Quote: EvenBobQuote: DRichQuote: EvenBobQuote: billryan120 million in bitcoin withdrawals overnite, 92% from so-called long term accounts.

link to original post

I was one of them. Better to abandon the ship when it's sinking then when it's already sunk. I don't need Bovada anymore therefore I don't need Bitcoin anymore. They can go screw themselves.

link to original post

Do you realize that Bitcoin is neither a person nor a company? It is an "asset". It would be like saying a Van Gough painting can go screw itself.

link to original post

Wrong. Bitcoin is a dog, my wife's nephew has a dog named Bitcoin and I've seen him. He answers to the name Bitcoin. And he's definitely not an asset.

link to original post

Wow, I did not know you were a dog hater. Dogs are definitely assets. They may be depreciating assets, but still assets.

Quote: DRichQuote: EvenBobQuote: DRichQuote: EvenBobQuote: billryan120 million in bitcoin withdrawals overnite, 92% from so-called long term accounts.

link to original post

I was one of them. Better to abandon the ship when it's sinking then when it's already sunk. I don't need Bovada anymore therefore I don't need Bitcoin anymore. They can go screw themselves.

link to original post

Do you realize that Bitcoin is neither a person nor a company? It is an "asset". It would be like saying a Van Gough painting can go screw itself.

link to original post

Wrong. Bitcoin is a dog, my wife's nephew has a dog named Bitcoin and I've seen him. He answers to the name Bitcoin. And he's definitely not an asset.

link to original post

Wow, I did not know you were a dog hater. Dogs are definitely assets. They may be depreciating assets, but still assets.

link to original post

I don't hate dogs, I've had dogs. Had my last one put down last year. It's just that now that I'm older I realize what a tremendous amount of work having a dog entails. They demand constant attention and are about 10 times more work than cats are. There's also a certain about of guilt with the dog because you feel like you're never doing enough because the dog is a 'want' machine, all it does is want want want. And you can't possibly fulfill all of that so you feel guilty. Screw that, I like dogs but I'm done with them. I'll never have another dog. Please remember this is a Bitcoin thread, don't get carried away with dog questions.

Bitcoin is down $31,000 for 2022. I think I started taking withdrawals at Bovada 2 years ago? I got out while the getting was good.

Quote: ChumpChangeAt least a slice of pizza doesn't cost $15,000...yet.

link to original post

That would depend on what toppings you got.

Quote: Ace2Remember, thereís no way bitcoin will ever drop below $20,000. Institutional investors will pounce at that key support level

link to original post

About 85% of bitcoin is owned by a very small group. Around two-thirds of it is owned by miners or companies associated with them.

Retail investors are considered to be people owning ten or less and they make up a little more than ten percent of the pie.

Needless to say, the pie used to be a lot bigger.

Quote: BloombergBillionaire New England Patriots owner Robert Kraft and star NFL quarterback Tom Brady are among those sharing in the pain of FTX Groupís sudden implosion.

Brady, formerly a prominent FTX booster, owns more than 1.1 million common shares of FTX Trading, bankruptcy court documents show. His ex-wife, supermodel Gisele Bündchen, has more than 680,000 shares in the same entity.

That's nothing when you concider their overall weath. Combined, they were once worth around 700 million, and now only 698 million.Quote: TumblingBonesFrom Bloomberg today:

Quote: BloombergBillionaire New England Patriots owner Robert Kraft and star NFL quarterback Tom Brady are among those sharing in the pain of FTX Groupís sudden implosion.

Brady, formerly a prominent FTX booster, owns more than 1.1 million common shares of FTX Trading, bankruptcy court documents show. His ex-wife, supermodel Gisele Bündchen, has more than 680,000 shares in the same entity.

link to original post

Did they even invest their own money or were shares given to them?

Quote: AxelWolfThat's nothing when you concider their overall weath. Combined, they were once worth around 700 million, and now only 698 million.Quote: TumblingBonesFrom Bloomberg today:

Quote: BloombergBillionaire New England Patriots owner Robert Kraft and star NFL quarterback Tom Brady are among those sharing in the pain of FTX Groupís sudden implosion.

