The IRS Advisory Council has recommended that the W2G threshold increase to $5,800.

IRS Commissioner Danny Werfel appeared to back such a move during a recent appearance in Congress.

How much longer till it's implemented, i don't know.

Over/Under that The new Guitar tower at former Vegas Mirage site will be completed 1st in 2027?

(RIP Mirage)

Not saying that as an argument it shouldn't happen, because it is far overdue.

To the argument that this is bad because it will make some people unemployed: If we think it's good to create work for slot attendants to manually hand out winnings, we should just make voucher print outs illegal and have all cashouts handpays. Voila: we just created thousands and thousands of new jobs and saved the economy!

And this article only seems to talk about slot machines. Will this increase apply to table games as well if it's implemented?

$5800, although I have no idea how they came up with it, is quite a significant improvement.

Quote: NathanIt should have been raised to $5,800 a long time ago. $1,200 was implemented in the 1970's when $1,200 was REALLY a big deal. In the 1970's, you could pay for almost an entire year's rent apartment. $1,296 was the average yearly amount in 1970. Nowadays, apartment rent is about $24,000 a year, a HUGE increase. 😵💫💡 So, in the 1970's, it made sense to tax starting at $1,200. In 2024, not so much. 💡

link to original post

I think keeping the amount at $1200 will insure less cheating on taxes. The higher the number is the more people will not be reporting their wins. I think they should go to a system where player cards are required and the total win is reported to the IRS at the end of the year.

Quote: DRichQuote: NathanIt should have been raised to $5,800 a long time ago. $1,200 was implemented in the 1970's when $1,200 was REALLY a big deal. In the 1970's, you could pay for almost an entire year's rent apartment. $1,296 was the average yearly amount in 1970. Nowadays, apartment rent is about $24,000 a year, a HUGE increase. 😵💫💡 So, in the 1970's, it made sense to tax starting at $1,200. In 2024, not so much. 💡

link to original post

I think keeping the amount at $1200 will insure less cheating on taxes. The higher the number is the more people will not be reporting their wins. I think they should go to a system where player cards are required and the total win is reported to the IRS at the end of the year.

link to original post

Should a waiter only be tipped by credit card?

How about buying something from a flea market?

Should the taco stand not be permitted to accept cash?

If you are truly worried about taxes being collected the last place I’d be looking is at gamblers who actually are winners hiding big jackpots between $1200 and $5800.

Quote: SOOPOOQuote: DRichQuote: NathanIt should have been raised to $5,800 a long time ago. $1,200 was implemented in the 1970's when $1,200 was REALLY a big deal. In the 1970's, you could pay for almost an entire year's rent apartment. $1,296 was the average yearly amount in 1970. Nowadays, apartment rent is about $24,000 a year, a HUGE increase. 😵💫💡 So, in the 1970's, it made sense to tax starting at $1,200. In 2024, not so much. 💡

link to original post

I think keeping the amount at $1200 will insure less cheating on taxes. The higher the number is the more people will not be reporting their wins. I think they should go to a system where player cards are required and the total win is reported to the IRS at the end of the year.

link to original post

Should a waiter only be tipped by credit card?

How about buying something from a flea market?

Should the taco stand not be permitted to accept cash?

If you are truly worried about taxes being collected the last place I’d be looking is at gamblers who actually are winners hiding big jackpots between $1200 and $5800.

link to original post

The IRS knows 99 percent of people with W2G’s are losing more than they win. The current amount is way too much paperwork for everyone for very little tax revenue

Quote: MukkeI wonder on average how many slot attendants would be made redundant if this hits.

Not saying that as an argument it shouldn't happen, because it is far overdue.

To the argument that this is bad because it will make some people unemployed: If we think it's good to create work for slot attendants to manually hand out winnings, we should just make voucher print outs illegal and have all cashouts handpays. Voila: we just created thousands and thousands of new jobs and saved the economy!

link to original post

I don’t know for certain but I would assume when slot machines went from coin to TITO this would have eliminated a lot of jobs, change attendants, slot technicians (less moving parts), & cashiers.

