companies merge and create less competition for the consumer.

link to original post

While everything you say here is correct, it also displays a clear sentiment of "entitlement".

You are a customer. The banks are businesses. And their business is money. Their biggest risk is that they lend you money and never pay it back, so they need to mitigate that risk. You are not their best friend and they do not know the background of why your usage patterns suddenly change. They have millions of customers so have to make decisions based on big data.

The reality is that manufactured spending and related behaviors look very suspicious. Not only in terms of them getting their money back, but also from a regulatory and financial reporting point of view. If you present too much risk or headache/individual work. They are simply better off without you as a customer.

From what I've tried to figure out about credit cards, they don't want you using more than a third of your credit limit, and after using more than a half, it could impact your credit score negatively. So if you've got a $2,500 credit limit and spend $1,250 one month, then add on another $750 before you pay the bill when it's due, you're using 80% of your credit limit which could cause problems.

If you have 4 cards with $2,500 credit limits on each for a total of $10,000 credit limit, I don't know if using 80% on one card counts so much when it's only 20% of your total available credit on all of your cards, but I'm gonna go with they don't look at your other cards because those are different credit card companies. Your credit score may not be impacted so much based on the total credit limit, but the credit card company may think you're over using the credit limit and don't like the risk. They could raise your limit if you update your income with them, or they could lower the limit substantially if they don't like the risk. Not sure how they get proof of income when they just ask an online question about your income amount.

Iím not sure how I portrayed a sense of entitlement in my post. I didnít suddenly charge up to the credit limit. I had a continuous high volume of transactions and was paying it off every month. That particular card was also my daily spender and had plenty of organic transactions. The other capital one card I had I rarely used, had no balance and perfect history for 15 years.Quote: MukkeQuote: SandybestdogI was buying gift cards with the Capital One Spark card (2% back) a couple years ago. I of course had perfect payment history with it and all that. I believe they didnít like those purchases and sent me a letter closing it. Except they werenít satisfied with closing just that. They also closed the other Capital One card that I had open since I was 18. I barely used this card and it sat mostly idle. But they werenít satisfied with just this either. They also closed my checking account that I had had open since I was about 13. They didnít want me as a customer at all.

A couple years ago I had an opportunity where I quickly needed to use all of my credit for an opportunity. My 2 Amex cards had been open for more than a dozen years and they were used to sporadic action from me. Understandably using up all of the credit line over a 3 month period gave them a little concern and they froze them pending a financial review. I have since come to find out that this is usually a death sentence but the lady called me twice and was professional and unfroze them and only reduced the credit limit on one by a minuscule amount. I paid them off a few months later.

These experiences taught me that you canít rely on one particular company as they can shut you down at any time. People talk how they have 3-4 Amex or Chase cards. No you have one. If they donít like you they can just shut you down. Itís like they say how can I get credit if you wonít give me any. Well itís also what the point of you giving me a credit line if you freak out if I want to use it all? The 2008 financial crisis was really awful for consumers as it saw so many companies merge and create less competition for the consumer.

link to original post

While everything you say here is correct, it also displays a clear sentiment of "entitlement".

You are a customer. The banks are businesses. And their business is money. Their biggest risk is that they lend you money and never pay it back, so they need to mitigate that risk. You are not their best friend and they do not know the background of why your usage patterns suddenly change. They have millions of customers so have to make decisions based on big data.

The reality is that manufactured spending and related behaviors look very suspicious. Not only in terms of them getting their money back, but also from a regulatory and financial reporting point of view. If you present too much risk or headache/individual work. They are simply better off without you as a customer.

link to original post

If credit utilization is an issue, why wouldnít they just reduce the limit instead of closing the card? It doesnít have anything to do with that. You just arenít the customer that they want.

My point is just that when it comes to credit cards, donít become too dependent on one company. Oddly enough I get offers for the same 2 cards in the mail from Capital One and the last car loan I got through the dealership was with them