Brady, formerly a prominent FTX booster, owns more than 1.1 million common shares of FTX Trading, bankruptcy court documents show. His ex-wife, supermodel Gisele Bündchen, has more than 680,000 shares in the same entity.

link to original post

Did they even invest their own money or were shares given to them?

link to original post

I don't think you are reading that correctly. They owned 1.8 million shares, not $1.8 million dollars worth.

Perhaps im missing something. I guess I was assuming shares were FTX tokens. Tokens were worth about a dollar at one time(?). What were the shares of which you speak worth? Does anyone know if they invested their own money, or if shares were given to them?Quote: billryanQuote: AxelWolfThat's nothing when you concider their overall weath. Combined, they were once worth around 700 million, and now only 698 million.Quote: TumblingBonesFrom Bloomberg today:

Quote: BloombergBillionaire New England Patriots owner Robert Kraft and star NFL quarterback Tom Brady are among those sharing in the pain of FTX Groupís sudden implosion.

Brady, formerly a prominent FTX booster, owns more than 1.1 million common shares of FTX Trading, bankruptcy court documents show. His ex-wife, supermodel Gisele Bündchen, has more than 680,000 shares in the same entity.

link to original post

Did they even invest their own money or were shares given to them?

link to original post

I don't think you are reading that correctly. They owned 1.8 million shares, not $1.8 million dollars worth.

link to original post

Quote: AxelWolfPerhaps im missing something. I guess I was assuming shares were FTX tokens. Tokens were worth about a dollar at one time(?). What were the shares of which you speak worth? Does anyone know if they invested their own money, or if shares were given to them?Quote: billryanQuote: AxelWolfThat's nothing when you concider their overall weath. Combined, they were once worth around 700 million, and now only 698 million.Quote: TumblingBonesFrom Bloomberg today:

Quote: BloombergBillionaire New England Patriots owner Robert Kraft and star NFL quarterback Tom Brady are among those sharing in the pain of FTX Groupís sudden implosion.

Brady, formerly a prominent FTX booster, owns more than 1.1 million common shares of FTX Trading, bankruptcy court documents show. His ex-wife, supermodel Gisele Bündchen, has more than 680,000 shares in the same entity.

link to original post

Did they even invest their own money or were shares given to them?

link to original post

I don't think you are reading that correctly. They owned 1.8 million shares, not $1.8 million dollars worth.

link to original post

link to original post

Shares peaked somewhat above $50. So a chunk of change. No idea if they invested their own money.

Quote: unJonQuote: AxelWolfPerhaps im missing something. I guess I was assuming shares were FTX tokens. Tokens were worth about a dollar at one time(?). What were the shares of which you speak worth? Does anyone know if they invested their own money, or if shares were given to them?Quote: billryanQuote: AxelWolfThat's nothing when you concider their overall weath. Combined, they were once worth around 700 million, and now only 698 million.Quote: TumblingBonesFrom Bloomberg today:

Quote: BloombergBillionaire New England Patriots owner Robert Kraft and star NFL quarterback Tom Brady are among those sharing in the pain of FTX Groupís sudden implosion.

Brady, formerly a prominent FTX booster, owns more than 1.1 million common shares of FTX Trading, bankruptcy court documents show. His ex-wife, supermodel Gisele Bündchen, has more than 680,000 shares in the same entity.

link to original post

Did they even invest their own money or were shares given to them?

link to original post

I don't think you are reading that correctly. They owned 1.8 million shares, not $1.8 million dollars worth.

link to original post

link to original post

Shares peaked somewhat above $50. So a chunk of change. No idea if they invested their own money.

link to original post

If they were given the shares and were acting as spokesman, they could be in trouble. Someone said the couple owned about a hundred million dollars worth, but I've no ideas how accurate that is.