Plus aren’t we still in a labor shortage anyway?

Quote: DWizard7The thing people don't commonly talk about is that the jurisdiction chips inside the machines are VERY time-consuming and complicated to swap out and, in some places, can only be done by the gaming commission. So they're going to still hand pay you at $1200, you just won't get a tax form until $5800.

link to original post

That is not true. Every machine has a configuration menu where that amount can be changed. It would take less than 5 minutes per machine to make that change.

Quote: DRich

I think keeping the amount at $1200 will insure less cheating on taxes. The higher the number is the more people will not be reporting their wins. I think they should go to a system where player cards are required and the total win is reported to the IRS at the end of the year.

link to original post

Making this change plus taxing only net winnings for the year would be ideal. WynnBet sports book terminals in Boston require a card above a certain amount of cash in; the same could be done for slots. Unfortunately, the tax code has moved in the opposite direction lately - specific removal of carry-over losses from gambling for professional gamblers. The Feds love any revenue they can get from sin taxes, and will not easily make changes that reduce revenue in practice.

- He's political. Yeah.

The increase only applies to slots, not table games.Quote: Deucekies...And this article only seems to talk about slot machines. Will this increase apply to table games as well if it's implemented?

link to original post

Quote: UP84The increase only applies to slots, not table games.Quote: Deucekies...And this article only seems to talk about slot machines. Will this increase apply to table games as well if it's implemented?

link to original post

link to original post

Ehh? Machine threshold $5800, tables $600?

Yup. The proposal only amends the part of the rule dealing with slot payouts.Quote: DieterQuote: UP84The increase only applies to slots, not table games.Quote: Deucekies...And this article only seems to talk about slot machines. Will this increase apply to table games as well if it's implemented?

link to original post

link to original post

Ehh? Machine threshold $5800, tables $600?

link to original post

Quote: UP84Yup. The proposal only amends the part of the rule dealing with slot payouts.Quote: DieterQuote: UP84The increase only applies to slots, not table games.Quote: Deucekies...And this article only seems to talk about slot machines. Will this increase apply to table games as well if it's implemented?

link to original post

link to original post

Ehh? Machine threshold $5800, tables $600?

link to original post

link to original post

That surprises me. Do you have a link or quote that shows that?

Quote: DRichQuote: UP84Yup. The proposal only amends the part of the rule dealing with slot payouts.Quote: DieterQuote: UP84The increase only applies to slots, not table games.Quote: Deucekies...And this article only seems to talk about slot machines. Will this increase apply to table games as well if it's implemented?

link to original post

link to original post

Ehh? Machine threshold $5800, tables $600?

link to original post

link to original post

That surprises me. Do you have a link or quote that shows that?

link to original post

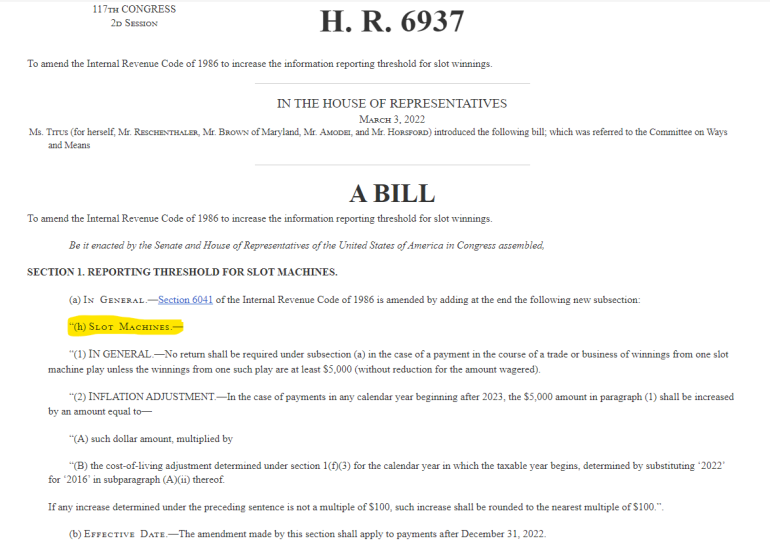

https://www.congress.gov/bill/117th-congress/house-bill/6937/text

Quote: TinManIf the W2G limit goes over 4k, I’m playing more $1 denom VP. Long overdue change but there are many incentives for politicians to keep the $1200 threshold.

link to original post

My understanding is that the IRS can set the limits themselves.