Who's that someone? Link? I thought whatever the bankruptcy court documents showed would be somewhat close to the truth. A hundred million dollars vs 1-2 million is an awfully big gap.Quote: billryanQuote: unJonQuote: AxelWolfPerhaps im missing something. I guess I was assuming shares were FTX tokens. Tokens were worth about a dollar at one time(?). What were the shares of which you speak worth? Does anyone know if they invested their own money, or if shares were given to them?Quote: billryanQuote: AxelWolfThat's nothing when you concider their overall weath. Combined, they were once worth around 700 million, and now only 698 million.Quote: TumblingBonesFrom Bloomberg today:

Quote: BloombergBillionaire New England Patriots owner Robert Kraft and star NFL quarterback Tom Brady are among those sharing in the pain of FTX Groupís sudden implosion.

Brady, formerly a prominent FTX booster, owns more than 1.1 million common shares of FTX Trading, bankruptcy court documents show. His ex-wife, supermodel Gisele Bündchen, has more than 680,000 shares in the same entity.

link to original post

Did they even invest their own money or were shares given to them?

link to original post

I don't think you are reading that correctly. They owned 1.8 million shares, not $1.8 million dollars worth.

link to original post

link to original post

Shares peaked somewhat above $50. So a chunk of change. No idea if they invested their own money.

link to original post

If they were given the shares and were acting as spokesman, they could be in trouble. Someone said the couple owned about a hundred million dollars worth, but I've no ideas how accurate that is.

link to original post

I don't really know the laws on that type of stuff. Is FTX considered a security?

Wasn't a case vs Kim Kardashian and Floyd Mayweather just dismissed regarding this type of thing?

I don't doubt that Brady & Bündchen will be sued, and they will probably settle.

Quote: DRichWho needs Bitcoin? I have just started investing in Chicken-coin.

link to original post

Paid $5 for a dozen eggs at Walmart last week. A year ago they were 99 cents.

June-Aug 9th it was at $0.000076 then spiked to $11.50 in one day, Someone had to be clucking like a chicken, it's at $9 right now.Quote: DRichWho needs Bitcoin? I have just started investing in Chicken-coin.

link to original post

Quote: EvenBobQuote: DRichWho needs Bitcoin? I have just started investing in Chicken-coin.

link to original post

Paid $5 for a dozen eggs at Walmart last week. A year ago they were 99 cents.

link to original post

But the CPI went down last month?

dude you're hijacking. I read that for nothing.Quote: ChumpChangeDeflation is when car prices go down 25% over one quarter. It's not when car dealers go out of business because they can't sell cars at inflated prices amid rising interest rates that killed off financing customers. Cars are going no bid at dealer auctions because the reserve is not coming down. The market is clogged with expensive cars that won't get marked down. Maybe the MSRP markups are disappearing and that would be a deflation. When dealers double the price with MSRP markups, just coming back down 50% would get the market back to MSRP.

link to original post

The CPI number is based in part on car sales, and there is a problem with that, as I explained.

*******************

As for eggs, with a 5 or 10-fold price increases, financially-stressed people will cut down or stop buying eggs. Other foods made with eggs will go way up in price or will be taken off the shelves because they can't be sold at inflated prices. If only the rich buy eggs, maybe prices will come back down?

Just In - Bird Flu: The Real Reason Why Eggs Are So Expensive - TYT - YouTube https://www.youtube.com/watch?v=4DaD3I7dtKY

I think only you know what you are discussing in your own head, oftentimes, we are lost understanding whatever nuanced talking points you are trying to convey.Quote: ChumpChangeI was making a distinction between the CPI number going down and what deflation is. The CPI going down is not deflation. Prices must come down for there to be deflation. If the CPI is above 0%, that's not deflation, prices are still rising.

The CPI number is based in part on car sales, and there is a problem with that, as I explained.

*******************

As for eggs, with a 5 or 10-fold price increases, financially-stressed people will cut down or stop buying eggs. Other foods made with eggs will go way up in price or will be taken off the shelves because they can't be sold at inflated prices. If only the rich buy eggs, maybe prices will come back down?

link to original post

Quote: ChumpChangeDeflation is when car prices go down 25% over one quarter. It's not when car dealers go out of business because they can't sell cars at inflated prices amid rising interest rates that killed off financing customers. Cars are going no bid at dealer auctions because the reserve is not coming down. The market is clogged with expensive cars that won't get marked down. Maybe the MSRP markups are disappearing and that would be a deflation. When dealers double the price with MSRP markups, just coming back down 50% would get the market back to MSRP.

link to original post

Deflation takes more than one quarter, I would not call it deflation until at least a year. But I agree on car prices. Dealers will take forever to lower auction reserves. They will be loathe to lower used car prices on the lot. Manufacturers were thought to have changed their attitude and not have lots full of iron to move and thus need few incentives.

We will be back to normal eventually. Manufacturers will not be able to help themselves.

Deflation is also your currency just buying more, which Bitcoin has been. Instead of printing more to get less the amount is fixed and you just keep dividing it more. The average person does not understand deflation at all.

Inflation/Deflation, 'Takes,' whatever period you are using to measure it; it's nothing more than a comparative tool. You could compare the price of a set of items to what the price was five minutes ago, if you wanted to. For most sets of five minutes, especially if you are only using a few items as a baseline, inflation/deflation will be 0%, or unchanged. It doesn't matter what I would call it, you would call it or anyone would call it---it's just what period of time is being used.

Would a five minute comparison for deflation/inflation be valid? Probably not. Unchanged most of the time.

Does it have to be based on an entire year? No. You can take a period of a few months and use it to see a trend, then do some research on market drivers and determine whether or not you think the trend will continue. That's probably a good idea when it comes to major purchases you might have upcoming.

The CPI is based on a basket of goods that is continuously redefined and whose definition is carefully engineered to produce outcomes consistent with the political desires of whatever administration is in power. It is an insincere metric.