They don't need a bill to command them to do it

Quote: RuddyDuckFrom the casino's perspective, is the "hand pay experience" worth the player paying taxes and having less cash on hand, or the casino paying extra staff? I think we see a significant number of new pay tables, likely a new way for casinos or slot machines to celebrate big wins, and 20% or more slot attendants lose their job. Some smaller casinos may opt for eliminating hand pays all together.

link to original post

No. And as the casino industry has proven time and time again is that they will get rid of unnecessary staff in an instant.

Started with Tito’s to cashless gaming in some markets. They’d love to never have to process a single hand pay ever again.

Quote: Bowler377There is also plenty of incentive for casinos to lobby politicians to raise the W2G threshold. I am surprised it took this long. Me personally, I have a feeling that casinos will insist on hand paying players winning anything between $1,200-$5,800, even if they don't use any W2G forms, and force slot players to go to the cage for larger cash outs of that size as well. They could also add a feature to the machines, requiring ID or players card to cash out.

link to original post

Then they would have to make it so you couldn't cash in without players card.

They would most likely be violating gambling regs if they allowed you to insert cash, then refused to cash out without a players card. Some people gamble without proper ID.

Quote: ChumpChangeAs with all things $3K and up, they could rig the machines to hand pay at $3K or more and only bring the tax forms around for whatever the IRS number will be if it will be.

link to original post

They won't allow you to INSERT over $3k. But if you insert $2900 and win $500, that is not a handpay (except for a select few).

You can cash that out and insert at another slot however you would have to go to cashier to redeem. Redemption machines won't take it unless playing it drops back to below $3k.

Quote: ChumpChangeAs with all things $3K and up, they could rig the machines to hand pay at $3K or more and only bring the tax forms around for whatever the IRS number will be if it will be.

link to original post

i can see casinos do $3k threshold for handpays to follow anti-money laundering regs

Quote: 100xOddsQuote: ChumpChangeAs with all things $3K and up, they could rig the machines to hand pay at $3K or more and only bring the tax forms around for whatever the IRS number will be if it will be.

link to original post

i can see casinos do $3k threshold for handpays to follow anti-money laundering regs

link to original post

There are no money laundering regs that I am aware of that have a $3000 cash limit. It is a common threshold used but not required.

Quote: 100xOddsQuote: ChumpChangeAs with all things $3K and up, they could rig the machines to hand pay at $3K or more and only bring the tax forms around for whatever the IRS number will be if it will be.

link to original post

i can see casinos do $3k threshold for handpays to follow anti-money laundering regs

link to original post

I thought the RICO reporting minimum in the USA was $10,000.

Quote: ThatDonGuyQuote: 100xOddsQuote: ChumpChangeAs with all things $3K and up, they could rig the machines to hand pay at $3K or more and only bring the tax forms around for whatever the IRS number will be if it will be.

link to original post

i can see casinos do $3k threshold for handpays to follow anti-money laundering regs

link to original post

I thought the RICO reporting minimum in the USA was $10,000.

link to original post

The bank secrecy act title 31 covers cash handling for money reporting. Any cash transaction over $10k in a 24 hour period needs to be reported.

The problem with casinos is, that casinos have shady reasons for demanding your ID: database reporting, monitoring the win/loss records for discrepancies, scrutiny at the cage, etc.

Other than that, what precisely are you talking about, or is this another "the CTR rule used to be $30K" misstatement?

It's tracked when cashing out, why would these slots do anything at $3000 when you could spin that off? Just like winning a poker pot of $3,000 doesn't do anything but cashing in $3,000 chips in the poker room does.