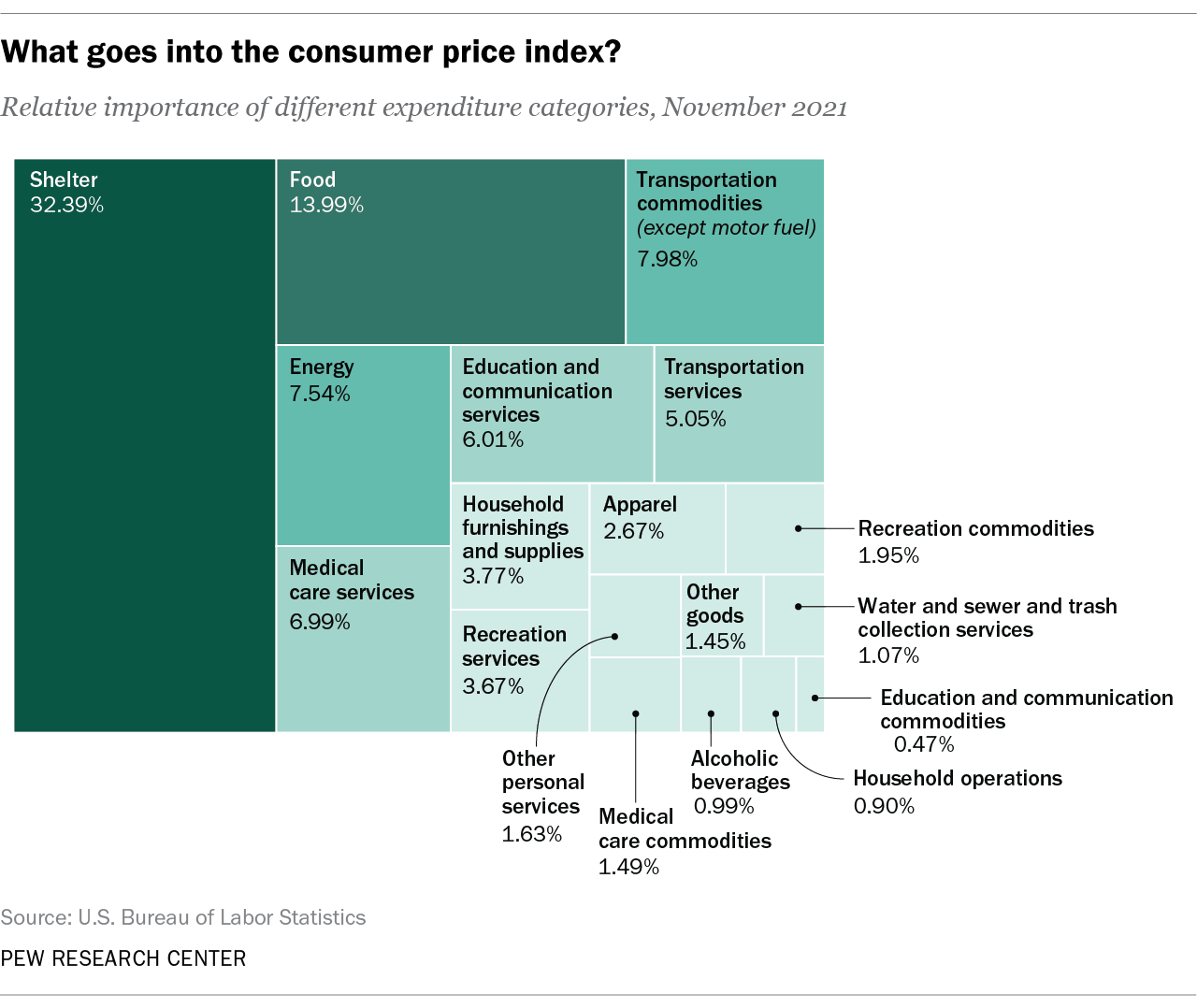

Quote: gordonm888The problem with the CPI as a metric is that it doesn't include: rent and other costs of housing, the price of wood and construction materials, gasoline, the price of airline tickets, the price of restaurant meals, the cost of OTC and prescription drugs, the cost of haircuts and other services, etc.

The CPI is based on a basket of goods that is continuously redefined and whose definition is carefully engineered to produce outcomes consistent with the political desires of whatever administration is in power. It is an insincere metric.

link to original post

It's a very flawed measurement, but politics keeps it as the benchmark. Imagine the outrage if an administration introduced a new formula showing a considerable CPI drop. For similar reasons, no administration will release a new formula that makes them look bad, so we stay with the flawed benchmark.

Usually the factoids that are so often getting squeezed off by one of the Cliff Claven type "AP" clubhouse regulars hanging out in the WoV forum are known to be loosely based on something that's almost kinda sorta partly true, after being lifted without attribution, re-jiggered, and stood upside down. Or, a bong water reflection thereof, when seasonally adjusted for someone's routine attempts to tout a confused version of a political ideology seasoned with a generous portion of some simmering personal resentments. And worth half a snicker, which is what they reliably get from most readers, unknown to the author of them and the small circle of treefort clubhouse residents.Quote:...doesn't include: rent and other costs of housing, the price of wood and construction materials, gasoline, the price of airline tickets, the price of restaurant meals, the cost of OTC and prescription drugs, the cost of haircuts and other services, etc...

Except sometimes, when not. And this is one that would absolutely need to be called a definite just plain "not." Very not, without the unsavory seasoning of the usual nuggets from the usual suspects, but indigestible if one happens to be very familiar with the subject. (And I have no doubt the original poster of the assertion truly believed it to be so... and will think for sure it came from somewhere or other.)

Quote: https://www.bls.gov/cpi/overview.htm (United States Bureau of Labor Statistics - CPI)

Sources of data

...Data on rents are collected from about 50,000 landlords or tenants...

...The biggest category by far is shelter, which accounts for nearly a third of the index...

Quote: gordonm888The problem with the CPI as a metric is that it doesn't include: rent and other costs of housing, the price of wood and construction materials, gasoline, the price of airline tickets, the price of restaurant meals, the cost of OTC and prescription drugs, the cost of haircuts and other services, etc.

The CPI is based on a basket of goods that is continuously redefined and whose definition is carefully engineered to produce outcomes consistent with the political desires of whatever administration is in power. It is an insincere metric.

link to original post

At some point you would think some group would publish a "real CPI" that has a good measure. PNC publishes the cost of the twelve days of Christmas based on their real cost, but no way they would do something useful like this lest they be locked out of the financial system. No partisan group could do it. At best a university that is known for their econ studies maybe.

It ensures an ample supply of labor.

But since slavery is against the law, the central banks do it through issuing (printing) more currency.

Bitcoin is designed to mimic the new discovery of gold.

Around 3% debasement annually for a specific number of years (over 100 or so).

I usually ignore the CPI because that's the gauge used for entitlements, such as social security disbursements.

So the CPI will be artificially deflated by including components that deflate more than the average (computers for example) to offset dollar debasement.

What inflation is to me is the increase of total dollars in circulation.

If the central bank debases more, then more dollars are chasing goods and services, usually bidding prices higher.

It's one of the greatest scams in the history of man.

Anyone that saves from years of labor usually has lower purchasing power over time, unless that savings increases by the amount of the debasement.

Quote: DoubleGoldInflation is a technique to secure forced labor (practically slave labor).

It ensures an ample supply of labor.

But since slavery is against the law, the central banks do it through issuing (printing) more currency.

Bitcoin is designed to mimic the new discovery of gold.

Around 3% debasement annually for a specific number of years (over 100 or so).

I usually ignore the CPI because that's the gauge used for entitlements, such as social security disbursements.

So the CPI will be artificially deflated by including components that deflate more than the average (computers for example) to offset dollar debasement.

What inflation is to me is the increase of total dollars in circulation.

If the central bank debases more, then more dollars are chasing goods and services, usually bidding prices higher.

It's one of the greatest scams in the history of man.

Anyone that saves from years of labor usually has lower purchasing power over time, unless that savings increases by the amount of the debasement.

link to original post

M1 or M2? How do you factor the velocity of money into your world views?

If you want to read scary, try this: Checkable deposits for households and nonprofit organizations has gone from $1.43 trillion in 2018 to $5.12 trillion at the end of September 2022.

https://www.federalreserve.gov/Releases/z1/default.htm

The one I am focused on right now is the 10-2 Treasury yield inversion.

When COVID occurred, the central bank debased by about 30+% in one year.

Those additional trillions indirectly flowed to the top 1%.

So the 1% snagged about $10T so far.

I knew what they were doing when they did it.

Quote: DoubleGold

What inflation is to me is the increase of total dollars in circulation.

The dollars cause the inflation. In the 1800s the USA had periods of inflation and deflation. We would have a financial panic once to twice a decade. In the 1800s we were mostly rural and poverty was common so some people did not notice it as much. New discoveries of gold or silver caused inflation, paper money was not the thing.

In 1913 this all got changed. A central bank was put in place with a mandate to keep prices stable. Other than the deflation of the early 1930s it worked well. A new system was created in 1944 though it was "hidden new." The dollar would be tied to gold and now it was to keep the world stable. Over time that did not hold up and we had another new system phased in 1964-1971.

Under this new system inflation would be a given. We decided we needed inflation so that debt could be repaid, from the government to corporations to those with mortgages. But it had to be contained. 2-3% a year lets there be fake growth in incomes to "grow into" debt. But then this falls apart every now and again like we are in now.

Eventually it will all fall apart. The USD will be worthless outside the USA and Americans will actually have to provide value for trade. Something new will take its place and it all starts over.

If the water is running and the drain is closed, a floating rubber ducky will rise.

If the water is stopped and the drain is open (like now and 1929) then the rubber ducky will be below the higher water mark.

I don't disagree with anything you wrote.

I will add that since fiat dollars are created out of nothing, that in theory, then the cartel can continue to debase to eternity until Congress terminates them.

So it's all about the collateral.

That's why they (the cartel forced the government) invented social security withholding matched by employers.