Quote: Bowler377There are additional laws in place to protect against intentionally dodging the $10,000 CTR requirement. Title 31 includes procedures for transactions of $2k+, $3k+, and $5k+. However, the law is written ambiguously enough, that nobody knows how to legally handle those smaller transactions of under $10k. Any business caught enabling people to dodge CTRs and other reporting requirements, can face ginormous fines, and quite possibly criminal charges.

The problem with casinos is, that casinos have shady reasons for demanding your ID: database reporting, monitoring the win/loss records for discrepancies, scrutiny at the cage, etc.

link to original post

There is a casino near me that requires a player card or ID to cash out a ticket over $1200. You have to go to the cage. You can refuse their request but I’m pretty sure you’ll 100 percent be on their radar if you do. They use this info to blacklist both advantage players and people who win.

As far as structuring and such, those might result in a SAR, which is a sort of catch all including to report those who seem to be taking steps to avoid cash reporting (CTRs).

Imprecision abounds with the lot of ye. At least you're not as bad as A.Wolf thinking a CTR is a piece of paper that may be shown off by the recipient. And then I've heard some of ye think that CTRs are issued for other than currency transactions.

If any of this matters to you, you should learn more about this. If it doesn't matter, then...it doesn't matter that you don't understand it precisely either.

Background Treas. Reg. § 1.6041.10 currently sets the tax reporting threshold for slot machine jackpot wins at $1,200. When a customer at a tribal (or commercial) casino wins a jackpot at a slot machine of $1,200 or more, a W-2G must be filed. The value of a $1,200 jackpot today is not the same as a $1,200 jackpot in 1977. According to the Bureau of Labor Statistics, since the implementation of this threshold (June 30, 1977) a comparable jackpot reporting threshold today would be $5,838.63.83 The IRSAC notes that H.R. 312584 was introduced in the House of Representatives on May 5, 2023, to amend the Internal Revenue Code of 1986 to increase the information reporting threshold for slot winnings to $5,000.85 The static reporting threshold has led to a dramatic increase in the number of reportable jackpots and thus the operational and labor costs of the IRS. In 2020, a year when most casinos closed for a portion of the year and reopened at significantly reduced capacity levels due to COVID-19, the IRS processed 15,842,229 Forms W-2G.86 By the IRS’s own estimates, the number of Forms W2G will increase to 18,042,600 by 2029.87 Historical data also shows this number has been increasing significantly over time, with under 9 million Forms W-2G processed in 2005.88 At the same time, most slot machine customers are in a net loss position at the end of the year. Unlike other forms of tax information reporting that report actual income, the Form W-2G reporting of a “payment” on a gross basis is different from the ultimate determination of the patron’s taxable gain or loss from slot play. Updating the slot jackpot reporting threshold to a realistic level such as $5,800 would reduce some of this W-2G “flag” reporting and help the IRS focus on forms and taxpayers associated with net gambling income at the end of the taxable year. Raising the reporting threshold to reflect inflation would not only be beneficial to IRS operations but would also ease operational burdens on the tribal (and commercial) casino operators. Tribal (and commercial) casinos bear significant labor costs and a business revenue loss because of this tax information reporting, as slot machines must be shut down and taken out of production of revenue to fulfill tax information reporting obligations. While tribal (and commercial) casino employees obtain information from slot machine customers to fill out Form W-2G, slot machines are locked down anywhere from 20 to 45 minutes. As noted earlier, there are millions of Forms W-2G sent to the IRS each year, resulting in significant lost revenue and valuable employee time. The IRSAC acknowledges that an increase in the threshold may initiate additional legislative action at the state level to address the impact to existing state statutes that are based on the W-2G threshold (i.e., debt setoff program matching). The Department of Treasury has regulatory authority to update the slot jackpot reporting threshold and has exercised such authority in the past. Treasury described this regulatory history in the preamble to the proposed version of Reg. § 1.6041.10 in 2015: “Section 6041 generally requires information reporting by every person engaged in a trade or business who, in the course of such trade or business, makes payments of gross income of $600 or more in any taxable year. The current regulatory reporting thresholds for winnings from bingo, keno, and slot machines deviate from this general rule. Prior to the adoption of the current thresholds in 1977, reporting from bingo, keno, and slot machines, was based on a sliding scale threshold tied to the amount of the wager and required the wager odds to be at least 300 to 1. On January 7, 1977, temporary regulation §7.6041-1 was published establishing reporting thresholds for payments of winnings from bingo, keno, and slot machine play in the amount of $600. In Announcement 77-63, 1977-8 IRB 25, the IRS announced that it would not assert penalties for failure to file information returns before May 1, 1977, to allow the casino industry to submit, and the IRS to consider, information regarding the industry’s problems in complying with the reporting requirements. After considering the evidence presented by the industry, the IRS announced in a press release that effective May 1, 1977, information reporting to the IRS would be required on payments of winnings of $1,200 or more from a bingo game or a slot machine play, and $1,500 or more from a keno game net of wager. On June 30, 1977, § 7.6041-1 was amended to raise the reporting thresholds for winnings from a bingo game and slot machine play to $1,200, and the reporting threshold for winnings from a keno game to $1,500.89 The amendment to Reg. § 7.6041 raising the slot reporting threshold to $1,200 in 1977 was “issued under the authority contained in section 7805 of the Internal Revenue Code of 1954.”90