Quote: DoubleGold

I will add that since fiat dollars are created out of nothing, that in theory, then the cartel can continue to debase to eternity until Congress terminates them.

link to original post

Only until the world sees the scam for what it is. One day the Saudis will demand something other than dollars. Then everyone else will. KSA we can put in their place with our military. But a few countries and eventually that gets hard.

Quote: AZDuffmanQuote: DoubleGold

I will add that since fiat dollars are created out of nothing, that in theory, then the cartel can continue to debase to eternity until Congress terminates them.

link to original post

Only until the world sees the scam for what it is. One day the Saudis will demand something other than dollars. Then everyone else will. KSA we can put in their place with our military. But a few countries and eventually that gets hard.

link to original post

Quote: AZDuffmanQuote: DoubleGold

I will add that since fiat dollars are created out of nothing, that in theory, then the cartel can continue to debase to eternity until Congress terminates them.

link to original post

Only until the world sees the scam for what it is. One day the Saudis will demand something other than dollars. Then everyone else will. KSA we can put in their place with our military. But a few countries and eventually that gets hard.

link to original post

Also in theory, another thing that could happen for them to be removed, is to incorporate a replacement and let the current USA corporation's debt default.

It'd have to be an entity in control of the military though.

No entity will be able to pay off so many trillions.

Quote: DoubleGoldunJon, I look at all of them on the FRED website.

The one I am focused on right now is the 10-2 Treasury yield inversion.

When COVID occurred, the central bank debased by about 30+% in one year.

Those additional trillions indirectly flowed to the top 1%.

So the 1% snagged about $10T so far.

I knew what they were doing when they did it.

link to original post

What is really scary IMO about this USA Treasury raid of over 30% of the national deficit in a short time period, is that someone was really desperate.

Never before did such a large transfer of wealth occur.

Someone was scared and grabbed the stash while they could.

I don't know if the COVID issue was related, but it looks like that could have been the cover IMO.

If these things are close to being true, then I'd expect something major pretty soon to hit the press.

https://decrypt.co/125257/bitcoin-national-security-thesis-paper-amazon-best-seller

Innocent coincidence, or is "something up"?

Don't know about up, but here's something sideways. And today is Thursday, and roses are red:Quote: DieterI noticed that most of the BitCoin ATMs I've encountered over the last week have been "Out of Order", usually with a handwritten sign taped on the completely dark screen.

Innocent coincidence, or is "something up"?

link to original post

"Hackers drain bitcoin ATMs..."

"...leaving customers on the hook for losses that canít be reversed, the kiosk manufacturer has revealed...."

"...team has been working around the clock to collect all data regarding the security breach and is continuously working to resolve all cases to help clients back online and continue to operate their ATMs as soon as possible. We apologize..."

/information-technology/2023/03/hackers-drain-bitcoin-atms-of-1-5-million-by-exploiting-0-day-bug/

https://arstechnica.com/information-technology/2023/03/hackers-drain-bitcoin-atms-of-1-5-million-by-exploiting-0-day-bug/

Thanks. I don't have a dog in the race, so I don't closely attend the crypto news.

Just curious; like I said, this is lots of ATMs across a lot of states. I didn't notice which manufacturers were involved, but I did see several styles and brands affected.

Quote: billryanI've never noticed a bitcoin ATM. What kind of fees do they charge? Do you deposit cash?

link to original post

Deposit cash yes, then there is a scanner you hold phone up to that scans QR bitcoin address from your BTC wallet

fee's are stiff.

Quote: billryanI've never noticed a bitcoin ATM. What kind of fees do they charge? Do you deposit cash?

link to original post

Yes. Deposit or withdraw cash; they can access a wallet via a scanned QR type code. I believe they also link to a phone number, take a photo of whoever does the transaction, and scans a presented ID like a drivers license.

I didn't look closely at the fees. I'm assuming the limit is under $10k.

I generally see "Bitcoin ATM of America", "coinflip", and possibly Coin Cloud, CoinHub, and bitstop brands. I should hope these sorts of outfits have websites.