Recommendations 1. Pursue addition to the IRS Priority Guidance Plan to increase the tax reporting threshold for slot machine jackpot winnings to $5,000 (modification to Treas. Reg. 1.6041-10). (Recommendations 1-2 align with SOP 4.7 – Strategically use data to improve tax administration.) 2. For calendar years beginning after the first year of a $5,000 threshold, consider periodic increases to increase the threshold to a dollar amount multiplied by the cost-of-living adjustment.

https://www.irs.gov/pub/irs-pdf/p5316.pdf pages 135 - 138 (November 2023)

*********************************************************************

It's about the overload of paperwork hand pays are generating. This leads me to believe hand pays will rise to the new IRS levels and not be stunted at $3K if the effort is to reduce costs to the casino in terms of lost time on the machines. The IRS may take a quick route to going straight to $5,000 then adding on the multiple hundreds in the following years, or if this drags on, may just go straight to $6,000.

Quote: ChumpChangeIt's about the overload of paperwork hand pays are generating. This leads me to believe hand pays will rise to the new IRS levels and not be stunted at $3K if the effort is to reduce costs to the casino in terms of lost time on the machines. The IRS may take a quick route to going straight to $5,000 then adding on the multiple hundreds in the following years, or if this drags on, may just go straight to $6,000.

link to original post

I can see others concerned about money laundering to lobby for $3k handpay threshold.

$3k is a good compromise. Ploppies would still see it as a huge increase which would make them happy and it would still lessen the paperwork by the casinos.

Personally, i just want it above $1251.

At $5 vp, any quads in db/ddb/tdb is a handpay.

At $3k threshold, i would only have 3 handpays this year instead of alot more.

Quote: 100xOddsQuote: ChumpChangeIt's about the overload of paperwork hand pays are generating. This leads me to believe hand pays will rise to the new IRS levels and not be stunted at $3K if the effort is to reduce costs to the casino in terms of lost time on the machines. The IRS may take a quick route to going straight to $5,000 then adding on the multiple hundreds in the following years, or if this drags on, may just go straight to $6,000.

link to original post

I can see others concerned about money laundering to lobby for $3k handpay threshold.

$3k is a good compromise. Ploppies would still see it as a huge increase which would make them happy and it would still lessen the paperwork by the casinos.

Personally, i just want it above $1251.

At $5 vp, any quads in db/ddb/tdb is a handpay.

At $3k threshold, i would only have 3 handpays this year instead of alot more.

link to original post

Won't someone think of the children??

$4001+ means 5 coin $1 royals are unencumbered with such troubles. ($1251 just isn't enough, IMO.)

Quote: Bowler377He who gives up freedom for security loses both!

link to original post

That's why I like a little of each.

Quote: Bowler377He who gives up freedom for security loses both!

link to original post

Benjamin Franklin once said: "Those who would give up essential Liberty, to purchase a little temporary Safety, deserve neither Liberty nor Safety